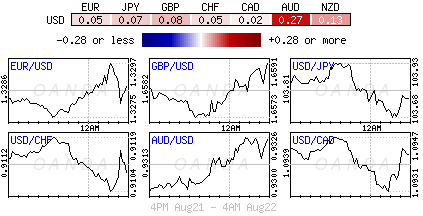

It's no surprise to see Capital Market relatively subdued ahead of the two keynote speakers at Jackson Hole Economic Symposium later today. Fed Chair Ms. Yellen speaks at 10am EST, while ECB's Draghi - who's unlikely to be "out" dovished by his colleague - is scheduled to appear at 2:30pm EST.

The market expects to hear from Ms. Yellen reassurance that interest rates will stay 'low' for some time, despite Fed minutes delivered mid-week that showing that US policy makers had discussed an earlier hike. The market is expecting a "dovish" overture from Yellen, if however, there is any indication that the more "hawkish" members on her team are beginning to influence her then investors should expect a massive uptick in 'volatility.' Fed 'hawkish' dissenter Plosser spoke after the US market close yesterday, expressing concern that US monetary policy is not reacting to changing data. He gave warning that the Fed would have to move faster, and also noted that wage inflation is too "lagging an indicator" to determine monetary policy. Any 'hawkish' hint and the US curve will shift quickly, as Treasuries back up aggressively (US 10-years +2.40%), while US equities should come under some intense selling pressure just as indices print new record highs.

Draghi cannot afford but be cool

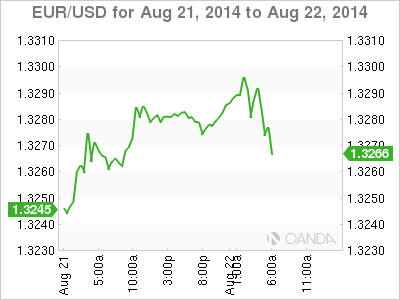

The EUR has been under intense pressure for a number of months (€1.3280) as investors expect the ECB to consider fresh easing measures while the Fed moves towards a tighter monetary policy. With the real threat of deflation, Euro region is already experiencing alarmingly low inflation, investors will want to be looking for any hints of new policies from the ECB's President. The Eurozone's best-case scenario for today's speech will be a "no" change to ECB stance. Draghi will have to tread very lightly in his speech, he cannot afford to stand in the way of the recent depreciation of the EUR.

'Mighty' buck needs a second wind

The recent dollar rally against the majors has been aggressive, more silent, but certainly on a determined run. It's not a surprise to see that it has checked its stride ahead of the Jackson Hole speeches, stalling before the 61.8% Fibo of the move from July last year at DXY: 82.51. In outright terms, that is the EUR/USD equivalent of €1.3222. This whole move has coincided with a Fixed Income rally - which may imply that caution is probably warranted. However, FI has been rallying all year. Today's speeches are entitled "Reevaluating Labor Market Dynamics" and it will take all of Draghi's orator skills to weave a dollar story into this topic. The President will be required to go off-line a tad to say anything currency related. The single unit has run into some heavy speculative selling at the €1.3300 psychological handle and is protected initially on the downside by more option barriers located one cent lower at €1.3200.

China stimulus call

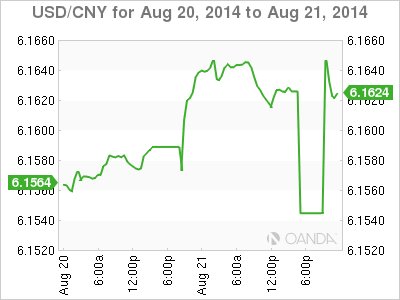

The Asian bourse rally seems to have run out of steam, particularly the Shanghai Composite, particularly after the surprise slowdown in China's flash manufacturing PMI yesterday.

Growth in China's vast factory sector slowed to a three-month low (50.3 versus 51.5) this month as output and new orders moderated despite the recent burst of government stimulus The lukewarm reading came as China's economic growth appears to be faltering again, with recent indicators ranging from lending to output and investment all pointing to weakness. More analysts are now calling for additional incentives and stronger scrutiny of growth targets.

This week's PMI miss would suggest that there is possibly room for "two" interest rate cuts by the PBoC in H2. However, the knock on effect from further policy easing could include "cuts in mortgage down payment requirement and rates." On the flip side, further economic weakness could lead to softer property sales and starts - maybe a new norm for 2015 resulting in Chinese GDP growth slowing to below the psychological +7% handle.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.