EUR/USD Forecast: Takes a breather after sharp rally, but bullish bias persists

Current Price: 1.1135

- EUR/USD retreats from Tuesday’s high but holds above 200-day SMA.

- Upbeat US data and a bounce in Treasury yields helped the greenback.

The EUR/USD pair gave up some ground on Wednesday, as investors decided to take a breather after pushing the EUR/USD to its highest level in nearly three months at 1.1213 on the back of Federal Reserve’s decision to cut rates by 50 bps. The Fed’s move – aimed at counteracting coronavirus negative effects – weighed on the dollar and drove Treasury yields to historic lows, although they both regained some traction on Wednesday. The Fed followed the Reserve Bank of Australia and was followed by the Bank of Canada in cutting rates. While other major central banks have pledged to act if necessary, markets are pricing a 10 bps cut by the European Central Bank at April’s meeting.

On the data front, EMU and German final Services PMI came in mostly in line with expectations in February, while Retail Sales in the Eurozone expanded 0.6% in January from a month earlier, reversing at the same time the previous 1.1% contraction. On the other side of the pond, the ADP employment report showed the US private sector added 183,000 jobs in February, above the 170,000 expected. However, January’s reading was significantly revised lower from 291,000 to 209,000. The ISM non-manufacturing PMI rose to 57.3 from 55.5 in January and above the 54.9 expected.

EUR/USD short-term technical outlook

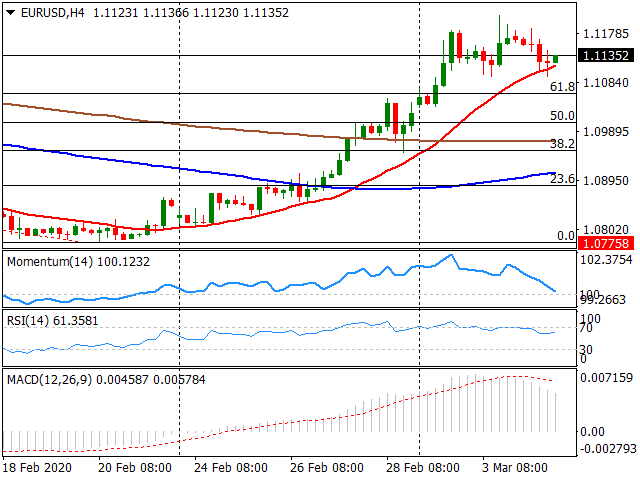

From a technical perspective, EUR/USD maintains a short-term bullish bias, although indicators are losing strength. Nevertheless, the pair has managed to hold above the 200-day SMA that stands as significant support at 1.1097. As long as it trades above that level, the focus will remain on the upside with 1.1213 and 1.1239 (December’s high) as next targets for bulls. On the other hand, if EUR/USD loses the 200-day SMA, it could fall to next significant support at the 1.1055 zone (100-day SMA) while below 1.1000 the bullish picture might get blurry.

Support levels: 1.1100 1.1055 1.1000

Resistance levels: 1.1213 1.1240 1.1260

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.