- EUR/USD has been stabilizing closer to 1.18 after Trump's discharge.

- US fiscal stimulus, eurozone coronavirus cases, and speeches from central bankers are eyed.

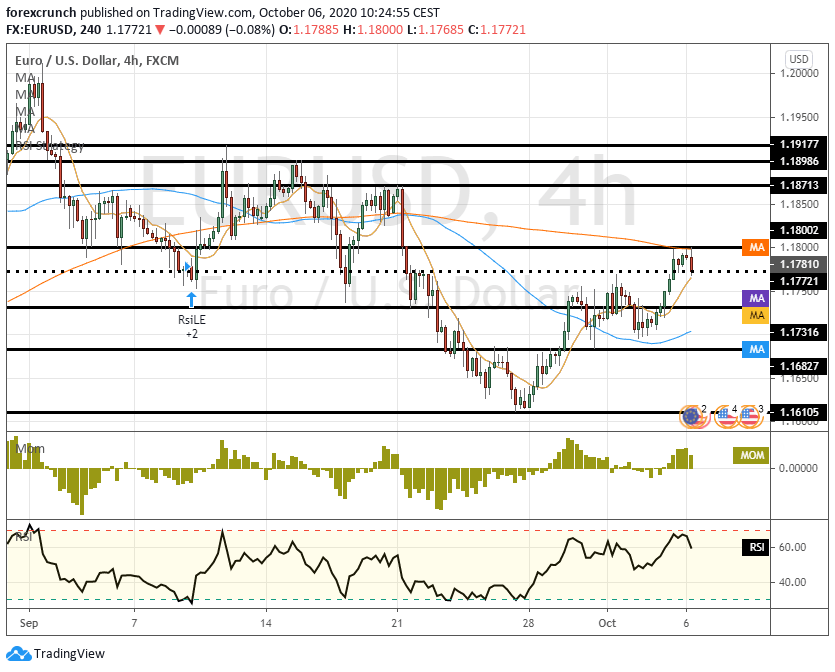

- Tuesday's four-hour chart is painting a bullish picture.

Break or bounce at 1.18? That is the question for EUR/USD traders, which have seen the world's most popular currency pair retreat after two attempts to move toward the round number after President Donald Trump was discharged from hospital.

The critical key is the US fiscal stimulus. The sooner and the larger a relief package comes, the more the safe-haven dollar can fall.

House Speaker Nancy Pelosi – who refused to go the coronavirus-infested White House – had a long telephone conversation with Treasury Secretary Steven Mnuchin. The extended conversation is an upbeat sign, and so is the lack of any leak from that talk. No news is good news in this case.

Democrats want a package worth $2.2 trillion and Republicans are only willing to go with $1.5 trillion. Will the GOP throw money at voters in the last bid to tilt the election?

That logic did not work earlier in the summer when additional funds could have changed the economic course ahead of the vote but may work now, amid the president's diminishing odds of winning the election.

Trump, who said he is "feeling better than 20 years ago," is probably not that content with his standing in opinion polls. National averages are pointing to rival Joe Biden leading by around 8% and he also trails in critical battleground states. The most recent surveys suggest were taken after the debate but do not fully encompass his positive coronavirus test.

It seems that he did not get a sympathy bump. According to a Reuters/Ipsos poll, 65% of voters – including 50% of Republicans – agreed that "if President Trump had taken coronavirus more seriously, he probably would not have been infected"

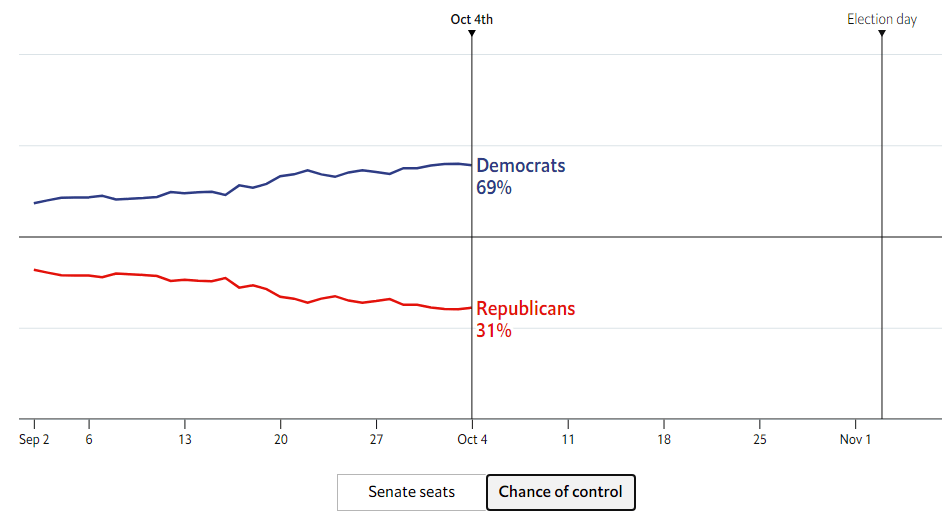

Models by FiveThirtyEight and The Economist are also pointing to a growing chance that Democrats win the Senate. A clean sweep for Dems implies regulation and taxes which markets dislike but also a larger stimulus package that investors are eager for.

Source: The Economist

Central bankers return to the scene on Tuesday. Christine Lagarde, President of the European Central Bank, will speak about the economy as eurozone coronavirus infections are on the rise. In her home country of France, Parisian bars will be closed on Tuesday. The Spanish capital Madrid is under lockdown and infections are advancing rapidly in Belgium, the Netherlands, and Ireland.

If Lagarde expresses concerns and readies more stimulus – also amid falling inflation – the euro could suffer. On the other hand, data from the summer remains encouraging – German factory orders exceeded projections with an increase of 4.5% in August.

Jerome Powell, Chairman of the Federal Reserve, will also deliver remarks later in the day. He is unlikely to stray from the bank's pledge to keep rates lower for longer, but without offering any imminent changes to the policy.

Recent US economic figures have been pointing to ongoing recovery, albeit losing steam. The Non-Farm Payrolls report showed an increase of 661,000 jobs, fewer than expected. On the other hand, the ISM Services Purchasing Managers' Index beat estimates. With four weeks to go until the elections, Powell is unlikely to say anything earth-shattering.

Overall, politics dominate but central bankers could also have a significant impact.

More Who will be the next president? Markets seem to care more about Congress' actions (for now)

EUR/USD Technical Analysis

EUR/USD is trading above the 50 and 100 Simple Moving Average, and benefiting from upside momentum. However, it is capped under 1.18, which is a psychologically significant level, the highest in two weeks, and where the 200 SMA hits the price.

Further above, 1.1870 was a high point in mid-September and it is followed by 1.1895 and 1.1915.

Support awaits at 1.1735, which provides support in early September, followed by 1.1730, a cushion from last week, and by 1.1610.

See Stocks to surge on Trump's discharge hopes, four reasons why a crash may follow

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.