EUR/USD Weekly Forecast: US Dollar set to extend its advance amid ruling risk-off mood

- The United States debt-ceiling issue and banking woes undermined the market sentiment.

- European Central Bank authorities repeat they are engaged in a cautiously hawkish path.

- EUR/USD set to extend its slump with 1.0745 as the ultimate support for bulls.

The EUR/USD pair lost its bullish steam and fell below the 1.0900 price zone, where it stands at the end of the week. The US Dollar surged amid mounting concerns about the United States (US) economic future. The banking crisis that begun in March, and the dovish stance adopted by the US Federal Reserve (Fed) undermined the market mood and fueled demand for safe-haven assets.

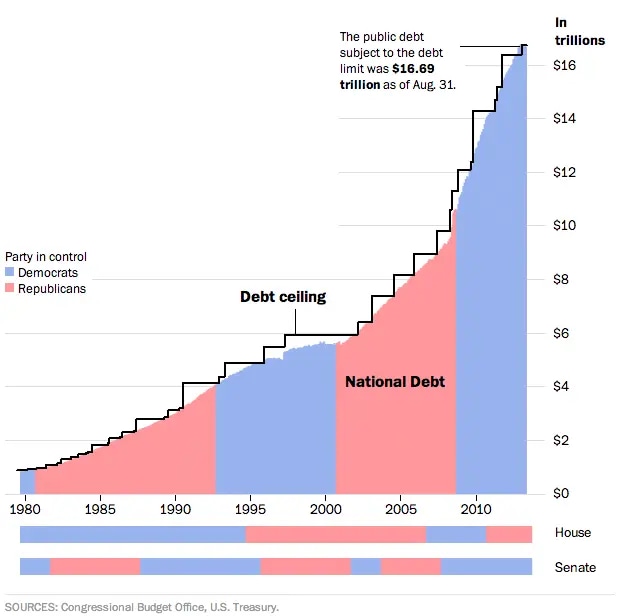

Debt ceiling worries again

Additionally, anxiety was fueled by the US debt-ceiling issue. Treasury Secretary Janet Yellen said the US government could become unable to pay its bills on time as soon as June 1 if Congress doesn't first raise the debt limit, currently at $31.4 trillion.

President Joe Biden has urged Republican lawmakers to vote in favor of raising the limits, but discussions between the two ruling parties continues. A meeting scheduled for this Friday was delayed for next Monday, when President Biden and top lawmakers from both parties will discuss a potential deal. Republicans would vote affirmative if Biden agrees to retroactive reductions in government spending.

Woes overshadowed encouraging US data, as inflation kept receding in April. The Consumer Price Index (CPI) rose by 0.4% MoM and by 4.9% YoY, slightly below expected. Also, the Producer Price Index (PPI) increased by 2.3% in the year to April, down from 2.7% YoY in the previous month. The news should have boosted the mood, as those suggest the Fed will remain on-hold in the upcoming meetings, helping the economy in dodging a recession.

One word about the debt ceiling: the US faces this issue every year, since the early 70s’. And each single time, financial markets turn cautious, only for the problem to be solved in the last minute. The caveat is that, the solution does not bring an equal release to the former concerns. And regarding this particular time, it’s worth remembering the fragility of the banking system amid Fed’s decision to drain liquidity to tame inflation.

ECB’s unimpressive hawkishness

Across the pond, things are no better. Eurozone (EU) macroeconomic data fell short of underpinning the Euro. Germany confirmed that the Harmonized Index of Consumer Prices (HICP) was up by 7.6% YoY in April, while Industrial Production in the country declined 3.4% MoM in March. Also, EU Sentix Investor Confidence fell to -13.1 in May, missing the market forecast.

European Central Bank (ECB) officials were on the wires, but add nothing new to what markets already knew. Generally speaking, authorities maintained the hawkish tone, although clarifying decisions will be made meeting-by-meeting, cooling speculation of whatever could happen in September. At the time being, speculative interest is convinced the ECB will pull the trigger in June and July.

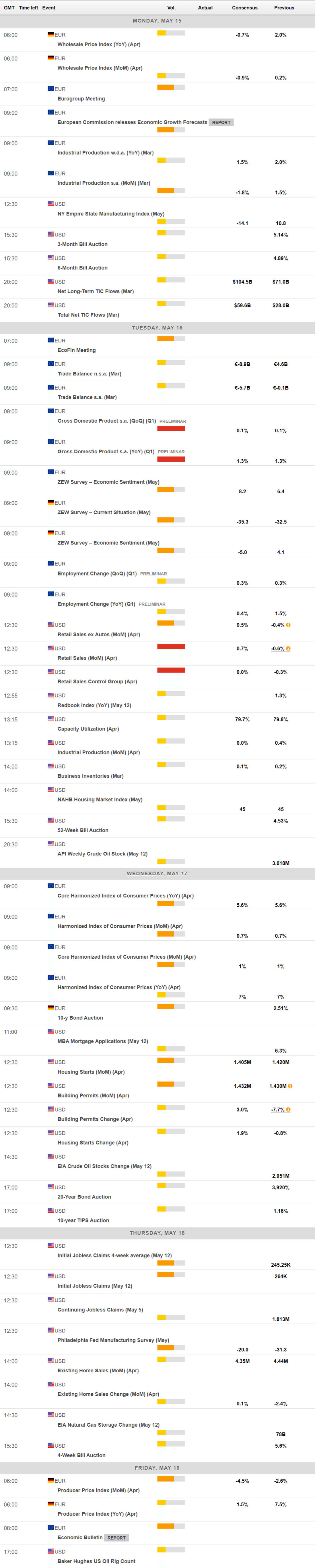

For the upcoming week, attention will remain on the US debt ceiling and banking health. The macroeconomic calendar has little relevant to offer, although the US will release April Retail Sales, while the EU will publish the second estimate of the Q1 Gross Domestic Product (GDP) and the final estimate of the April HICP. The Europan Commission will release the Economic Growth Forecasts report, while Germany will offer the May ZEW Survey on Economic Sentiment. Most likely, the mood will remain sour.

