EUR/USD Weekly Forecast: Dollar surfing yields’ wave

- US Treasury yields reached one-year highs amid hopes for an improving economy.

- Growth and employment-related data take centre stage next week.

- EUR/USD giving signs of changing course in the daily chart.

Risk-related sentiment and reflation trade set the market’s tone this week and will likely keep driving currencies during the next one. The EUR/USD pair peaked on Thursday at 1.2242, its highest level in over a month, but trimmed gains on Friday to finish a second consecutive week unchanged just above the 1.2100 level.

Fed not worried, yields soared

Long-term US Treasury yields soared, while shorter-term ones also advanced, although to a lesser extend. Bonds sold off in anticipation of higher inflation and prospects for massive stimulus boosting spending. The market has already priced in US President Joe Biden’s $1.9 trillion stimulus package, while US Federal Reserve head Jerome Powell reiterated that quantitative easing is here to stay.

Testifying before Congress, Powell remarked that the “economic recovery remains uneven and far from complete,” while the path ahead is highly uncertain. In this scenario, the accommodative monetary policy will remain as long as both employment and inflation recover to the desired levels. About the latter, he repeated that policymakers are open to see it run slightly above the 2% target for a period of time. On employment, Powell said that the real unemployment rate could be closer to 10%, adding that there’s a long way ahead of full employment. When asked about yields, he said that he is not concerned about it, as it’s tied to optimism about the outlook. US policymakers still believe an economic comeback will come later in the year, despite the ultra-loose policy will likely extend into the next one.

The yield on the 10-year Treasury note peaked at 1.61% on Thursday, its highest since February 2020, with stocks nosediving afterwards, with the Nasdaq being the worst performer amid persistent pressure on tech-shares. The DJIA, however, retreated from fresh record highs, with the long-term bullish perspective barely affected. The American currency finally got to run on Friday, on the back of plummeting stocks.

Slow macroeconomic progress

Generally speaking, macroeconomic data was encouraging. German IFO Business Climate improved to 92.4 in February from 90.3 in January, while the country’s Gross Domestic Product was upwardly revised to 0.3% QoQ in Q4. The March GFK Consumer Confidence Survey improved to -12.9 in March, beating expectations. Also, European inflation was confirmed at 0.9% YoY in January, while the February Economic Sentiment Indicator printed at 94.3, better than the previous 91.5 and the expected 92.

In the US, Durable Goods Orders surged 3.4% in January, much better than the 1.1% expected, while Initial Jobless Claims shrank to 730K in the week ended February 19. The country’s Q4 GDP was upwardly revised to 4.1% as expected.

Employment and growth under the spotlight

The upcoming week will be a busy one, as Markit will publish the final versions of its February PMIs for the EU and the US. The official US ISM Manufacturing PMI will be out on Monday, foreseen at 58.6, while the services index will be released on Wednesday and is expected at 58.5.

Germany will release the preliminary estimates of February inflation, January Retail Sales and Factory Orders for the same month, all of them growth-related numbers. The EU will also release its inflation estimates and January Retail Sales.

US employment-related data will take centre stage starting on Wednesday, with the release of the ADP survey. The report is expected to show that the private sector added 125K in February, after gaining 174K in the previous month. On Thursday, the country will publish February Challenger Job Cuts, Initial Jobless Claims for the week ended February 26, and Q4 Unit Labor Cost and Nonfarm Productivity. Finally, on Friday, the US will publish the February Nonfarm Payroll report. At the time being, the market expects a 110K increase in job creation and an unemployment rate of 6.4%.

EUR/USD technical outlook

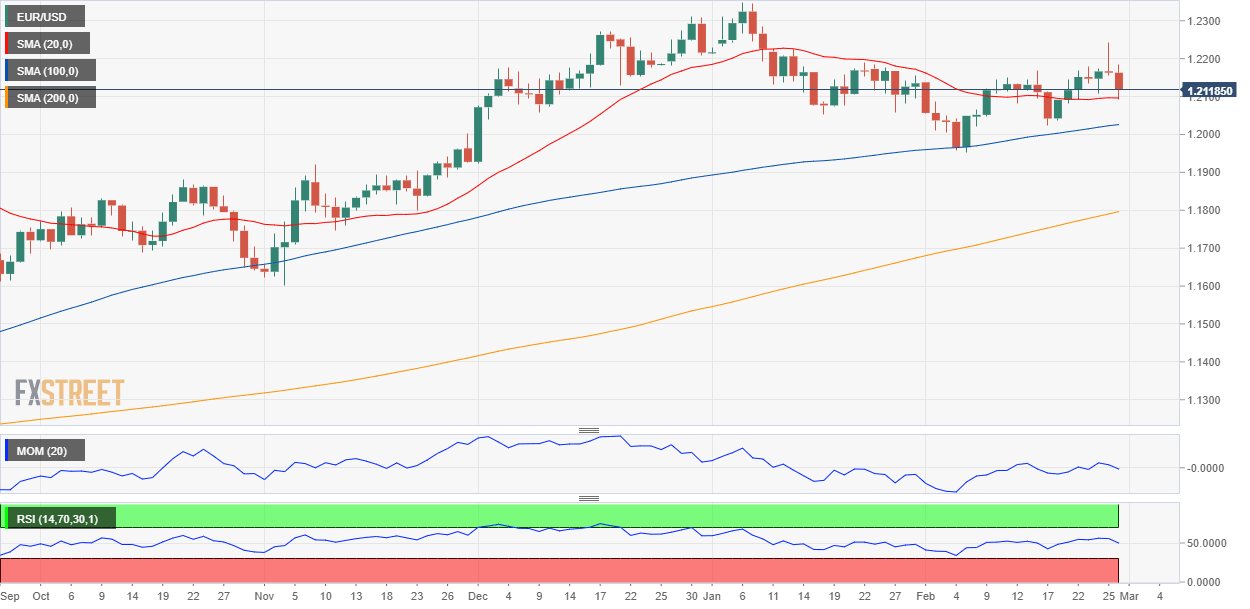

The weekly chart for the EUR/USD pair says little new. The risk in the long-term remains skewed to the upside, as the pair keeps developing above a bullish 20 SMA, which advances far above the larger ones. Technical indicators have lost directional strength but remain within positive levels.

Meanwhile, the pair keeps trading above the 38.2% retracement of its November/January rally at 1.2060 and was unable to sustain gains beyond the 23.6% retracement around 1.2170, a level that has contained advances since mid-January.

In the daily chart, Thursday’s candle and the subsequent Friday’s slump scream reversal. Nevertheless, the pair is holding above a flat 20 SMA, while the longer moving averages are maintaining their bullish slopes below it. In the meantime, technical indicators are heading lower, with the Momentum holding above its midline and the RSI entering negative levels.

The mentioned 1.2060 level is the immediate support ahead of the monthly low at 1.1951. To the upside, the pair will likely meet sellers around 1.2170, but once the latter, 1.2240 comes next. Once above this last, 1.2349 is the next bullish target.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that the dollar is set to continue running in the upcoming weeks, as bears dominate the weekly and monthly perspectives, with the pair seen approaching the 1.2000 level on average. Bulls re-take the lead in the quarterly view, with 46% of the polled experts betting for an advance, and the pair is seen, on average, at 1.2166.

The Overview chart indicates that bulls are still strong. With little exceptions, the pair is seen holding mostly above the 1.2000 level, and as high as 1.2500 in the upcoming months. The three moving averages present modest bearish slopes but remain mostly neutral.

Related Forecasts:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.