The perfect scapegoat

S2N spotlight

I am not going to share any great insight about the pros or cons of tariffs. The die has been cast, and all that remains is to see who blinks first. There is a lot of ego at stake, and we are living at a time of exaggerated posturing on the geopolitical stage, so I think it is unlikely that we will see any backtracking or bending the knee from the main actors.

If you are panicking at the moment, you are a bit late, but for now you need to put your emotions aside and be ready to take action if that is what your strategy requires.

I wrote a number of weeks ago that I am sure Warren Buffett’s record cash pile of $390 billion will seal his legend as the GOAT for many generations to come. Well played, sir.

The reason I titled today’s letter “The Perfect Scapegoat” is because the stock market was/is a bubble looking for a prick. I am not calling the President of the United States names. Valuations were/are out of control, nosebleed heights, priced to perfection. I am not suggesting for a second that Trump tariffs didn’t tip the scales. I am simply saying if it wasn’t tariffs, it would be something else.

Today I want to spotlight how trading the VIX as part of your portfolio may not produce the results you think. We all follow the financial press and hear them say the VIX is trading at very low levels or the VIX has shot up. What is the VIX? It is an index that reflects the expected volatility of the S&P 500 over the next 30 days. The key point that you see from this chart is that the VIX indicator oscillates. It is mean-reverting. So surely investing when the VIX is below 15, for example, and exiting around 30 is a good strategy? Last week, the VIX was up 109% and 50% in one day. It is tempting to think if I traded the VIX, I could be a billionaire.

Not so fast. You have 2 options to invest in the VIX. You can invest in a very liquid ETN (exchange-traded note) called VXX, or you can invest in the VIX futures contract, get some leverage, and roll it every month yourself like you do your California roll. The VXX data only goes back to 2018, so I start from there for comparative purposes.

As you can see, these two lower charts look nothing like the spot VIX Index you often hear about in the media and see in the top chart. They steadily bleed value because of a phenomenon called “contango,” which just means longer-dated futures typically cost more. To maintain the position, you must repeatedly sell the soon-to-expire contract and buy the pricier, longer-dated one—a “negative roll.”

The takeaway I want to leave you with is that trading the VIX long term is an expensive strategy that is unlikely to produce a favourable return. We are all very clever after the fact, thinking we can time these volatility surges. There are other cheaper ways of buying volatility. I am simply demonstrating how a naive VIX strategy is not the way to play the long game.