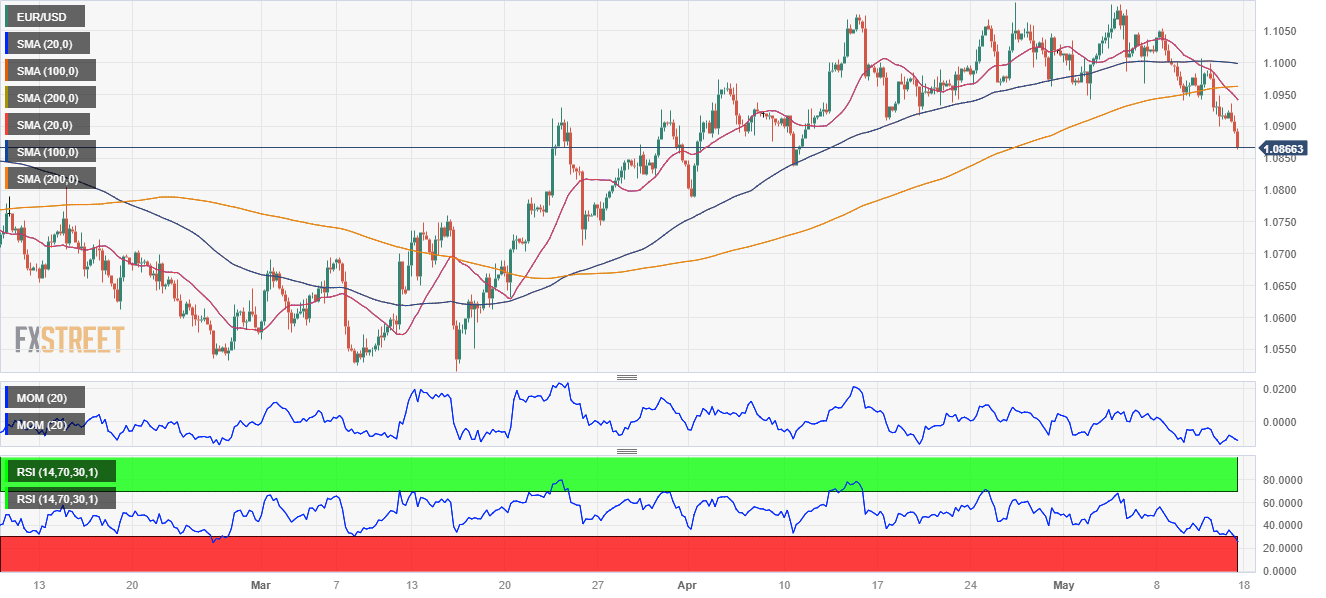

EUR/USD technical outlook

The EUR/USD pair was able to advance just one out of the last five days, ending the week at one-month lows.

The case for a bearish extension over the upcoming days gains strength, according to technical readings in the weekly chart. The Momentum indicator eases within neutral levels, holding just above its 100 level. The Relative Strength Index (RSI) indicator, on the other hand, retreated sharply from overbought levels, and while it still remains above its midline, it heads south almost vertically. At the same time, the pair is pressuring a bearish 100 Simple Moving Average (SMA), and as the 200 SMA stands pat far above the current level. Finally, the 20 SMA maintains a bullish slope below the current level, acting as dynamic support at around 1.0790.

EUR/USD is set to extend its decline according to the daily chart. The pair is below a mildly bearish 20 SMA for the fourth consecutive day, with the moving average now providing dynamic resistance at around 1.0985. The longer moving average keep advancing below the current level, but lost a good part of their bullish strength. Finally, technical indicators head south well below their midlines and without signs of downward exhaustion.

The 1.0800 level is the natural immediate support, en route to 1.0745, the 61.8% retracement of the 2022 yearly decline. A break below the latter should open the door for a long-term USD rally. The 1.0980/1.1000 area will be a tough bone to break now, although if the pair manages to recover above it, 1.1100 is a possible target.

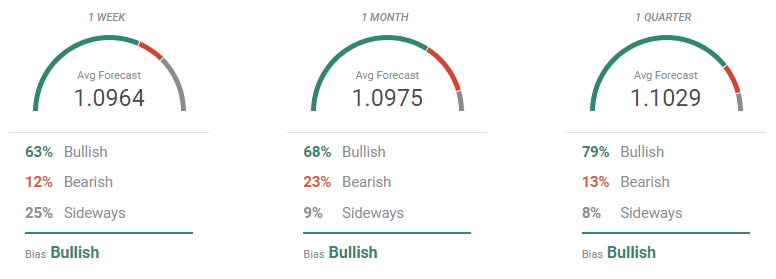

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that the latest EUR/USD slump caught investors off guard. Most market participants believed the EUR/USD would hold above the 1.0900 mark. On average, bulls not only are a majority in the three time frames under study but also their number increases in time. On average, however, the pair is seen between 1.0960 and 1.1030, somehow suggesting buyers are losing conviction.

The Overview chart shows that the nearest moving average turned south, but also that the longer ones maintain their bullish slopes. In the monthly perspective, most potential targets accumulate in the 1.0800/1.1200 region, while the range in the quarterly view increases to 1.0900/1.1400. The number of experts betting for slides sub-1.0800 is low, which means any further slide could be corrective, and that buyers are willing to add at lower levels.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.