US Services PMI November Preview: Are initial claims the sign markets think?

- Services Purchasing Managers' Index expected to slip to 56 from 56.6.

- Employment Index predicted to climb to 50.9 from 50.1

- Initial Jobless Claims have excited fears of a slowing economy.

- Dollar has faded as US economy is scrutinized.

A modest gain in US unemployment claims since the beginning of November has markets looking back to March and the historic layoffs that marked the beginning of the pandemic economic shutdowns.

Although there have been few additional signs in the business community of an impending slowdown, the increasing number of restrictions imposed by governors of COVID-19 afflicted states are too reminiscent to be completely ignored.

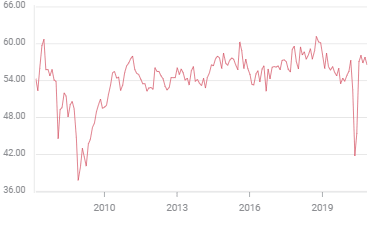

The Services Purchasing Managers' Index (PMI) from the Institute for Supply Management (ISM), the premier survey of business sentiment, is forecast to dip slightly to 56 in November from 56.6 in October. The Services Employment Index is predicted to climb to 50.9 from 50.1 and the New Orders Index is projected to fall to 49.6 from 58.8. Service industries represent about 85% of US GDP.

Service PMI

ISM Manufacturing PMI

Attitudes among manufacturing executives were little changed in November despite the increase in unemployment filings and rise in COVID-19 diagnoses nationwide.

The overall Manufacturing PMI from the Institute for Supply Management (ISM) fell to 57.5 last month from 59.3, its best level since September 2018. The 55.8 average over the last six months has been the highest in two years.

The Manufacturing Employment Index dropped to 48.4 in November from 53.2, which had been its first placing above the 50 expansion-contraction mark in 15 months.

Factory managers remain wary about hiring. It took five months of expansion and the strongest new orders figures in almost two decades before the the Employment Index reached 50 in October. That caution will remain until the pandemic is history.

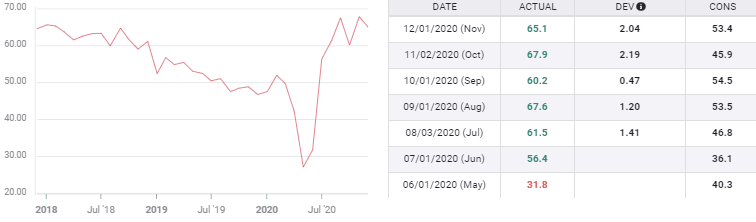

New Orders Indexes: manufacturing and services

In the most important category for measuring future activity, the Manufacturing New Orders Index came in at 65.1 in November following October's 17-year record at 67.9. The result was far better than the 53.4 forecast, keeping its excellent six-month run intact and again belying analysts' gloom.

Manufacturing New Orders

Since the recovery began in earnest in June economists have had difficulty judging the the amount of new business being generated. The manufacturing index has averaged 63.1 from June and has beaten its consensus estimate by an average of 14.8 points each month.

The Services New Orders Index has had a similar disparity between figures and forecasts. The six-month average from May is 58.05 , the forecast average is 46.3, a difference of 11.75.

Markit PMI

The American PMIs from this UK firm were unexpectedly robust in November. The Manufacturing Index registered 56.7, up from 53.4 in October and well ahead of the 53 forecast. The Services Index turned in at 57.7 following October's 56.9, also better than its 55.3 consensus prediction.

Employment and GDP

About 55% of the 22.16 million Nonfarm Payroll layoffs have returned to work. The unemployment rate has fallen to 6.9% in October from 14.7% in April.

Payrolls are forecast to add 520,000 workers in November which is in line with the declining totals every month since the renewal began in May. The unemployment rate is expected to drop to 6.8% from 6.9%. The Labor Department Employment Situation Report for November will be released on December 4 at 8:30 am EST.

American economic growth has recovered at a faster pace in the third quarter, 33.1%, than it plunged in the second, 31.4%. More importantly that rate appears to be continuing into the fourth quarter. The Atlanta Fed GDPNow model's latest estimate of December 1, which includes the November Manufacturing ISM report, is 11.1%.

Conclusion and the dollar

Services PMI will not stray very far from its manufacturing sibling or Markit cousin.

Market sensitivity to any signs of rising unemployment in the United States is understandable.

Claims are not going to explode into the catastrophe of the spring. The recent 67,000 increase in initial claims over two week is only the third largest in the last eight months.

A more likely scenario is a slow increase as the business closures eliminate the few remaining positions in the affected sectors without engendering an economy wide impact.

The potential slowdown in the US and its restraint on interest rates combined with the the lack of progress in securing a new stimulus package from Congress has taken the dollar to its pandemic lows.

A better than expected ISM will not relieve the anxiety from the labor market though it could give the dollar a modest boost much as the Markit reports did on November 23.

A worse than anticipated result will only confirm the market's already negative judgement.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.