S2N observations

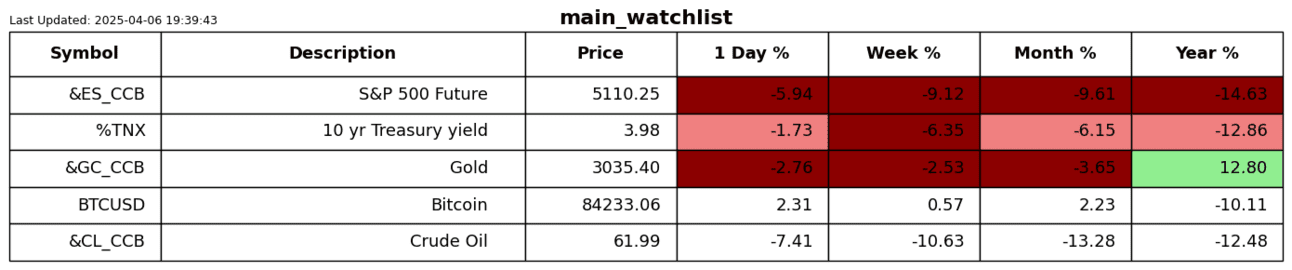

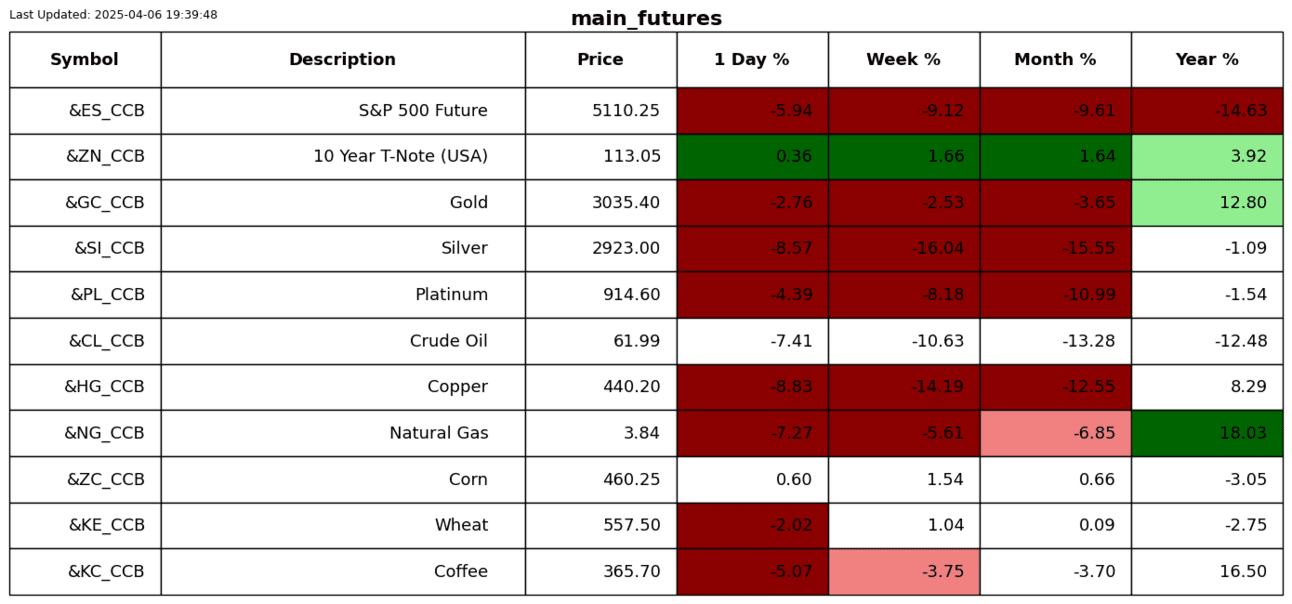

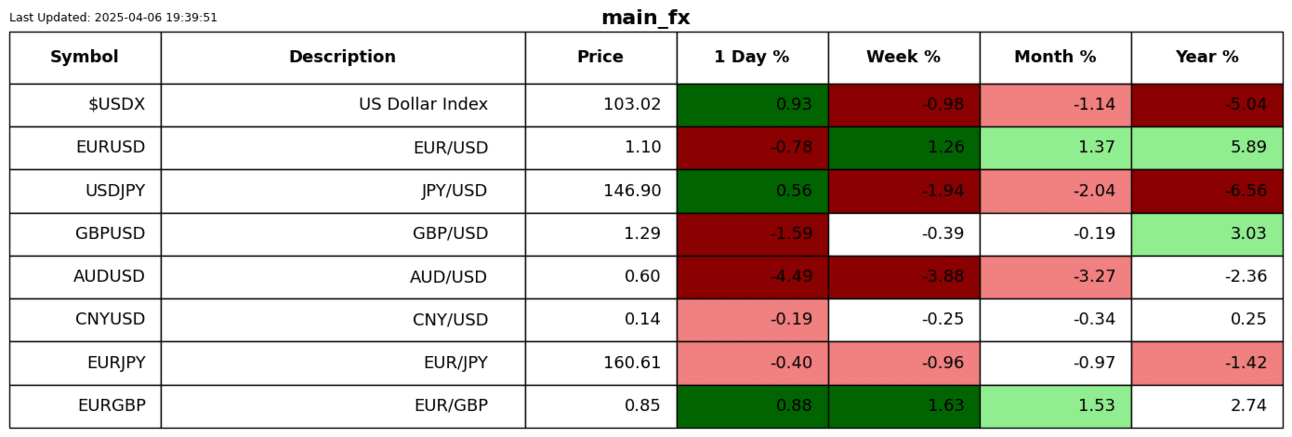

The S&P 500 futures are currently in bear market territory as I write this at 3pm Monday in Sydney, Australia. The S2N Argus trading tool, as you can see in real time below, is available for all Trade Nation clients.

The Nasdaq composite was down 22% as of Friday’s close.

The semiconductor SOX Index is down 39% from its highs.

