EUR/USD Forecast: US Dollar struggles to extend gains ahead of Powell, Lagarde

EUR/USD Current price: 1.0728

- ECB President Christine Lagarde and Fed Chairman Jerome Powell on the wires.

- The Eurozone confirmed the June Harmonized Index of Consumer Prices at 2.6% YoY.

- EUR/USD may extend its near-term recovery, although bears dominate the wider view.

The EUR/USD pair trades with a soft tone on Tuesday, further retreating from the peak posted at the beginning of the week at 1.0775. The US Dollar advanced despite tepid United States (US) data as the country reported on Monday that the ISM Manufacturing Index contracted to 48.5 in June from 48.7 in May, missing expectations of an uptick to 49.1.

A decline in stocks and government bond yields helped the Greenback extend gains on Tuesday, as the market mood turned sour ahead of words from Federal Reserve (Fed) Chairman Jerome Powell and European Central Bank (ECB) President Christine Lagarde, scheduled to participate in a monetary policy panel at the 2024 ECB Forum on Central Banking in Sintra.

Data-wise, the Eurozone confirmed the Harmonized Index of Consumer Prices (HICP) at 2.5% YoY in June, while the core reading matched the preliminary estimate of 2.9%, also missing expectations of 2.8%. The US calendar has nothing relevant to offer beyond potential comments from Powell and Lagarde in the aforementioned event.

EUR/USD short-term technical outlook

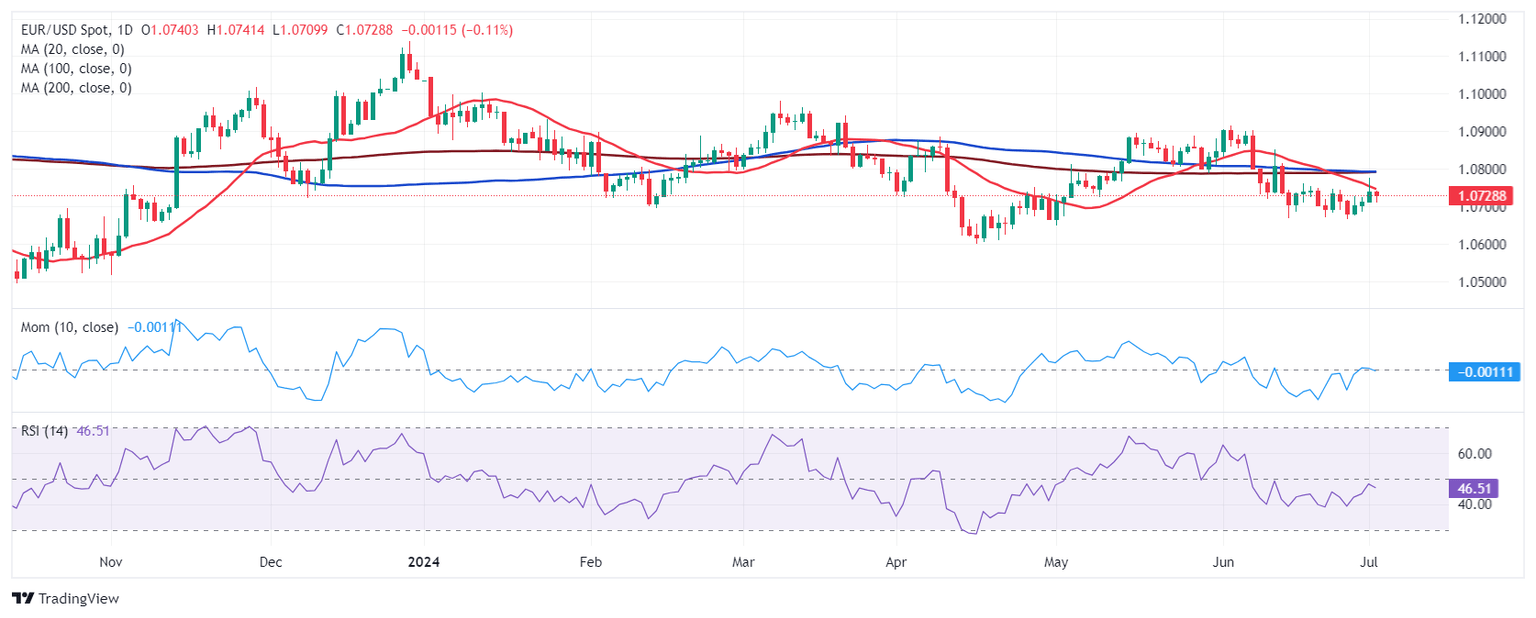

The daily chart for the EUR/USD pair shows it trades below a bearish 20 Simple Moving Average (SMA), which extends its downward slope below directionless 100 and 200 SMAs. In the meantime, technical indicators retreat from their midlines and gain downward strength within negative levels, skewing the risk to the downside.

In the 4-hour chart, however, chances skew in the opposite direction. Technical indicators slowly grind higher above their midlines, in line with increasing buying interest. At the same time, EUR/USD trades above a bullish 20 SMA, with dips below the indicator attracting longs. The pair is currently battling a bearish 100 SMA, with gains above the level exposing the weekly high at 1.0775.

Support levels: 1.0700 1.0665 1.0620

Resistance levels: 1.0775 1.0810 1.0845

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.