EUR/USD Price Forecast: ECB delivers, US GDP misses

EUR/USD Current price: 1.0414

- The European Central Bank cut interest rates by 25 bps each, as expected.

- The US Gross Domestic Product printed at 2.3% in Q4, missing expectations.

- EUR/USD remains stuck around 1.0400, with no clear directional clues in the near term.

The EUR/USD pair consolidated around 1.0400 throughout the first half of the day, little changed after the United States (US) Federal Reserve (Fed) announced its decision to keep the benchmark interest rate on hold in its January meeting, as expected. Fed Chairman Jerome Powell delivered a balanced speech, not too dovish nor too hawkish. As a result, financial markets returned to pre-announcement levels once the dust settled.

The lack of action around EUR/USD was also due to first-tier events, which are already out. On the one hand, the European Central Bank (ECB) announced its decision on monetary policy. The ECB delivered as expected by lowering key rates by 25 basis points (bps) each. With this decision, the interest rates on the main refinancing operations, the marginal lending facility and the deposit facility stood at 2.9%, 3.15% and 2.75%, respectively.

“The economy is still facing headwinds, but rising real incomes and gradually fading effects of restrictive monetary policy should support a pick-up in demand over time,” the accompanying statement reads. The headline did not trigger any EUR/USD reaction ahead of President Christine Lagarde’s speech and US data.

The US published the first estimate of the Q4 Gross Domestic Product (GDP), which showed that the economy grew at an annualized pace of 2.3% in the three months to December, below the expected 2.6% and the 3.1% posted in Q3. Additionally, the core Personal Consumption Expenditures Price Index increased by 2.5% on a quarterly basis, matching the market consensus. The country also published Initial Jobless Claims for the week ended January 24, which unexpectedly improved to 207K from the previous 223K.

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it remains at around 1.0400, trading in the red for a third consecutive day, although with the downside limited. The same chart shows the 100 and 200 Simple Moving Averages (SMAs) remain far above the current level, with the shorter one maintaining a strong bearish slope. The 20 SMA, in the meantime, provides dynamic support at around 1.0350. Finally, technical indicators offer uneven directional clues yet hold within positive levels, suggesting absent selling interest.

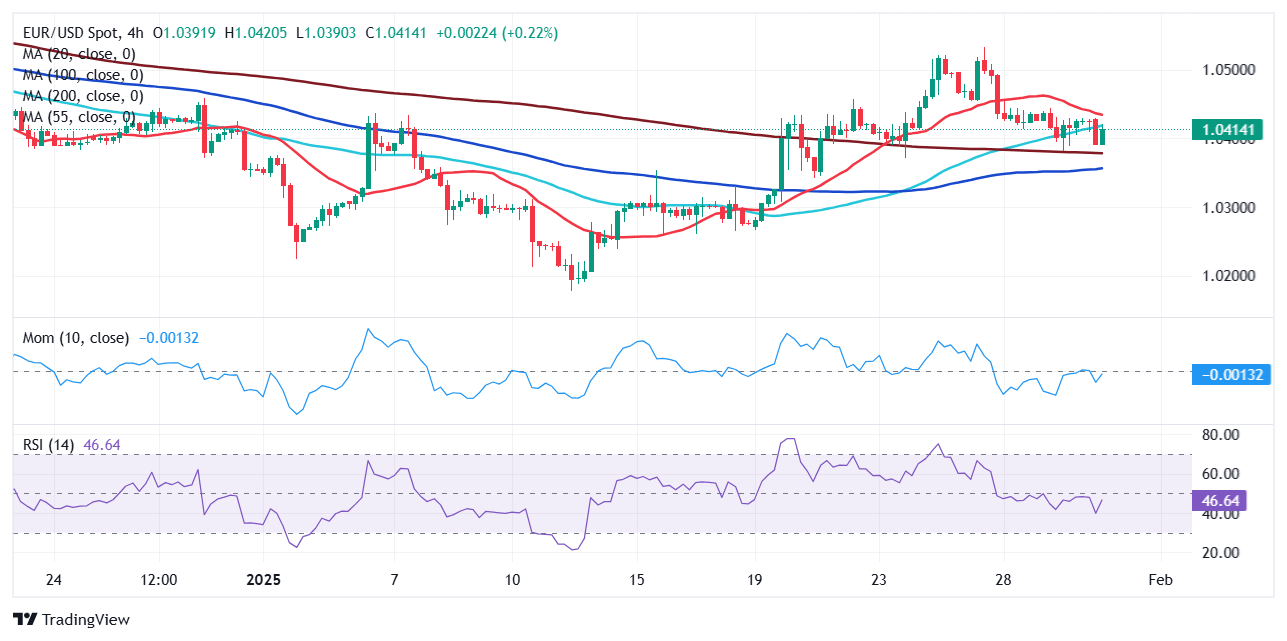

In the near term, according to the 4-hour chart, EUR/USD lacks clear directional strength. A bearish 20 SMA caps advances in the 1.0440 region, while a bearish 200 SMA provides support at around 1.0380. In the meantime, technical indicators have turned flat below their midlines, suggesting a limited bullish potential.

Support levels: 1.0380 1.0350 1.0310

Resistance levels: 1.0440 1.0485 1.0520

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.