EUR/USD Forecast: The year changed, but not the trend

EUR/USD Current Price: 1.2216

- Financial markets will slowly return to normal in the next few days.

- US indexes finished the year at record highs, undermining the dollar’s demand.

- EUR/USD is technically bullish despite the latest near-term corrective decline.

The EUR/USD pair eased Thursday ahead of an early close, ending the day in the red but the week with modest gains in the 1.2215 price zone. The dollar was the weakest currency for 2020, falling to multi-year lows against most of its major rivals. Wall Street, on the other hand, kept rallying, with US indexes posting record closes. The US published Initial Jobless Claims for the week ended December 25, which came in at 787K from 806K in the previous week. The improvement is tricky, as the Christmas holiday made it a shortened week.

The market will slowly return to normal in the upcoming days, although it would take some time for majors to adjust at the beginning of the year. This Monday, Markit will release the final versions of its December Manufacturing PMIs for the EU and the US, while the EU will release January Sentix Investor Confidence, foreseen at -5 from -2.7 in the previous month.

EUR/USD short-term technical outlook

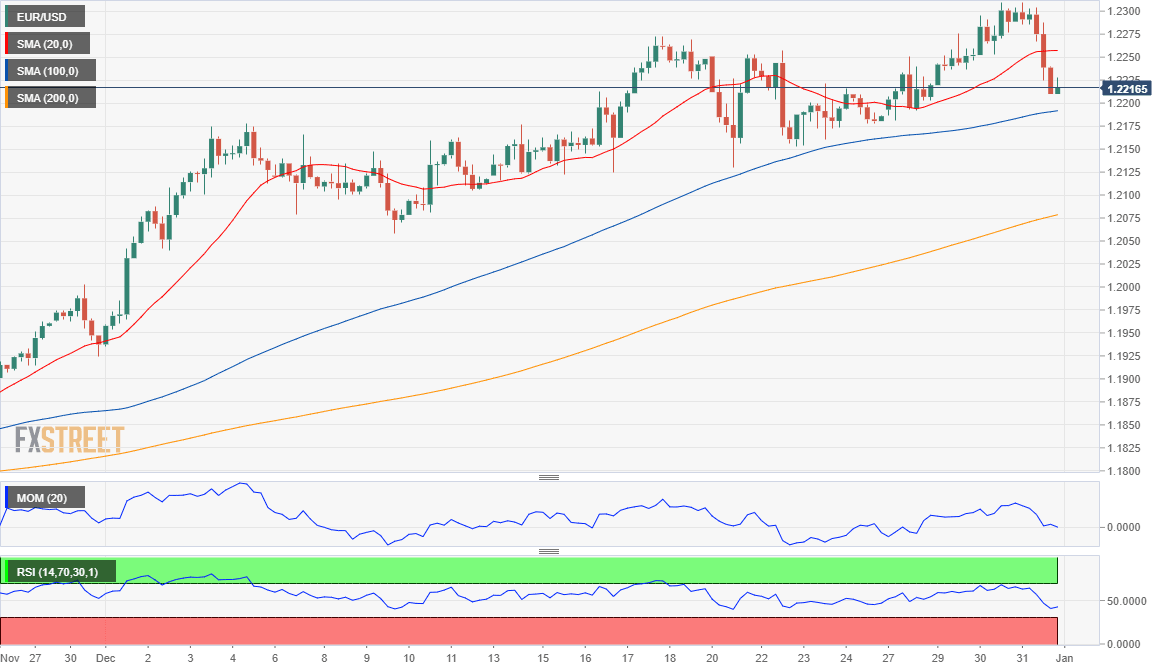

The EUR/USD pair eased on profit-taking after hitting a year’s high at 1.2309. The daily chart shows that the latest decline seems corrective, as the pair remains above all of its moving averages, which maintain their bullish bias. Technical indicators eased within positive levels, correcting overbought conditions. In the near-term, and according to the 4-hour chart, however, the pair broke below its 20 SMA, which is now flat at around 1.2270, while technical indicators head south within negative levels, suggesting the corrective decline may continue in the upcoming sessions.

Support levels: 1.2210 1.2170 1.2075

Resistance levels: 1.2260 1.2310 1.2345

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.