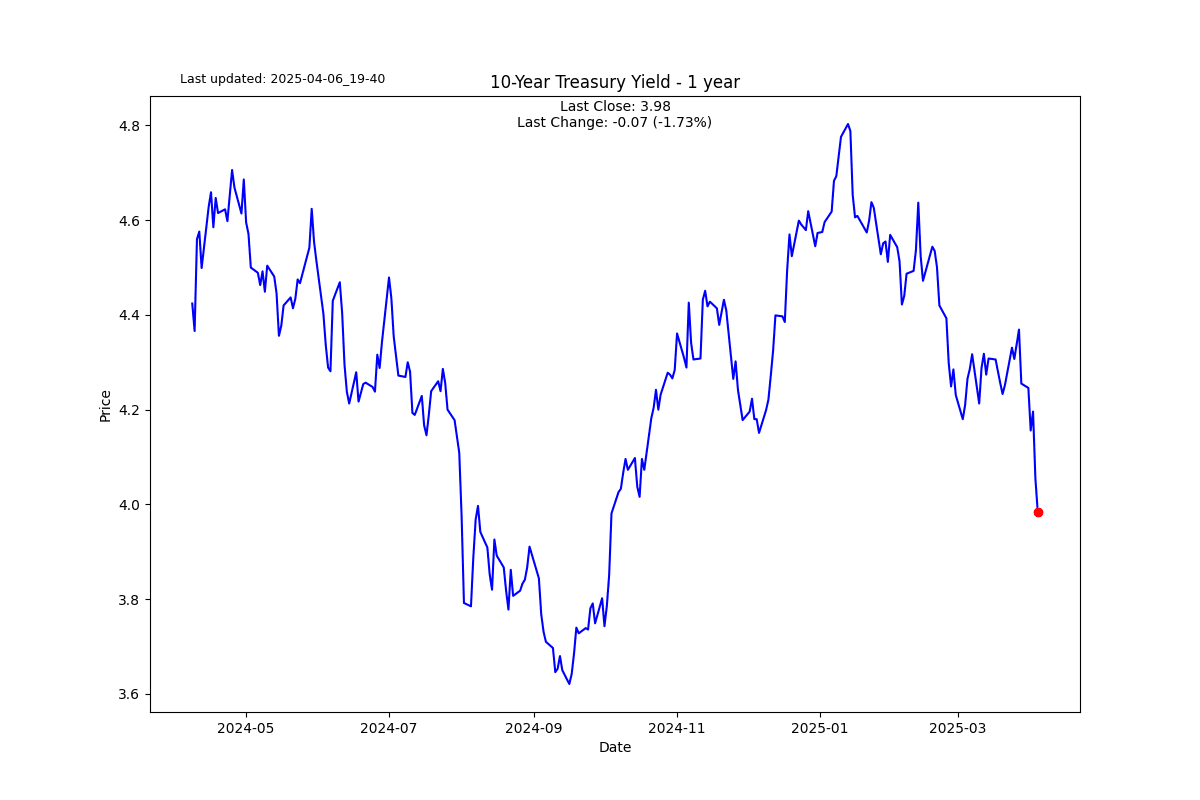

Bonds have performed incredibly well recently. The 10-year yield is under 4%. You can see that bonds are still heavily underwater from price highs despite the recent rally.

