Late Wednesday in Italy, he made a speech anticipating the may concern to discuss today is inflation. Among the remarks, he said that low rates are not enough to boost the economy, and that “fiscal and structural policies must also do their part.” And while market awaits him to launch more measures, there are big chances he decides to take a wait and see stance, having already repeated several times rates are at their lowest possible, after last meeting announcements.

In the meantime, stocks are in selloff mode, with US indexes at levels not seen since early August probably the main reason of recent short term dollar weakness. Japanese Nikkei lost in 2 days all of September gains, fueling yen gains.

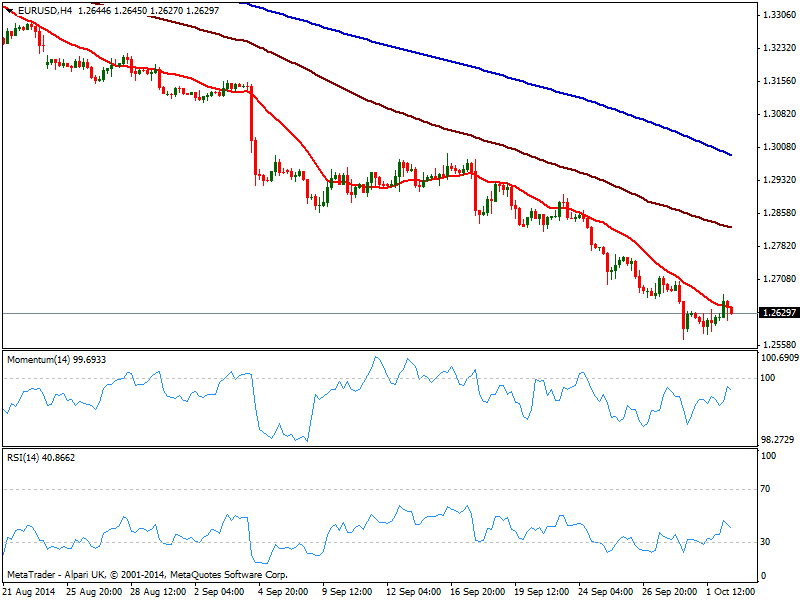

So what will the EUR/USD do? My take is that with no new measures, market may feel disappointed and resume the downside, with a break below recent low at 1.2570 pushing buyers out of the market and triggering stops: next downward target comes then at 1.2520/30 price zone. If on the other hand, the ECB head manages to favor its local currency, the recovery can extend up to 1.2740 price zone. Anyway, US employment figures early Friday will have the final word on whether the recovery can or not extend in time.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.