EUR/USD Price Forecast: Sellers maintain the pressure, aim for sub-1.0300 levels

EUR/USD Current price: 1.0330

- The Hamburg Commercial Bank downwardly revised the December EU Manufacturing PMI.

- United States indexes aim to start the day with modest gains despite the souring mood.

- EUR/USD trades near a fresh two-year low and looks to extend its slump.

The EUR/USD pair trades near the 1.0300 level, down to its lowest since November 2022, as the US Dollar (USD) maintains its positive momentum, particularly against high-yielding rivals amid a risk-averse environment. Spot Gold is the best performer against the Greenback, while the Euro (EUR) is among the worst ones.

As financial markets slowly return from the long holiday, the macroeconomic calendar started offering some figures, albeit nothing relevant so far. The Hamburg Commercial Bank (HCOB) published the final estimates of the December Manufacturing Producer Manager’s Index (PMI) for the Eurozone, showing a modest downward revision to 45.1 from the previous estimate of 45.2. The official report highlighted “another month of deteriorating manufacturing sector conditions across the Eurozone, stretching the current sequence of decline to two-and-a-half years.”

Speculative interest maintains the focus on the latest United States (US) developments. On the one hand, the upcoming return of Donald Trump to the White House and his pre-announced policies may shaken the global financial picture. On the other hand, the Federal Reserve’s (Fed) decision to slow the pace of interest rate cuts, bringing back the “higher for longer” concerns.

The US published MBA Mortgage Applications for the week ended December 27, which fell by 12.6% after losing 0.7% in the previous week. Later in the day, the country will release Initial Jobless Claims for the last week of December, while S&P Global will post the final estimate of the December Manufacturing PMI.

Ahead of the opening, stocks trade mixed, with most Asian and European indexes posting losses. Wall Street’s futures, however, aim higher.

EUR/USD short-term technical outlook

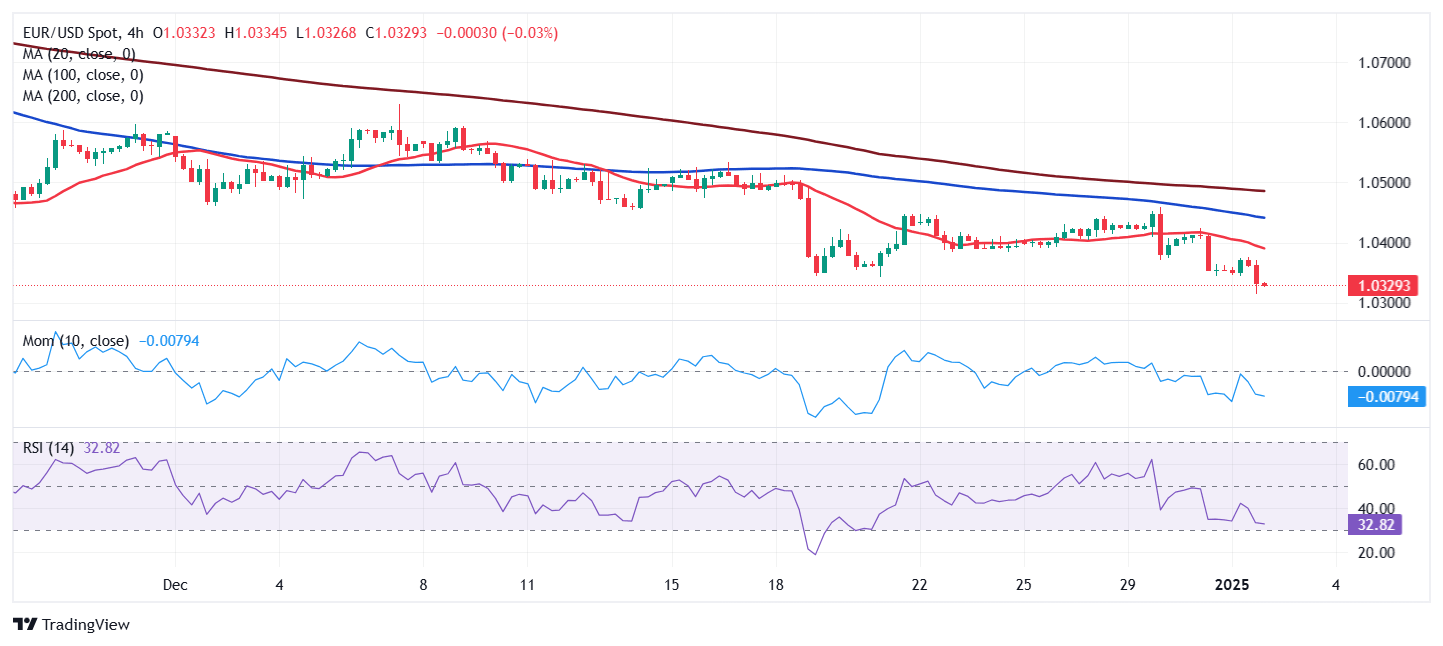

From a technical point of view, the EUR/USD pair is poised to extend its slump. The daily chart shows it trades in the red for the third consecutive session and not far from an intraday low of 1.0313. A bearish 20 Simple Moving Average (SMA) keeps heading south far below the 100 and 200 SMAs while providing dynamic resistance at around 1.0450. Technical indicators, in the meantime, head lower with uneven strength, still skewing the risk to the downside.

The EUR/USD pair is bearish in the near term. The 4-hour chart shows moving averages maintain their bearish slopes, with the 20 SMA accelerating lower below the longer ones, in line with the dominant downward trend. Meanwhile, technical indicators head firmly lower within negative levels, approaching oversold readings without showing signs of bearish exhaustion.

Support levels: 1.0310 1.0285 1.0240

Resistance levels: 1.0375 1.0410 1.0450

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.