EUR/USD Price Forecast: Bears remain well in control

- EUR/USD weakened further and hit new yearly lows near 1.0460.

- The US Dollar traded on a strong note and clinched YTD tops.

- Markets’ attention will be on upcoming flash PMIs readings.

EUR/USD faced a tough battle on Thursday, struggling to maintain its recent momentum as selling pressure intensified. In fact, spot gathered extra downside pressure and debilitated to the 1.0460 area, hitting fresh lows for the year.

The Euro's weakness coincided with renewed strength in the US Dollar (USD), driven by easing geopolitical tensions and the revival of the so-called "Trump trade." The US Dollar Index (DXY) surged, clocking a new YTD top around 107.15 amid a decent bounce in US yields across the spectrum.

On the monetary policy front, the Federal Reserve (Fed) recently lowered its benchmark interest rate by 25 basis points, setting the target range at 4.75%-5.00%. This move, widely expected by markets, is part of the Fed’s ongoing efforts to steer inflation toward its 2% target. However, cracks in the labour market are starting to show, even as unemployment remains historically low.

Fed Chair Jerome Powell recently struck a cautious tone, emphasizing that the central bank is not in a hurry to implement further rate cuts. This dampened expectations for a December cut, lending late-session support to the Dollar. Similarly, FOMC Governor Michelle Bowman stressed the need for prudence in reducing rates, while Governor Lisa Cook advocated for further easing, provided inflation continues its downward trajectory.

Across the Atlantic, the European Central Bank (ECB) has also adopted a careful approach. After cutting its deposit rate to 3.25% in October, the ECB has hit pause on further rate adjustments, waiting for more clarity from upcoming data. Still, signs of underlying inflationary pressures remain, as negotiated wage growth in the euro area rose to 5.42% in the third quarter.

Looking ahead, the potential for renewed tariffs on European or Chinese goods under a possible Trump administration could reintroduce inflationary risks in the US. Should the Fed maintain its cautious stance or lean hawkish in response, the USD could gain further, keeping EUR/USD under continued pressure.

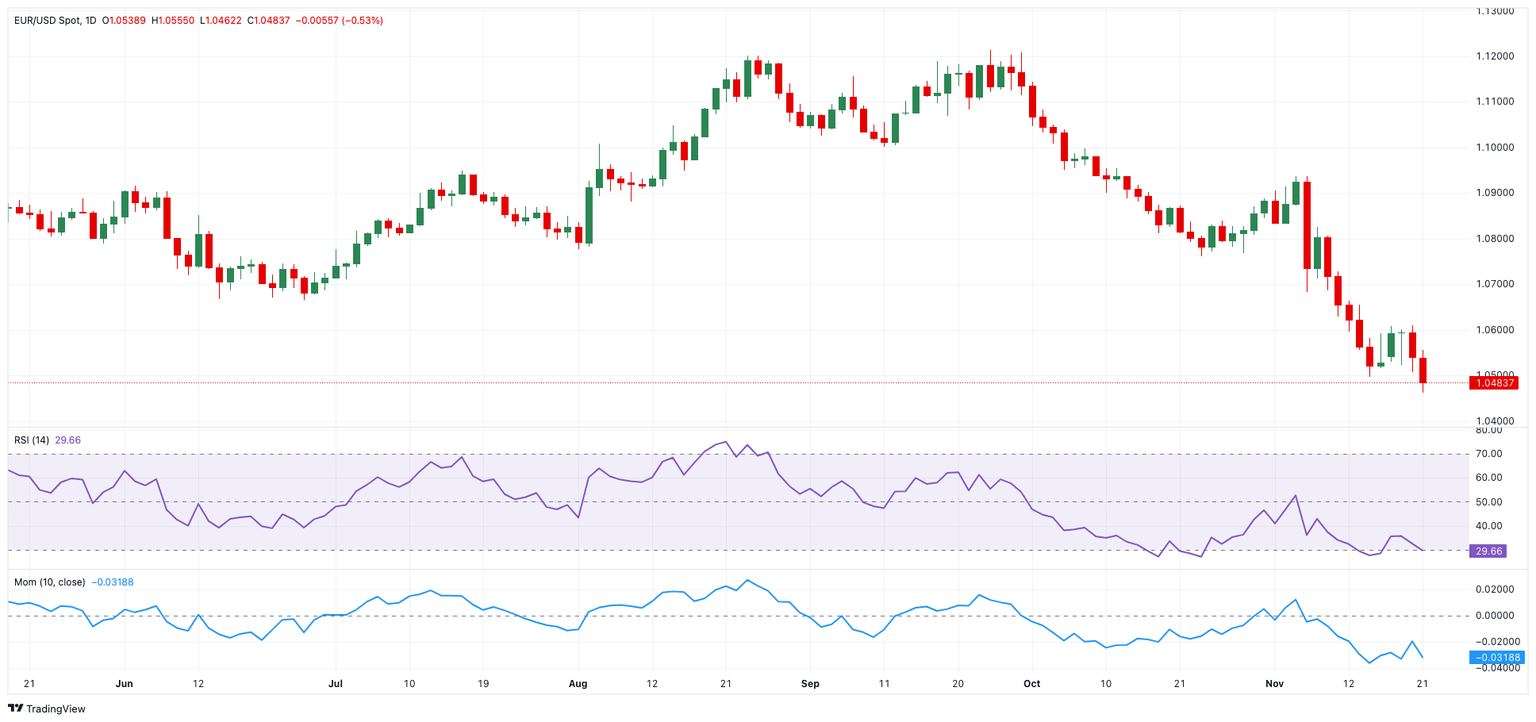

EUR/USD daily chart

Technical Outlook for EUR/USD

Further losses may drive the EUR/USD down to its 2024 low of 1.0461 (November 21), seconded by the 2023 bottom of 1.0448 (October 3).

On the upside, the 200-day SMA at 1.0860 provides immediate resistance, ahead of the interim 55-day SMA at 1.0899 and the November high at 1.0936 (November 6).

Furthermore, the short-term technical picture is bearish as long as the EUR/USD remains below the 200-day SMA.

The four-hour chart indicates a likely continuation of the bearish trend. That said, initial resistance is at 1.0609 prior to 1.0653, and 1.0726. The next negative goal is 1.0461, followed by 1.0448. The Relative Strength Index (RSI) eased to around 41.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.