- European inflation was higher than anticipated in December, according to preliminary estimates.

- The United States employment sector remains tighter than what the Fed wishes.

- EUR/USD battles to resume its bullish trend, increasing chances of a bearish breakout.

The US Dollar kick-started the year on a strong footing, appreciating against most major rivals. The EUR/USD pair fell to 1.0876, further retreating from its late December peak of 1.1139, and heads into the weekend trading at around 1.0980.

Financial markets returned from the winter holidays and are looking for fresh direction. Speculative interest took some profits out of the table after thin trading helped EUR/USD reach a multi-month high. But investors also chose to reduce bets on upcoming rate cuts after macroeconomic figures confirmed the economic contraction extended into December 2023, while inflation in the Eurozone remained elevated at the end of the year.

Concerning macroeconomic developments

On the one hand, S&P Global released the final estimates of its December Producer Manager Indexes (PMIs), which showed manufacturing and services output remained below 50 - the line that separates contraction from expansion- in the European Union (EU) and the United States (US). The latter published the official ISM PMIs, with the manufacturing index printing at 47.4 and the services one resulting in 51.4, which provides some support to the US Dollar.

On the other hand, Germany unveiled the preliminary estimate of the Harmonized Index of Consumer Prices (HICP), which unexpectedly jumped to 3.8% YoY in December, according to preliminary estimates. At the same time, the EU HICP rose 2.9% in the year to December, much higher than the previous 2.4%. Finally, German Retail Sales plunged by 2.5% MoM in November, much worse than anticipated.

Restricted growth but still high inflation could affect central banks’ decisions. The idea of slower progress is welcome as long as it comes by the hand of easing price pressures. The aforementioned figures suggest the European Central Bank (ECB) should stick to the “higher for longer” mantra, as additional rate hikes risk a steep recession. Across the pond, however, the Federal Reserve (Fed) seems to be dealing with a slightly better situation, but macroeconomic figures are falling short of suggesting a rate cut in the first quarter of the year.

Speaking of which, the Federal Open Market Committee (FOMC) unveiled the Minutes of the December meeting. Officials noted that “the policy rate is likely at or near its peak for this tightening cycle,” not actually a surprise after three consecutive on-hold decisions. Also, the document showed policymakers believe a rate cut is possible in 2024 but gave no hints on when or how it might occur.

US labor market remains tight

A critical clue on where the Fed is heading next came from the labor sector. The US published multiple employment-related figures, including the ADP survey and the Nonfarm Payrolls (NFP) report. ADP indicated that the private sector added 164K new positions in December, much higher than the 115K anticipated by market participants. The NFP report showed the country created 216K new jobs in December, while the Unemployment rate held steady at 3.7% according to the US Bureau of Labor Statistics (BLS), both readings beating expectations. Average Hourly Earnings climbed 4.1% YoY up from 3.9% in November. The upbeat report gave the US Dollar a near-term boost, as it means the Fed would need to maintain rates at current levels for longer than previously anticipated.

