The EUR/USD pair eased from a fresh year high set at 1.1437 after an encouraging US employment report that anyway, was only enough to justify some profit taking of the Yellen-triggered rally in the pair.

The Nonfarm Payroll report showed that the US added 215,000 new jobs in March, while the unemployment rate ticked slightly higher, up to 5.0%. Wages were a positive surprise coming in at 0.3% monthly basis against the 0.2% expected and taking the year-on-year change up to 2.3%. Market´s initial reaction was tepid, but as the US session develops the dollar is broadly higher across the board.

Yellen said on Tuesday that the US central bank should proceed cautiously in raising rates, suggesting rates will remain lower for longer which resulted in a sharp dollar sell-off that persisted until the release of the NFP report, leaving the pair overstretched to the upside. The market however, has little reasons to buy back the greenback, as a rate hike is now out of the picture until September.

View the Live chart of the EUR/USD

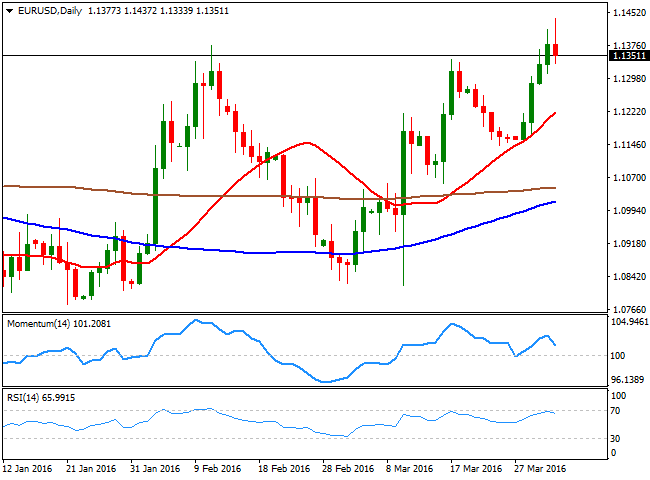

Anyway, the EUR/USD pair turned into the red for this Friday, and stands above the 1.1300 level and the daily chart suggests the pair may correct further lower at the beginning of the upcoming week, as the technical indicators are turning south from near overbought levels, but at the same time, the price is far above its 100 and 200 SMAs, and the 20 SMA maintains a sharp bullish slope around 1.1200, the level to break to consider the downward move will turn into a bearish continuation rally.

In the weekly chart, is clear that selling interest has been appearing on approaches to the 1.1460/70 region ever since early 2015, and the tough level held once more. Still the price is quite close to it to consider the reversal is confirmed. The risk of a breakout beyond it due to dollar's weakness is still high. If the level is finally broken, the pair can extend its rally up to 1.1713, the high posted on August 2015.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.