- US-China trade talks and Brexit fueled risk-on sentiment.

- Data and central banks’ announcement being ignored at the time being.

- EUR/USD recovery set to continue in the upcoming days.

Risk-on has taken over the financial sphere these last couple of days, on encouraging news coming from the two big turmoil fronts, Brexit and the trade war between the US and China. The EUR/USD pair has advanced for a second consecutive week, recovering the 1.1000 threshold and rallying to 1.1062, on hopes both ships will reach good port.

Light at the end of the tunnel?

Market players ignored macroeconomic data that kept signalling an economic slowdown in the EU. Clearly, a resolution on the two mentioned issues will significantly lift odds for the situation to reverse. According to the latest headlines, EU’s chief Brexit negotiator, Michel Barnier, got the green light from the EU27 fro there to be negotiations with the UK, in an attempt to get to a deal before the current October 31st deadline for the UK to leave the EU.

Meanwhile, and after returning to the negotiation table Thursday, US President Trump stated that trade talks with Chinese representatives “went very well” in day one. More talks are expected late Friday. Could happen that big headlines surge post-market’s close. Also, it seems unlikely a full agreement will be announced these days, but positive developments and partial arrangements could keep the markets in risk-appetite mode. The contrary, could also happen and result in safe-haven assets gapping higher at the weekly opening.

Light data-week ahead

The US Federal Reserve released the Minutes of its latest meeting mid-last week, but the statement failed to impress as it repeated well-known messages and lacked clues about what’s next in monetary policy.

If the US and China will put an end to their dispute is unclear. Same goes for Brexit. Yet as long as the market remains confident, the ongoing trend will continue, with the warning that, given ECB’s latest decision, demand for the shared currency remains subdued.

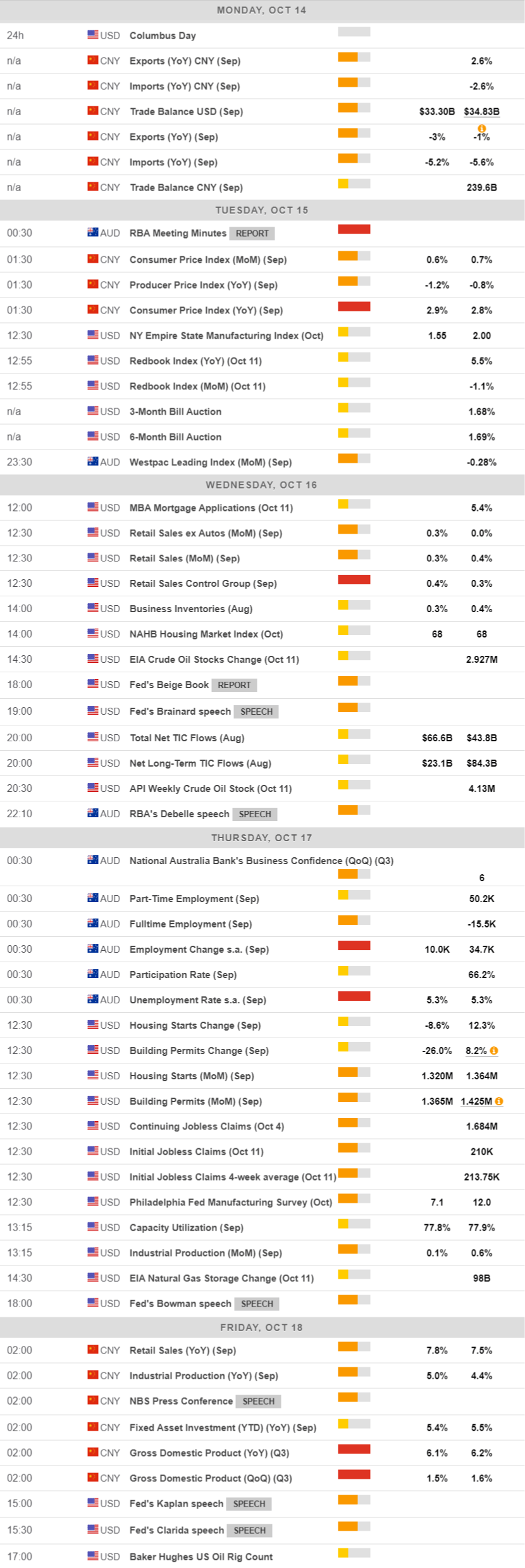

The upcoming week with start in slow-motion from the fundamental point of view, as the US, Canada and Japan will celebrate local holidays. Action in that front will be limited, which will maintain the political jitters in the spotlight.

Anyway, Germany will release the October ZEW Survey next Tuesday, with Economic Sentiment seen deteriorating further in the country and the EU. The EU will release September final inflation figures, seen unchanged from the preliminary estimates, while the US will unveil Wednesday, September Retail Sales.

