The Bank of England will have its monthly economic meeting this Thursday, the second one with the new methodology of releasing minutes right after the meeting, and not two weeks later, as they did for several years.

The Central Bank will therefore, release its latest decisions regarding the current rates and the Asset Purchase Program, both expected to remain unchanged. Focus will turn then on how policy makers vote. In their last meeting early August, only 1 out of the 9 PMC members voted for a rate hike, whilst the rest preferred to maintain the ongoing policy on hold.

The news was quite disappointing for Pound buyers, particularly considering that officers have been largely jawboning on a rate hike during the previous weeks. This time, market's expectations are low, given that Britain's data has been on a tear ever since the August meeting, but the Minutes will be closely watched by investors, looking for clues on the timing for a possible rate hike in the UK during the first half of 2016.

Ahead of the release, another batch of negative data hit the UK, with the latest NIESR GDP estimate pointing for a 0.5% growth in the three months ending in August 2015, below the previous reading of 0.7%. Earlier in the day, Industrial Manufacturing and Production unexpectedly shrunk in July, whilst the trade deficit in goods and services grew to £3.4 billion in July 2015, a widening of £2.6 billion compared with a month before.

Additionally, Chinese economic slowdown has spurred fears of contagion amongst other major economies, and there's a good chance the Central Bank will attribute the latest backdrop in data to worldwide woes. Nevertheless, BOE's Governor Mark Carney, will likely pledge for a sooner rate hike, and with no changes in the 8-1-0 vote, the Pound may re-surge.

Effects on GBP/USD

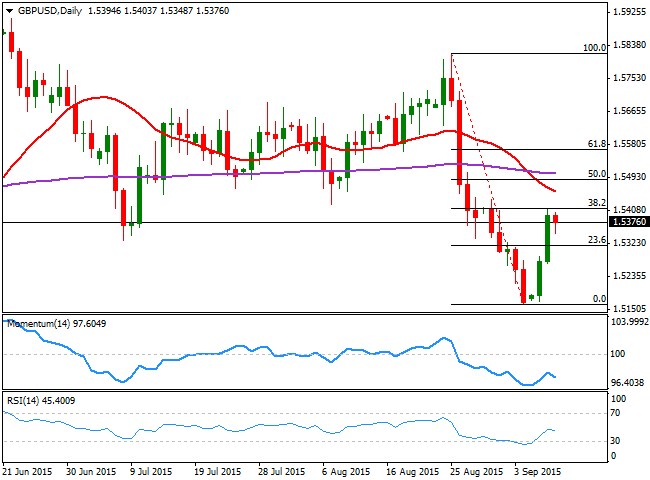

The GBP/USD pair has been clearly reflecting the poor macroeconomic releases, declining over 650 pips during before finally finding some demand in the mid 1.51 region. The following rally however, has stalled at 1.5410, the 38.2% retracement of the latest decline. A generally hawkish stance from Carney, and a similar, or better MPC voting on the upcoming highs, should see the pair breaking through the Fibonacci resistance, and extending towards the 1.5490 level in the short term, the 50% retracement of the same rally.

If Carney is however dovish, with no mentions to a sooner rate hike and all of the MPC members decided to keep the current policy on hold, the GBP/USD pair will likely break below 1.5315, the 23.6% retracement of the same rally, and extend down to 1.5250, a strong static support area.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.