EUR/USD Weekly Forecast: US Dollar to emerge victorious

- Inflation continued to ease in the United States, spurring optimism.

- Germany's economic slowdown dragging the Union into a recession.

- EUR/USD hesitating on the downside, US Dollar poised to win the battle.

The EUR/USD pair finishes the week on the downside, although losses were modest, with the pair still close to the 1.1000 threshold. Financial markets struggled for direction amid uncertainty surrounding the economic future, failing to set a directional path.

The mixed United States (US) monthly employment report released by the end of the previous week revived concerns about whether the US Federal Reserve (Fed) would continue hiking rates or not, as the Nonfarm Payrolls (NFP) report showed the Unemployment Rate fell to 3.5% in July, while wages increased. Annual earnings were up 4.4% in July, now rising at a faster pace than inflation.

Inflation still in the eye of the storm

The US Dollar kick-started the week resuming its former advance, pushing EUR/USD to a weekly low of 1.0928 as expectations mounted ahead of the release of US inflation figures, meant to share some light on the future monetary policy. In the meantime, German data hit the Euro, as Industrial Production contracted by 1.5% in June, while the July Harmonized Index of Consumer Prices (HICP) was confirmed rising 6.5% YoY, following a 6.8% increase in June.

Being Germany the leading European economy, trouble in the country means trouble for the Union. German’s slowdown is dragging EU growth as a whole, and the odds of a recession increase over time. The European Central Bank (ECB) has no choice but to continue tightening its monetary policy, regardless of the risks involved. ECB officials have flipped from discussing the need for a pause to anticipating another rate hike next month.

Finally, on Thursday, the US Bureau of Labour Statistics informed the US Consumer Price Index (CPI), which rose by 0.2% MoM and 3.2% YoY, slightly below anticipated. The annual core inflation was 4.7%, easing from the previous 4.8%. The market turned optimistic with the news, and EUR/USD jumped to 1.1064 as the news boosted bets for no more Fed rate hikes this year.

Central banks between a rock and a hard place

Still, optimism was short-lived, and the Euro quickly trimmed gains as a couple of Fed officials hit the wires with hawkish comments. The most notable was Federal Reserve Bank of San Francisco President, Mary Daly, who said she supports not prematurely projecting Fed moves, repeating the well-known message that rate movements are data-dependant. Finally, she added that CPI data came in “largely as expected” and that it does not say victory on inflation.

By the end of the week, the US reported the July Producer Price Index (PPI), which increased by 0.3% in the month and by 0.8% from a year earlier. Healthy inflationary pressures that should not be read as worrisome, even if above the market expectations. Additionally, the preliminary estimate of the August Michigan Consumer Sentiment Index printed at 71.2, better than the 71 expected but below the previous 71.6.

The imbalance between the Fed and the ECB is no news. European central banks have been trailing the Federal Reserve ever since the 2008 crisis, which generally results in the US Dollar merging victorious. So far, however, financial markets are still mainly trading on sentiment. However, it won’t take long until encouraging US data primarily benefits the Greenback instead of high-yielding rivals.

Data-wise, the upcoming week will bring US Retail Sales, expected to have risen by 0.3% in July, and the latest Federal Open Market Committee (FOMC) Minutes. The Euro Zone will release the second estimate of the Q2 Gross Domestic Product (GDP), expected to confirm a 0.3% growth in the three months to June and the July HICP.

EUR/USD technical outlook

The EUR/USD pair is bearish, although the weekly chart shows buyers have defended the 1.0900 threshold since late July. Somehow, it seems that the US Dollar is a bit exhausted, although, with the pair trading at current levels, a tide change is still unclear.

The weekly chart shows EUR/USD still battling to regain ground above the 61.8% retracement of the 1.0833/1.1275 rally at 1.1005, yet at the same time, it bounced from a mildly bullish 20 Simple Moving Average (SMA). The latter has extended its advance above the 100 SMA, limiting the bearish potential of the pair. At the same time, technical indicators slid further from their June peaks, skewing the risk to the downside, although failing to confirm another leg south. The Momentum indicator is pretty much flat around its 100 level, while the Relative Strength Index (RSI) indicator aims modestly lower at around 55.

The technical perspective in the daily chart favors a bearish extension. EUR/USD trades below a firmly bearish 20 SMA, while a mildly bullish 100 SMA provides support, currently at around 1.0925. Finally, the Momentum indicator advances, although within negative levels, while the RSI indicator consolidates around 46, reflecting the absence of buying interest.

The pair bottomed at 1.0911 in August, the level to break to confirm a bearish continuation, initially towards the 1.0830 price zone. Once below the latter, EUR/USD can fall as low as 1.0720.

The key level to watch on the upside is the aforementioned weekly high at 1.1064, with gains above the level exposing the 1.1120 region en route to 1.1180/90.

EUR/USD sentiment poll

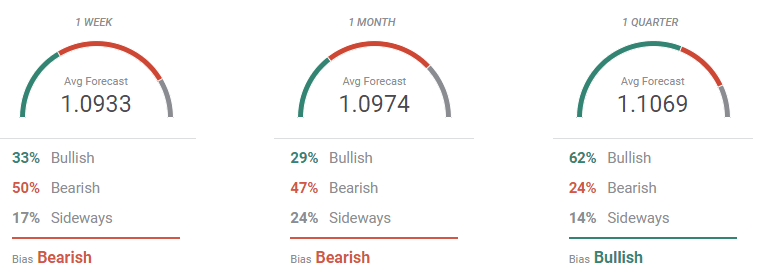

The FXStreet Forecast Poll shows that bears outpace bulls in the weekly and monthly perspectives, although EUR/USD is seen holding above the 1.0900 threshold, on average. In the quarterly view, however, bulls take the lead, jumping to 62% of the polled experts vs roughly 30% in the previous periods analyzed. Still, the pair is seen holding into familiar levels, with the average target at 1.1069.

The Overview chart reflects the ongoing uncertainty, as the near-term moving averages aim marginally lower, while the quarterly one turned modestly north. What seems more interesting, EUR/USD is seen for the most, holding above 1.0800, with some minor bets below the level in the three-month perspective. Also, worth noting the upper end of the range increases from 1.1200 in the one-month view to 1.1400 in the three-month one.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.