Investors appear to be positioning themselves conservatively ahead of the first reading of Q2's US GDP tomorrow. It's no surprise that there is very little movement in the major currency pairs before such a major economic release. Last time out for many was a painful experience. Everyone seems comfortable in keeping his or her powder dry ahead of three day's of heavy events and data risks that also include tomorrows FOMC and last month's US job's report this Friday.

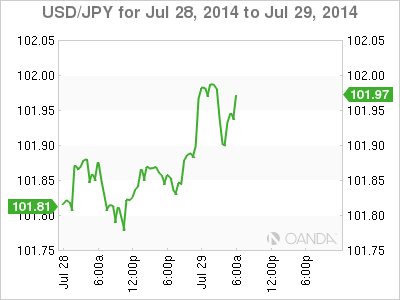

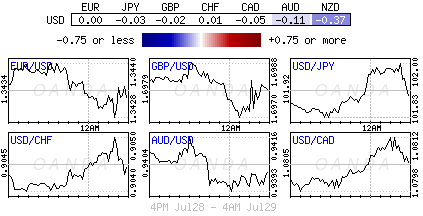

Any forex market action thus far can be attributed to Asia. Euro dealers prefer to sit on their hands ahead of the transatlantic market handover later this morning. They are patiently waiting for fresh details on the EU/US sanctions against Russia - no one wants to make any false moves so late in the game. The Kiwi dollar continues to flounder a week after the RBNZ's expected "tight-dovish" response (hike rates while indicating a holding pattern). This time the blame sits with the giant dairy Co-op Fonterra who has slashed their forecast for milk payments to farmers. Their predictions have managed to shave half-a-cent of their own domestic currency (NZD$0.8510). Across to Japan, USD/JPY has managed to print a fresh three-week high in the overnight session, briefly trading above the psychological ¥102 handle on a combination of month-end dollar demand and with the Nikkei ending the day nicely in the black.

Japan's UE rate climbs

Keeping analysts awake was the release that Japan's unemployment rate actually climbed (+3.7% vs. +3.5%) despite a multi-year high in job availability (job to application ratio: 1.10 -highest rate in 22-years - vs. 1.09). Japan's labor force participation rate month-over-month remained unchanged at + 59.9%. Thus far, Japans economic data for June has been consistently disappointing. Accompanying the weak labor numbers was last night's soft retail sales release (-0.6%), which could suggest that Prime Minister's Abe higher consumption tax imposed in April continues to constrain domestic spending. The BoJ's hands are currently tied and it's natural for them to remain rather optimistic. Board members continue to call Japan's economic recovery "moderate" and remain confident in achieving their +2% inflation target. Nevertheless, the BoJ insists that they would adjust policy if necessary after examining risks. Maybe it time for the BoJ to reassess its outlook on exports at the upcoming policy meeting in early August?

Super Mario Saves the EUR

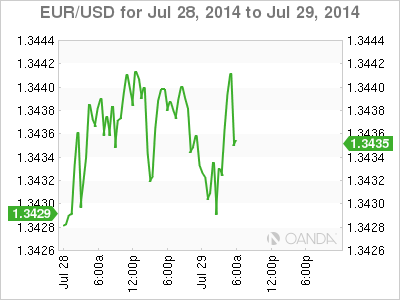

The Euro's single unit should be counting its blessing's that it remains contained to a tight trading range. The market has just passed the two-year anniversary when Draghi saved the EUR by uttering three words - "Whatever it takes." The unit is currently handcuffed by a plethora of option expiries today, approximately €2billion worth within the €1.34-35 range. This in itself, and not sanction rumors or jockeying for economic positions, is likely to take a firmer grip in an already moribund market. EUR option bids precede stop levels at €1.3400-10. It's rumored that CTA exit orders are beginning to pile just south of €1.3375 mark, while Asian interest has similar orders on the topside, but a big figure higher (€1.3475). The lack of forex interest has investors looking at both equities and the fixed income market for opportunities. Until G7 rate divergence actually occurs, opportunities are limited for the bigger forex moves and reason enough why major currency positioning is relatively neutral.

German Bull Flattener Persists

With equity bourses in neutral territory ahead of the US open has again favored the German bund. Of later, there has been better buying from a variety of accounts, including overseas and hedge funds for that curve, and ever since old record highs have been broken. Also aiding the demand for debt product is month-end - it's extending the bund's "bull flattener." The general lack of market liquidity across the various asset classes has managed to exaggerate price moves. This is also a seasonal phenomenon, and probably hardest hit in the summer months. The Bund "bull flattener" is been driven by big European 'extensions,' supposedly twice the monthly average over the past year, pushing the 10-year German benchmark to +1.15% or -132bp back of its US equivalent - US 10's +2.47%.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.