Eurozone SMEs manage for now but their finances will get worse

Policy measures propping up funding to eurozone SMEs have worked well, but all-too-familiar eurozone rifts between North and South are opening up again.

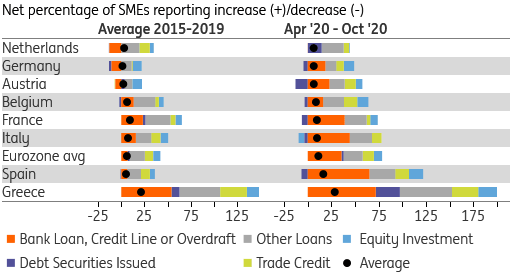

Net 35% of eurozone SMEs needed additional bank credit facilities this year

The latest ECB Survey on Access to Finance ("SAFE") queried eurozone businesses from early September through the first half of October, before major new constraints were imposed throughout Europe. However, the spring lockdown measures had already left their mark on the health of small and medium-sized enterprises, and concern about a second wave was already in the air. A net 46% of eurozone SMEs reported a drop in turnover, the worst score on record (even worse than 2009, when the SAFE was first held). The biggest impact was felt in Italy and France (over 50% of SMEs reporting a contraction in turnover), while the impact was relatively mild in the Netherlands and Belgium (net 32%). This obviously has financial consequences. In the “normal” years of 2015 to 2019, on average a net 6.7% of eurozone SMEs reported needing a bank loan, credit line or overdraft facility. This jumped to 35.7% in the surveyed period. Indeed, helped by government guarantee schemes, bank borrowing increased sharply almost everywhere in the eurozone in spring.

SME financing needs

Source: ECB SAFE, ING

Behind the eurozone numbers are some familiar north-south dividing lines. In Germany, the Netherlands and Belgium, the reported net additional need for bank facilities was below 20%, and even just 0.3% in the Netherlands. By contrast in Spain, a net 65% of SMEs needed to draw on their bank, with Italy and France around 40%.

SMEs got the financing they needed to tide them over

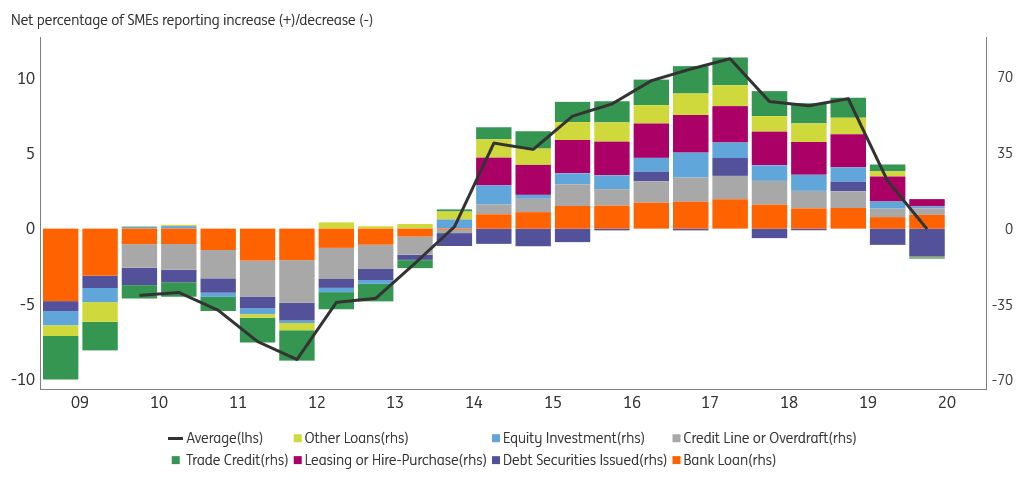

Eurozone SMEs on balance reported no change in the availability of finance. This can be considered positive given the circumstances, though it can also be interpreted as a deterioration compared to the years 2015-2019 when the availability of finance continuously improved. Bank facilities remained available in the surveyed period, a sign that policy measures to support bank lending, including guarantee schemes, worked. A conclusion also borne out by bankruptcy figures, which have stayed below 2019 levels so far this year.

Eurozone availability of finance for SMEs

Source: ECB SAFE, ING

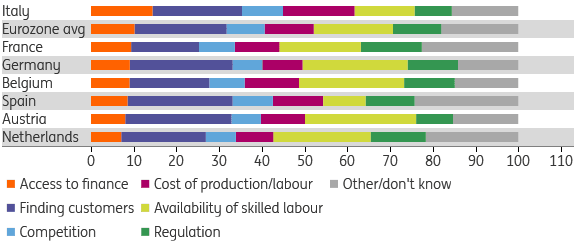

The biggest increases in availability of bank facilities were reported in Spain, Italy and France. Those are indeed the countries that saw the biggest bank lending growth this year. SMEs in the Netherlands and Belgium reported reduced availability of bank facilities, though this should be put in the context of relatively low financing needs reported in these countries (see above). Indeed the “financing gap”, which is the difference between financing needed and obtained, widened everywhere, but the least in the Netherlands, Germany and Belgium. Moreover, obtaining finance remained “the least of my worries” for most SMEs. Finding customers and the right employees remain top concerns.

Most pressing SME problem

Source: ECB SAFE, ING

Asked why the availability of finance changed, eurozone SMEs overwhelmingly pointed to the much deteriorated general economic outlook and reduced prospects for their own firm. Government measures, including guarantee schemes, mitigated the impact. Banks generally remained willing to lend, according to SMEs.

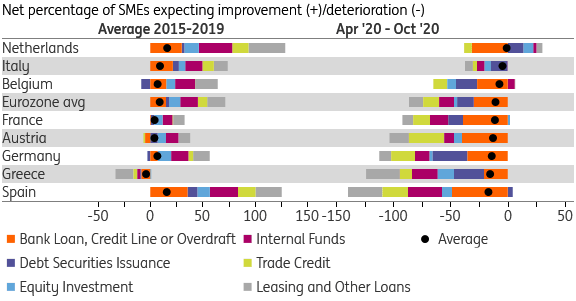

It ain't over till the mass vaccine stings

SMEs are understandably pessimistic about the expected availability of finance in the near future. Dutch SMEs are least pessimistic about this. On balance, they expect reduced availability of bank facilities to be almost fully compensated by other sources, mainly increased security issuance and equity investment. Italian SMEs are also not overly pessimistic. The biggest SME pessimists can be found in Spain, Greece and… Germany. The last one is a surprise, given that the German government has implemented relatively generous support facilities, and also given that German SMEs report one of the lowest needs for finance in the eurozone (see above).

SME expected availability of finance

Source: ECB SAFE, ING

The ECB Survey on Access to Finance of Enterprises confirms that efforts to keep financing available for businesses in the eurozone generally worked well. The gap between funding needed and sources available did widen, but only by a moderate amount, taking the size of the economic impact into account. SMEs reported much bigger financial problems back in 2010-2012. That said, providing liquidity to businesses has attended to immediate financing needs, but does not address solvency issues. This is perhaps the biggest item on the financial to do-list. Moreover, familiar rifts within the eurozone have opened up again, with SMEs in the North generally reporting low financing needs, and those in the South reporting bigger impacts on turnover and correspondingly higher demand for finance.

Read the original analysis: Eurozone SMEs manage for now but their finances will get worse

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.