But continued weaker-than-expected US macroeconomic readings have been the key market driver, sending the dollar lower across the board, with the EUR benefiting partially. The wires were fulfilled with FED's officials comments, pointing out that a rate hike in the US will likely come later in the year, another factor weighing on the greenback.

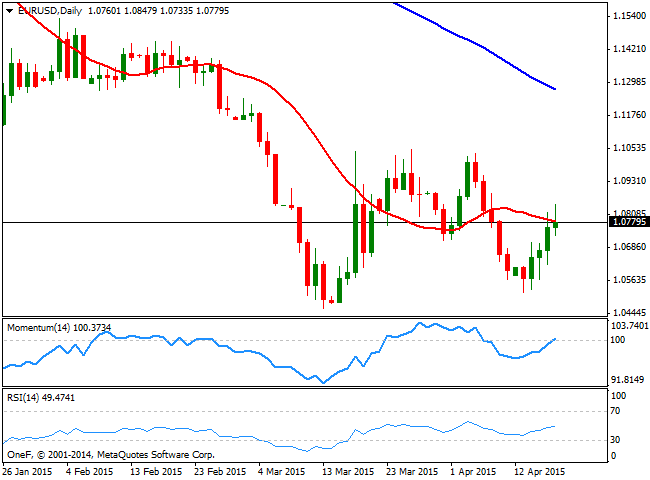

As for what's next, the daily chart shows that the price stalled around a mild bearish 20 SMA, whilst the technical indicators recovered up to their mid-lines, where they stand. The weekly chart shows that the 20 SMA maintains a strong bearish slope well above the current level, too far away to be taken into account for the next week, whilst the technical indicators aim higher from extreme oversold levels. In this last time frame, the RSI stands at 32, suggesting further corrections are possible, but not yet confirming a bottom. The pair needs to overcome the mentioned high at 1.0847 next week, to be able to extend up to 1.0950, a strong static resistance level. Beyond this last, the highs in the 1.1040/50 region are next. And it will take a clear break above this last, to confirm the mentioned bottom.

On the other hand, the immediate support comes at 1.0590, with renewed selling interest below it opening doors for a retest of the year low of 1.0461. If this last gives up, market will be looking for parity up next.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.