- EUR/USD has been falling in reaction to Draghi's dovish speech.

- The focus will later shift from the ECB to the Fed ahead of its critical meeting.

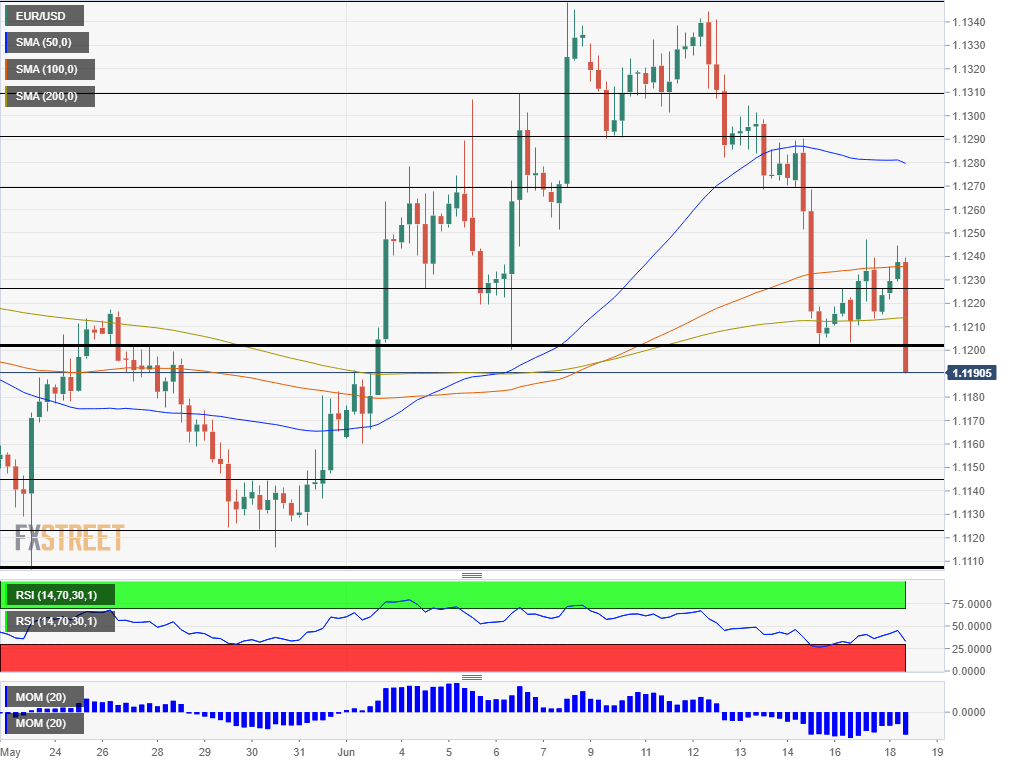

- Tuesday's four-hour chart shows there is more room for falls.

Super Mario has not lost his magic – at least for EUR/USD bears. European Central President Mario Draghi has said that cutting interest rates remains part of the bank's toolkit – even though the deposit rate is deep in negative territory. Draghi noted that negative rates have proven to be a very important tool.

Moreover, the Italian central banker has stressed that if the outlook does not improve, additional stimulus is needed. And not only interest rate cuts are on the cards. The Frankfurt-based institution may also consider renewing its Quantitative Easing (QE) program which has "considerable headroom" according to Draghi.

Draghi has been speaking in the ECB's annual conference in Sintra, Portugal – in an event which draws many academics. However, Draghi's intentions are not theoretical – the bank will deliberate the situation and the potential instruments.

EUR/USD has dropped from around 1.1230 to 1.1190 at the time of writing, and the free-fall may have some room to run.

In the US, tensions have been mounting ahead of the Federal Reserve's decision on Wednesday. Similar to the ECB, the Fed may also consider rate cuts – but probably not at this meeting. Fed Chair Jerome Powell and his colleagues are set to change their guidance and hint about slashing rates. Markets are pricing in two cuts this year, but the Fed may not necessarily go that far – they had last projected leaving them unchanged for the remainder of the year.

See

EUR/USD Technical Analysis

EUR/USD is suffering from significant downside momentum on the four-hour chart. Draghi's words have sent it below the 100 Simple Moving Average it had struggled to cross and below the 200 SMA.

The world's most-popular currency pair dropped below 1.1200, which is not only a psychological round number but also provided support in recent days as well as in early June.

Overall, bears are in full control.

Support awaits only at 1.1145 which served as resistance in late May when it traded on lower ground. The next support is the bottom of that range, at 1.1125. Next, we find the 2019 trough of 1.1107. The next lines are from June 2017 – two years ago – at 1.1025 and 1.0900.

Above 1.1200, resistance awaits at 1.1225, which provided support in early June. Next, 1.1250 capped EUR/USD in recent days and 1.1270 served as support beforehand.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.