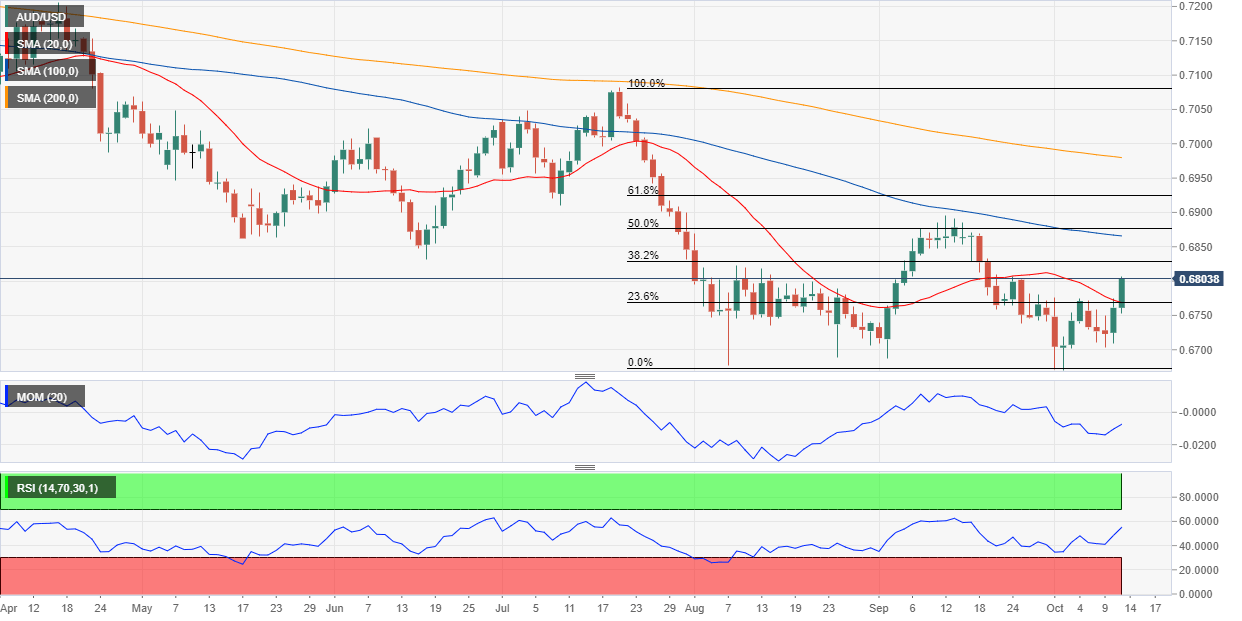

EUR/USD technical outlook

The EUR/USD pair’s bounce from fresh 2-year lows seems poised to extend in the upcoming days, but an interim bottom has not yet been confirmed. Considering the latest monthly slump, measured from June’s top at 1.1411, the pair remains below the 38.2% retracement at 1.1080. Chances of a more sustainable recovery would increase if the pair manages to advance beyond this last. At the same time, the pair has broken above a daily descendant trend line coming from the mentioned high, and as long as it holds above it, the rally may well continue.

In the weekly chart, the bearish case is firmly in place as technical indicators have recovered within negative levels, while the price remains far below all of its moving averages, with the 20 SMA retaining its bearish slope below the larger ones, and converging with the 50% retracement of the mentioned decline at 1.1140.

In the daily chart, however, the pair has rallied above its 20 DMA for the first time since early September but holds below bearish larger moving averages. The 100 DMA converges with the mentioned 50% retracement of the monthly decline, reinforcing the relevance of the 1.1140 region as resistance. Technical indicators head firmly higher within positive ground, further supporting additional gains ahead.

The 1.1000 figure is the immediate support and where the pair would lose the bullish bias, and return to the lower band of 1.0900.

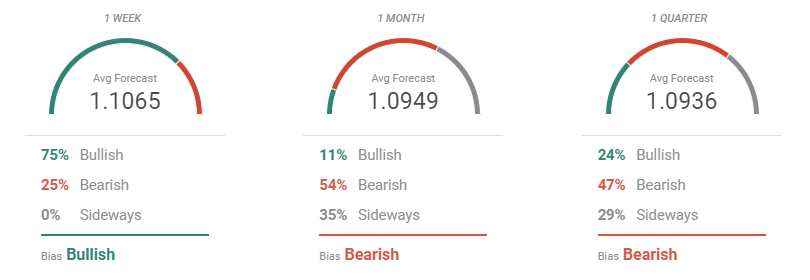

EUR/USD sentiment poll

The FXStreet Forecast Poll supports the technical perspective, at least short-term, as in the weekly outlook, the pair is seen up by 75% of the polled experts, heading toward an average target of 1.1065. Bears take over in the monthly and quarterly perspectives, with the pair seen then below the 1.1000 figure.

The Overview chart shows that the weekly moving average turned higher and stands above the current level, but in the longer time-frame under study it retains its bearish slope. One note of warning comes from the 3-month view, as most targets accumulate above the current level, a first sign that the pair may have reached an interim bottom in the longer run.

Related Forecasts:

GBP/USD Forecast: Three Brexit scenarios as a deal seems real

USD/JPY Forecast: Trump's art of the trade deal may trigger extended rally

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY recovers to 142.50 area during BoJ Governor Ueda's presser

USD/JPY stages a modest recovery toward 142.50 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.