EUR/USD sellers took full control [Video]

![EUR/USD sellers took full control [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/european-union-currency-5219766_XtraLarge.jpg)

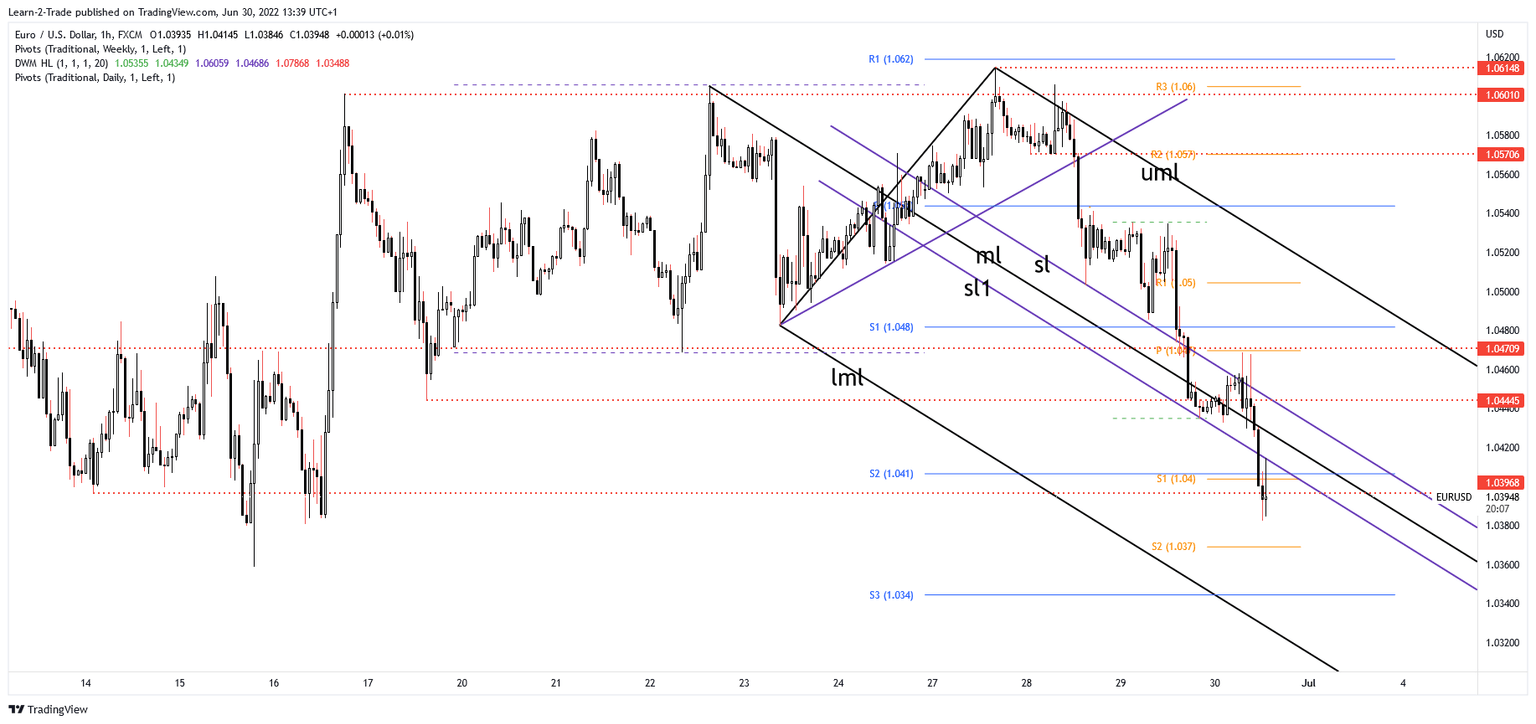

The EUR/USD pair is trading in the red at 1.0393 at the time of writing. The bias is bearish after taking out the near-term downside obstacles. Today, the Euro-zone data came in mixed while the US reported poor economic data. The US Unemployment Claims came in at 231K in the last week versus 228K expected, while the Core PCE Price Index rose by 0.3% less versus 0.4% expected. Still, the greenback remains strongly bullish as the Dollar Index confirmed an upside continuation. As you already know, the FED is expected to continue hiking rates in the next monetary policy meeting, so that’s why the USD may dominate the currency market.

From the technical point of view, the EUR/USD confirmed more declines after taking out the 1.0470 and 1.0444 downside obstacles. Its false breakout with great separation above the inside sliding line (sl) of the descending pitchfork signaled strong downside pressure. The aggressive breakdown below the median line and through the sliding line (sl1) could activate a border sell-off. Now, it challenges the 1.0396 static support. Validating its breakdown may attract more sellers.

Join Learn 2 Trade VIP Group now!

Join Learn 2 Trade VIP Group now!

Author

Olimpiu Tuns

Learn 2 Trade

Olimpiu is a seasoned Market Analyst / Trader with 11 years of experience in the financial markets having expertise in Forex, Commodities, Index, Cryptocurrencies, and Stocks.