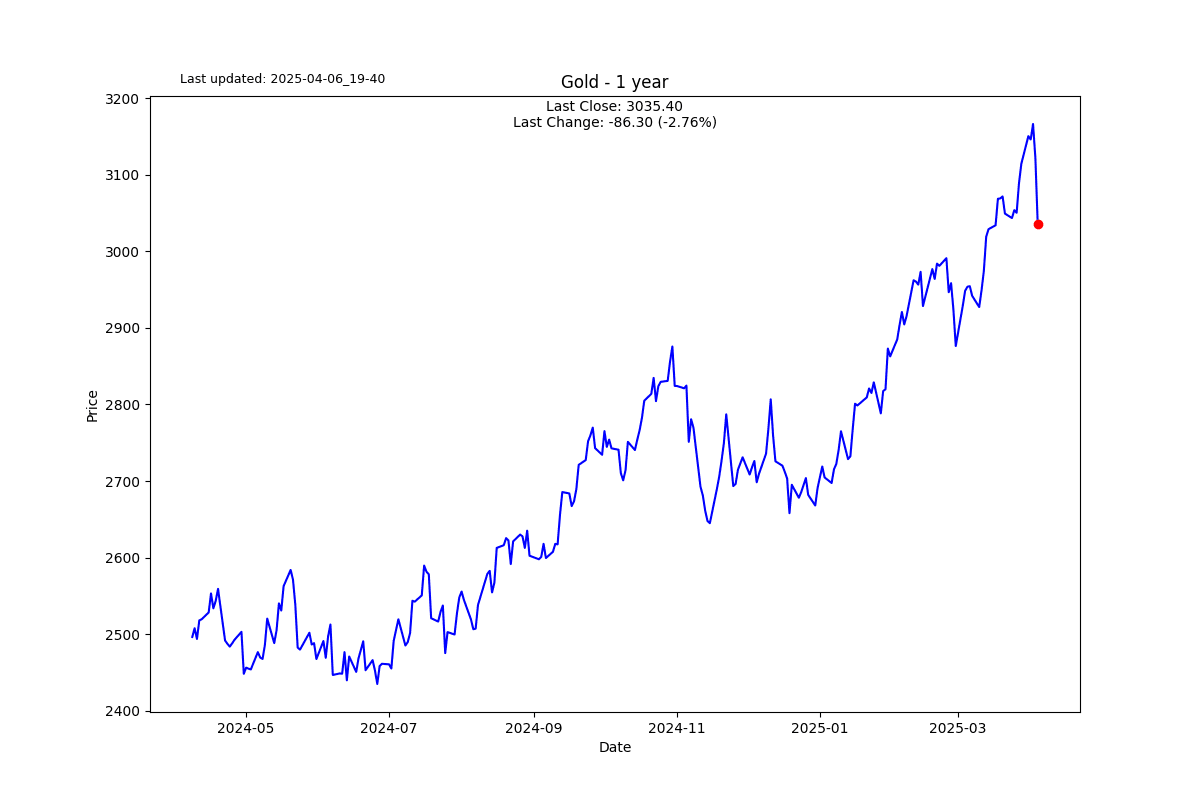

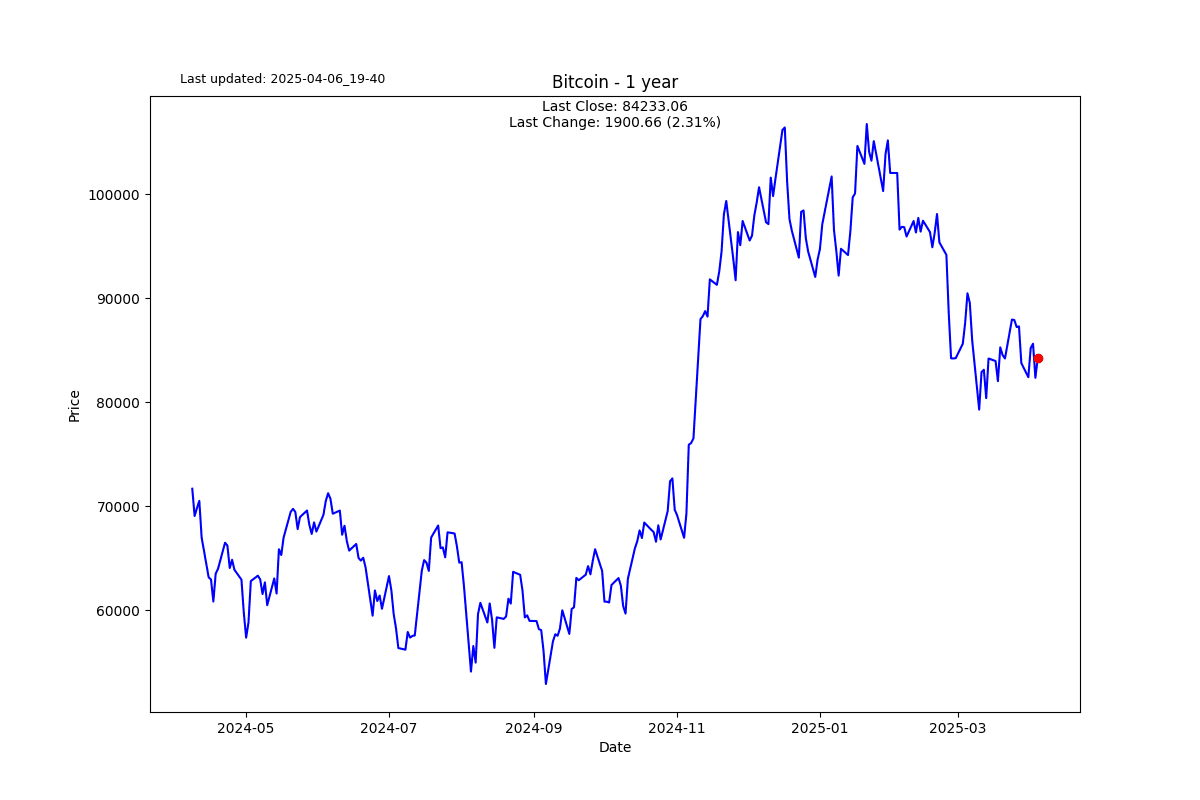

Bitcoin is starting to look vulnerable again. Bitcoin was like a deer in the headlights after Liberation Day; it just stood still, giving hodlers the chance to think they were invincible. I would never follow the Winklevosses on X; I used to. They were among the most annoying followers I have had the displeasure of encountering. Constant cheerleading BS, zero nuance. However, a few hours before the rot set in, one of the clowns—I mean, twins—had this to say. [it popped up on my feed.]

It didn’t take long from then for Bitcoin and the other coins to choke. I am not sure how much ammo Michael Saylor has left to buy Bitcoin, but without him propping it up, MicroStrategy is only 8,000 away from their cost price. Crypto is the ultimate animal spirits trade; if the spirits have been banished, then the only animal growling is going to be the bear, Michael Bearman.

I cannot see oil any other way than coming down further from these levels. A weak global economy fits that narrative.

I know today’s letter has been a bit all over the place, much like my mind. I have one final parting comment to my manic letter. I am prepared to place a bet that there will be a fair-sized financial company bankruptcy announcement before the end of the month. You don’t have this kind of volatility and not break something in the complex financial derivative business.

We may even hear of one before the close of business today.

S2N screener alert

There have been so many big move alerts. I am just sharing one. The S&P 500 had a very rare weekly down Z-score of -4 for only the 11th time in 50 years.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.