- EUR/USD has been extending its rally amid US fiscal stimulus and vaccine hopes.

- The worsening coronavirus crisis on both sides of the pond and data could halt the rally.

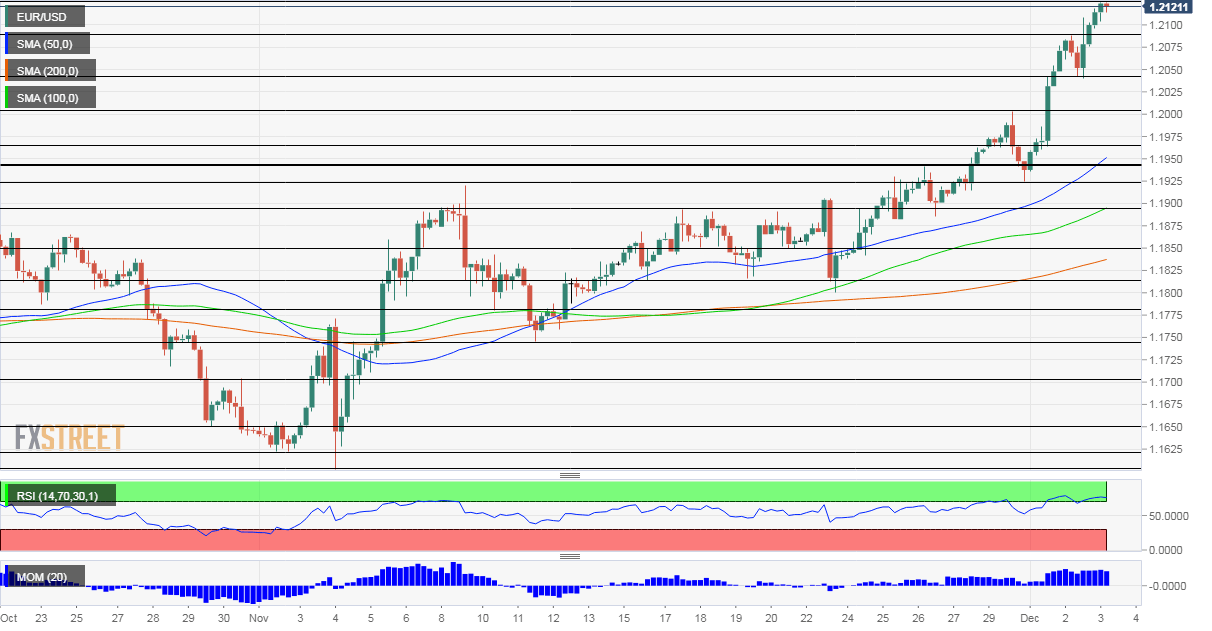

- Thursday's four-hour chart is showing overbought conditions once again.

Rally, short correction and another rally? That has been the pattern for EUR/USD in recent days but it may run out of steam without another dose of encouraging developments. The world's most popular currency pair has been benefiting from two developments, which have their countertrends as well.

1) Downing the dollar in Washington

The latest leg down for the safe-haven dollar comes from Washington. House Democrats gave their blessing to a trimmed-down bipartisan deal crafted by Senators. While a package worth $908 billion is below what markets wish for, any cash agreed in the lame-duck session would be a blessing.

Will Republicans and Democrats strike a deal or just continue talking? That could be critical for euro/dollar.

President-elect Joe Biden aims for additional relief once taking office That heavily depends on Dems taking control of the Senate in Georgia's special elections in early January.

On the other hand, the greenback may benefit from a flight to safety amid another bipartisan consensus – a new bill curbing Chinese firms' activity in US stock markets is another thorn in Sino-American relations. Outgoing President Donald Trump is set to sign the bill into law.

Apart from both political developments, data is eyed on Thursday. Weekly Unemployment Claims are set to tick down after rising for two consecutive weeks, a worrying development last seen in July.

See US Initial Jobless Claims Preview: What was old is new again

Later on, the last hint ahead of Friday's Nonfarm Payrolls comes from the ISM Services Purchasing Managers' Index and its employment component. Growth likely continued in November, yet at a slower pace.

See US Services PMI November Preview: Are initial claims the sign markets think?

2) Vaccine vs. the virus

One of the main upside drivers for markets came from rapid announcements related to COVID-19 vaccines. The UK regulator was the first in the West to approve immunization, giving another shot in the arm to markets. While most European countries have turned a corner against the virus, the largest country is still struggling.

German Chancellor Angela Merkel announced that restrictions will remain in place until after the Christmas holiday season and into January, expressing concerns about the current situation. In America, the covid crisis reached new highs with hospitalizations topping 100,000, daily infections nearing 200,000 and mortalities hovering around 2,700, levels last seen in the spring.

Will markets focus on the light at the end of the tunnel or the current darkness? The vaccine-virus tug of war is an ongoing theme.

3) Brexit may move the euro

For EUR/USD, a fresh boost could come from Brexit talks. Intense negotiations continue in London and the latest reports suggest that France may veto a deal if it sees too many compromises. While the daily grind of headlines mostly affects the pound, any big move will likely move the euro.

A collapse of EU-UK talks could trigger a substantial correction while a deal could extend the rally, even if other factors such as US fiscal stimulus fail to provide fresh fuel for the rally.

Overall, most positive developments seem to be priced in and fresh optimism is needed to sustain the rally.

EUR/USD Technical Analysis

Euro/dollar is benefiting from upside momentum on the four-hour chart, but the Relative Strength Index is well into overbought territory once again. The last time that it happened earlier in the week, the currency pair corrected to the downside.

Resistance awaits at the recent 32-month high of 1.2125, followed by 1.2150 and 1.22, levels that were in play in the spring of 2020.

Support is at 1.2080, where the recent correction began, followed by 1.2040, that correction's lower point. Further down, 1.2005 and 1.1960 await EUR/USD.

See EUR/USD Forecast: Three reasons for the massive breakout and big levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.