EUR/USD muted as investors digest US inflation data

The US dollar moved sideways after the latest consumer inflation data from the United States. The data showed that US inflation remains high in April as the cost of most items rose. However, the headline figure of 8.3% was lower than the previous 8.5%. It was also the first time in eight months that inflation moved lower. According to the statistics agency, the price of most important items like groceries, air tickets, and gasoline remained at elevated levels. Therefore, investors will be focusing on statements by Fed officials. Its policies will need to hike rates without stifling growth.

The British pound moved sideways ahead of important economic numbers from the UK. The Office of National Statistics (ONS) will publish the latest manufacturing and industrial production and GDP numbers in the morning session. Economists expect the data to show that the UK economic growth slowed in March. They believe that the economy saw no growth in March as it rose by 1.0% in the first quarter. Meanwhile, economists expect that manufacturing and industrial production declined in March.

The Mexican peso moved sideways ahead of the latest interest rate decision by the country’s central bank. Analysts expect that the central bank will deliver another 0.25% rate hike in this meeting. If this happens, it will push the headline rate to 7.0%. The bank has been hiking rates since May 2021 when its benchmark was at 4.0%. The rate hikes are intended to help slow inflation, which currently stands at a 21-year high of 7.45%. In addition to the Banxico rate hike, other key data to watch will be US and Swiss producer price index (PPI).

USD/MXN

The USDMXN pair is trading at 20.25, which is slightly below its weekly high of 20.40. On the four-hour chart, the price is between the 38.2% and 23.6% Fibonacci Retracement level. The pair has moved to the 25-day moving average while the MACD has moved slightly above the neutral level. It has also moved slightly below the slanted resistance shown in red. Therefore, the pair will likely keep falling as bears target the key support at 20.

EUR/USD

The EURUSD pair moved sideways as investors reacted to the latest US consumer inflation data. On the three-hour chart, the pair is slightly below the dots of the Parabolic SAR while the Relative Strength Index (RSI) has moved to the neutral level of 50. The On-Balance Volume (OBV) has moved slightly upwards. The pair will likely remain in this range as investors process key economic data from the US and statements by Christine Lagarde.

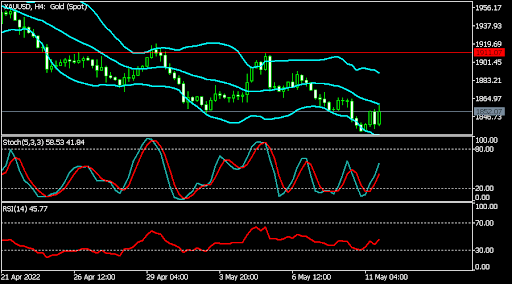

XAU/USD

The XAUUSD pair moved sideways after the latest data from the United States. The pair is trading at 1,850, which is between the lower and middle lines of the Bollinger Bands. It remains slightly below the 25-day and 50-day moving averages while the Stochastic Oscillator has moved above the neutral level. Therefore, the pair will likely resume the bearish trend.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.