EUR/USD Forecast: United States employment data taking centre stage

EUR/USD Current price: 1.0869

- The US Dollar turned higher as risk aversion took over financial markets.

- United States employment figures could affect the upcoming Federal Reserve decision.

- EUR/USD retreated from above 1.0900, but additional losses not clear yet.

The EUR/USD pair peaked at 1.0915 early on Tuesday, as the US Dollar gathered bearish momentum in Monday's American session following tepid growth-related United States (US) data. The ISM Manufacturing PMI unexpectedly contracted to 48.7 in May from 49.2 previously, worse than the 49.6 expected. In the end, the USD safe-haven condition won the battle, pushing EUR/USD towards the 1.0860 price zone mid-European session.The pair maintains its negative tone amid a scarce European macroeconomic calendar and as investors await US employment-related figures. The country will release April JOLTS Job Openings, foreseen at 8.34 million, and Factory Orders for the same month, expected to have posted a modest 0.6% advance in the month.

This week's focus will be on US employment data, as speculative interest will try to assess its impact on future Federal Reserve (Fed) monetary policy decisions. In the next few days, the US will publish the ADP survey on private job creation, weekly unemployment figures and the Nonfarm Payrolls (NFP) report.

EUR/USD short-term technical outlook

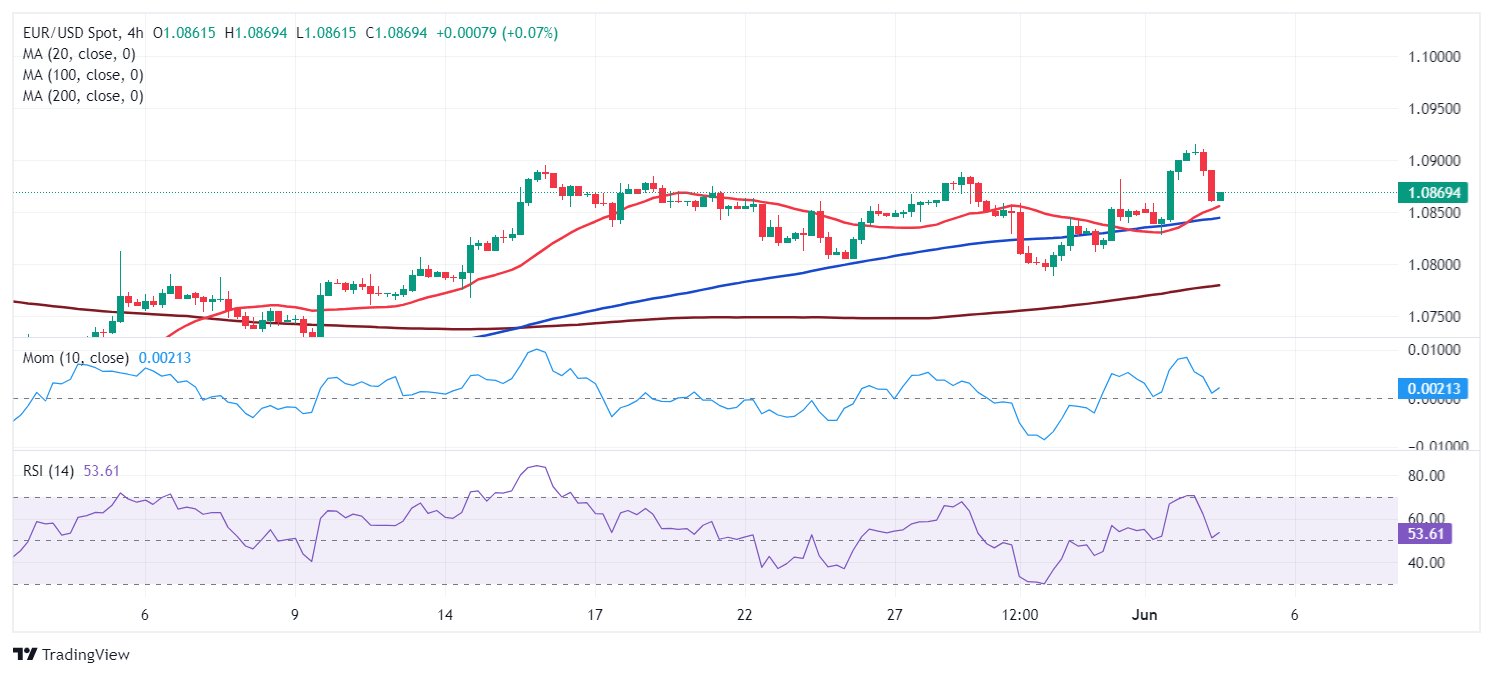

The daily chart for the EUR/USD pair showed it trimmed half of Monday's gains, but the bearish potential remains limited. The pair continues to develop above all its moving averages, with the 20 Simple Moving Average (SMA) maintaining its upward slope above directionless 100 and 200 SMAs. Technical indicators turned south but lack strength enough to confirm a bearish extension. The Momentum indicator currently stands at around its 100 line, while the Relative Strength Index (RSI) indicator barely retreats from near overbought readings, suggesting sellers lack power.

In the near term, EUR/USD bearish potential also seems limited. The intraday decline stalled just above a mildly bullish 20 SMA, which stands above advancing longer moving averages. Finally, technical indicators have retreated after flirting with overbought conditions but lost their downward strength well above their midlines. The intraday peak fell short of testing the resistance level at 1.0910. Once above the latter, bulls will likely gain more confidence.

Support levels: 1.0820 1.0780 1.0740

Resistance levels: 1.0910 1.0960 1.1000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.