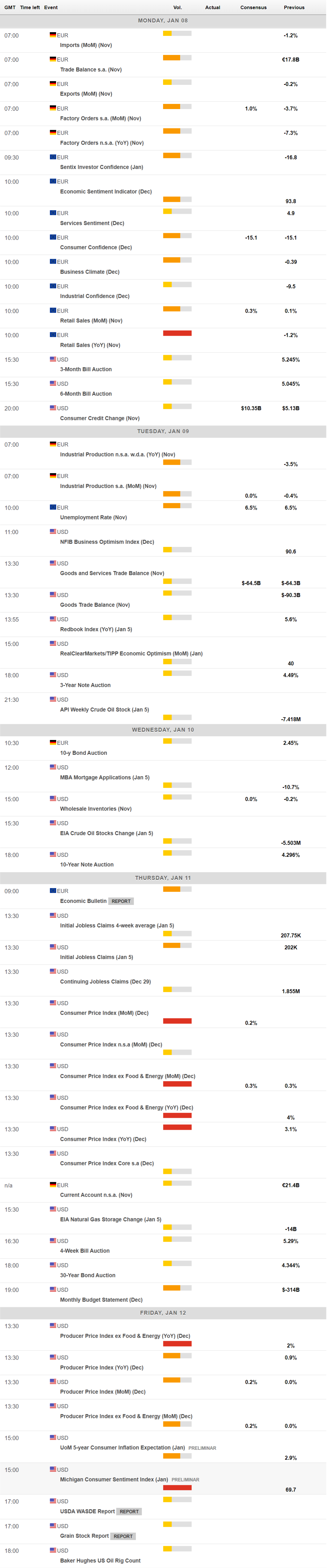

The upcoming week will bring fresh clues on US price pressures. The country will release next Thursday the December Consumer Price Index (CPI), foreseen up by 0.2% MoM. On Friday, it will be the turn of the Producer Price Index (PPI) for the same month, expected to post a modest 0.2% monthly increase. EU November Retail Sales stand out in the European macroeconomic calendar.

EUR/USD technical outlook

From a technical point of view, the EUR/USD pair is ending the week with substantial losses, and while bears dominate, they are still lacking control. The weekly chart shows the pair met sellers around a flat 200 Simple Moving Average (SMA) late in December but develops far above mildly bearish 20 and 100 SMAs. Technical indicators, in the meantime, have turned marginally lower within positive levels, still far above their midlines.

In the daily chart, however, the risk of another leg south has increased. EUR/USD is battling to recover above a bullish 20 SMA, which limits the upside at around 1.0950. A directionless 200 SMA provides support at around 1.0845, the first level to beat to the downside next week. Finally, technical indicators seesaw around their midlines, lacking clear directional strength.

EUR/USD needs to recover the 1.1000 threshold to shrug off the negative stance, with resistance then at 1.1060 and 1.1120. Below 1.0900, the aforementioned 1.0845 is the immediate support level, with a break below it exposing the 1.0760 area.

Euro price in the last 7 days

The table below shows the percentage change of Euro (EUR) against listed major currencies in the last 7 days. Euro was the weakest against the Pound Sterling.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.66% | -0.26% | 0.45% | 1.18% | 1.83% | 0.97% | 0.27% | |

| EUR | -0.66% | -0.94% | -0.21% | 0.58% | 1.19% | 0.32% | -0.40% | |

| GBP | 0.25% | 0.90% | 0.70% | 1.43% | 2.07% | 1.21% | 0.52% | |

| CAD | -0.45% | 0.20% | -0.72% | 0.74% | 1.38% | 0.51% | -0.17% | |

| AUD | -1.25% | -0.56% | -1.46% | -0.79% | 0.59% | -0.28% | -0.96% | |

| JPY | -1.87% | -1.14% | -2.13% | -1.35% | -0.56% | -0.89% | -1.58% | |

| NZD | -0.98% | -0.28% | -1.24% | -0.52% | 0.22% | 0.88% | -0.69% | |

| CHF | -0.28% | 0.39% | -0.49% | 0.18% | 0.90% | 1.57% | 0.65% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The Fed’s Bostic, Barr, Waller, Jefferson, and Mester are set to speak on Monday.

EUR/USD: Could FOMC Minutes provide fresh clues?

The EUR/USD pair advanced for a fourth consecutive week, comfortably trading around 1.0860 ahead of the close. Progress had been shallow, as the pair is up roughly 250 pips from the year low of 1.0600 posted mid-April.

Gold looks to extend uptrend once it confirms $2,400 as support

Gold price continued to push higher last week and rose above $2,400 on Friday, gaining nearly 2% for the week. Investors will continue to scrutinize comments from Fed officials this week and look for fresh hints on the timing of the policy pivot in the minutes of the April 30-May 1 meeting.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.