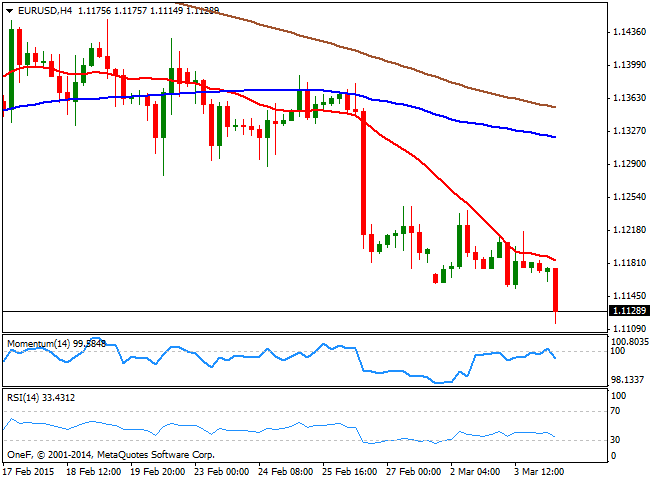

Nevertheless, the bearish tone accelerated with the pair poised to break below the 1.1100 figure. In the 4 hours chart, the price was unable to overcome a strongly bearish 20 SMA, currently around 1.1180, whilst the technical indicators turned lower, with Momentum retreating from its midline and the RSI indicator heading south around 33. Additional stops are likely standing below 1.1090, with a break below it fueling the slide down to 1.1050 in the short term, although further declines are unlikely ahead of ECB economic policy decision tomorrow. TO the upside, the mentioned 1.1150 level comes as the immediate resistance, followed by the 1.1180/1.1200 region.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.