Bank of Japan governor asks PM Abe to follow through on “third arrow”

US U Michigan Sentiment and PPI were lower than expected on Friday

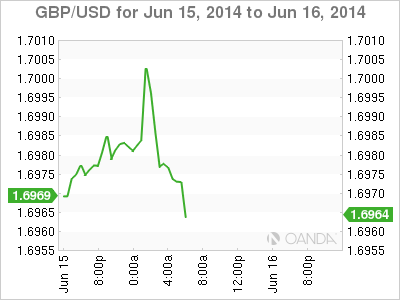

Bank of England hawkish comments put interest rates hikes earlier than expected

The World Cup kicked off late last week and went into overdrive in the weekend. Around the world trading desks large and small will be more concerned with injury reports and score sheets than economic releases. Volume is expected to remain low even as the armed conflicts in Iraq and Ukraine continue to drive geopolitical risk upwards. Commodities and safe havens continue to be bid as uncertainty grips certain markets as other seems impervious awaiting the interest rate implications and hints that will be delivered this week.

Central banks continue to drive the agenda. Last week Bank of England governor Mark Carney turned hawkish and indicated the Old Lady might be close to the Federal Reserve in regards to interest rate hike timing. Carney’s statements on Thursday will continue to have an impact this week as the UK is set to release inflation data on Tuesday and the minutes from the MPC meeting in Wednesday. The BOE has also been granted new powers to limit mortgages as UK housing has been identified a major risk to the recovery not only by the central bank but also by the IMF.

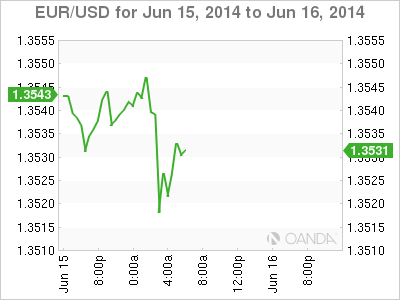

With Carney’s statements and the European Central Bank’s actions earlier this month the US Federal Reserve has been relegated to the background but this changes on Wednesday, as the Federal Open Market Committee will issue a statement regarding interest rates and the pace of the continuing tapering of bond buying. The US economy has shown definite signs of improvements but it remains to be seen if the Fed will deem it enough of a signal to increase the taper. It is expected that chair Yellen will announce the same pace of $10 billion on Thursday. The US employment situation has seen improvement but the consumer is still unsure which limits the sustainability of the recent positive momentum.

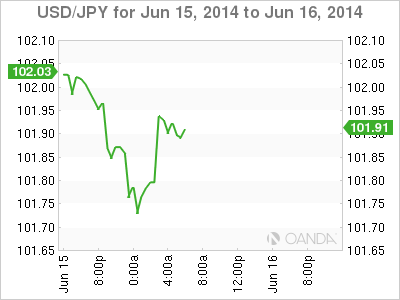

The Bank of Japan continues to hold a confident assessment of the economy. The monetary policy statement out of Japan signaled no change to the interest rate or the size of the stimulus package. This was expected by the market given the impressive first quarter results. It is also known that those numbers were boosted by a higher sales tax introduced in April which prompted consumers to preempt it by making purchases before it came into effect. Earlier governor Kuroda did state that Prime Minister Shinzo Abe’s third arrow of labour reform needs to be followed through. The JPY continues to strengthen jeopardizing the success of Abenomics as it has broken below 102 as the market awaits the FOMC to offer a strong USD scenario.

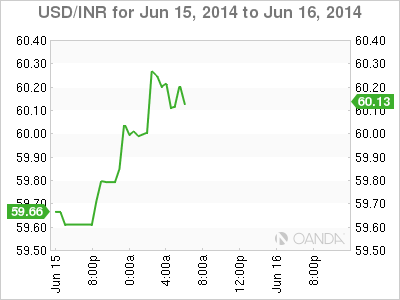

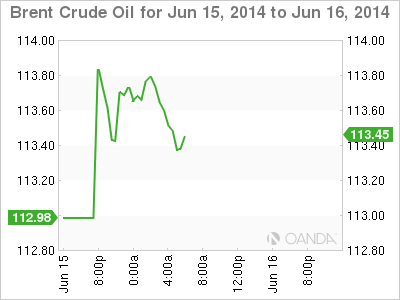

Emerging markets will act as the canary in the coal mine as the majors remain shielded from social and armed unrest. The Indian Rupee continues to lose ground versus the USD as Iraq is the main supplier of oil to India. The rising price of oil will not help the Reserve Bank of India in its ongoing battle against inflation and the INR is bound to be under attack as risk aversion rises the challenge set before Modi’s newly elected government. The current economic climate will test the nascent partnership between RBI’s Rajan and Modi as they seek measures to control the outflow of investment that could put 2014’s growth targets out of reach.

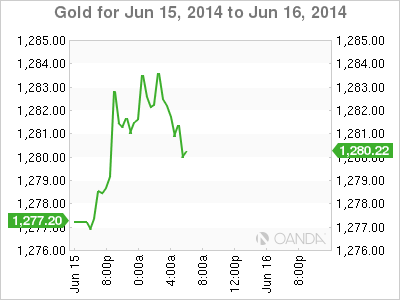

Oil and gold continue to rise given the situations in Iraq and Ukraine. The Iraqi insurgency slowed their advance on the weekend as the US is ready to mobilize an aircraft carrier. There are no immediate disruptions forecasted to the nation’s oil supply, but that could change is the armed conflict continues. Russia and Ukraine continue to negotiate the gas deal that has become a political tug-of-war between the newly elected president of Ukraine and the Kremlin. Adding fuel to the dispute was the news of a military airplane brought down by Pro-Moskow rebels. Oil recorded an over 4 percent rise last week and could continue to move upwards if both situations continue unresolved. Gold has benefitted from safe haven demand at closed at $1,276 on Friday.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.