GBP/USD Forecast: Three Brexit scenarios as a deal seems real

- GBP/USD has emerged from the abyss and soared amid fresh hopes for a Brexit deal.

- The EU Summit on Brexit is set to dominate trading and overshadow top UK data.

- Mid-October's daily chart is showing that bulls are gaining momentum.

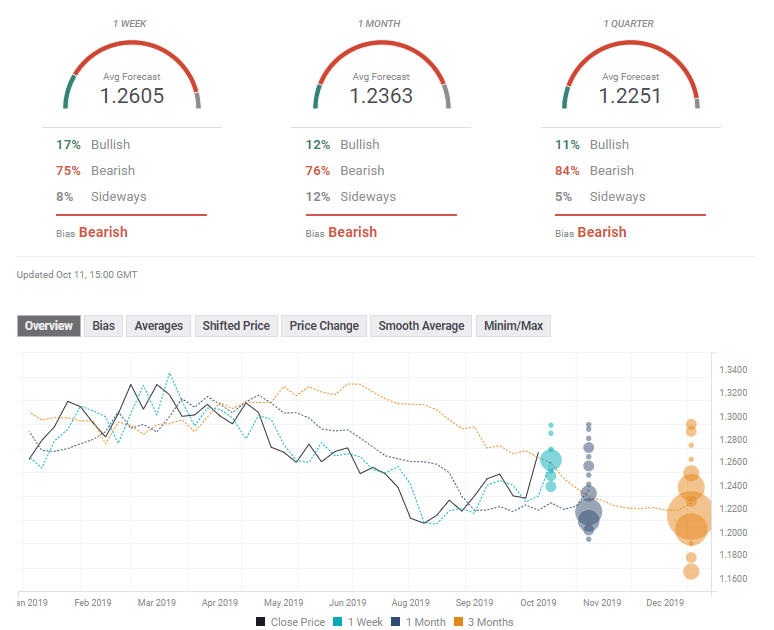

- The FX Poll is showing skepticism about the pound's rally.

A deal or no deal? At the time of writing, there is no clear answer but only one certainty – high volatility is set to prevail. GBP/USD's range may exceed the 500 pips seen now as an accord is within reach. Apart from Brexit headlines, top-tier figures from the UK and US-Sino trade talks may also have an impact.

This week in Brexit: Light at the beginning of the tunnel

It has been a week of two tales – despair up to midday on Thursday and a wild rally afterward. The EU deemed Boris Johnson's plan as insufficient but agreed to continue talking. Sources at the PM's office spoke to the Spectator and seemed to threaten countries that would not support an extension of Brexit with reducing British defense support.

The mood worsened after 10 Downing Street released a readout of a call between Johnson and German Chancellor Angela Merkel. Many European journalists and politicians were bemused by the aggressive tone portrayed in the leaks from London – which seemed distant from the cautious German leader's style. European Commission President Donald Tusk criticized the UK for "playing a stupid blame game." Chief EU Negotiator Michel Barnier added that "we are not in a position to reach a deal."

The downbeat news kept GBP/USD depressed around 1.22 – until the game-changing then came the game-changing meeting between Johnson and his Irish counterpart Leo Varadkar. The two men met at a wedding venue near Liverpool and talked about the UK's divorce from the EU. After three hours, they announced "a pathway to a possible deal."

Details are trickling out slowly, but the aim is to find a solution that would keep Northern Ireland (NI) aligned with EU regulations and customs – allowing borders to remain open and maintain the peace. An accord would also give citizens a say on what future they want, along the lines of Johnson's proposal.

Sterling surged and has been on the up and up. After a meeting between Barnier and Brexit Secretary Stephen Barclay, the bloc gave a green light to intense negotiations that some Brussels insiders called "a tunnel."

GBP/USD has hit a high of 1.2685 at the time of writing, jumping by nearly 500 pips.

Next in Brexit: Three scenarios

The tunnel talks mean intense negotiations also over the weekend, aimed to clinch a deal ahead of the critical EU Summit on October 17-18. Merkel, one of the protagonists of the past week, will meet French President Emmanuel Macron on Sunday. They will likely take stock of the negotiations and may issue a statement about it – determining GBP/USD's open on Monday.

Both sides are close to a deal, but it is unclear if Johnson will continue receiving support for the deal from the hardliners in his party or the Democratic Unionist Party (DUP). The small group of 10 MPs objects any changes that would undermine the union.

There are three scenarios

1) A deal is reached and hardliners back it

In this scenario, the PM convinces the Brexiteers that letting NI drift away – proposals that he objected in the past – is the best possible option to get Brexit done. Labour MPs from Leave-voting constituencies to back it and it is then set for sailing through parliament on Saturday, October 19.

GBP/USD would surge and perhaps hit 1.32.

Markets prefer a soft deal – perhaps the Norwegian model – and preferably no Brexit at all. However, the pound has been pricing in a no-deal as late as September and its recovery does not price in an accord – just a short delay. The rally we have seen may only be the beginning.

2) Deal without support

The DUP may convince Conservative hardliners to reject the deal and Labour MPs would refuse to back a "Tory Brexit" in this scenario. However, all sides may agree that elections are the way out – and the UK asks for an extension. Johnson may be convinced that a new House of Commons would provide the seal of approval.

In this case, the pound may drift lower on uncertainty, but not collapse. A victory for Johnson may seal the deal, while a Labour-Liberal Democrat win may trigger a second referendum and eventually revoke Brexit. Despite uncertainty and markets' preferred options, the downside is limited.

3) No deal – uncertainty may plunge the pound

If the UK and the EU fail to agree on a pathway to Brexit, Britain will be on course to ask for an extension – but greater uncertainty may send it lower – even if an imminent no-deal is averted.

The EU may be growing tired of endless Brexit negotiations – just like the British public. Macron and other leaders may want the UK to just get over with it and leave – even if the price is economic damage. A failure to reach an accord means fresh negotiations as the best-case scenario – and that means prolonged suffering.

Other events: A US-Sino deal is also close

US-Sino trade talks have seen a similar dynamic of gloomy headlines early in the week and then seeing a deal within reach later on. At the time of writing, President Donald Trump and also the Chinese media have been positive. An accord may fail to include all problematic items, but provides relief for the global economy and weighs on the safe-haven US Dollar.

The Federal Reserve's meeting minutes have repeated similar messages – content about the US economy but worries about the global headwinds. The hawks wanted to communicate when the rate reductions will end while doves were worried about signals of a recession.

US data have been mixed with marginally worse than expected inflation numbers but upbeat consumer sentiment. In the UK, Gross Domestic Product (GDP) dropped in August but came on top of an upward revision for July.

Other UK events: Top-tier data

Brexit headlines before, during, and after the EU Summit are set to be left, right, and center for pound trading. However, the UK's jobs report on Tuesday is also of interest. The labor market remained robust in July with the unemployment rate standing at 3.8% and wages rising by 4% yearly (bonuses included). While the jobless rate is set to increase to 3.9% and wage growth to slow to 3.7%, these remain upbeat figures.

Inflation figures for September are due out on Wednesday. After a disappointing fall to 1.7% in August, acceleration is on the cards for September. The Bank of England has maintained its hawkish bias despite uncertainty. An increase in inflation will likely keep it from changing its mind and forecasting rate cuts.

Retail sales complete the trio of top-tier figures. After a slide of 0.2% in August, the volume of sales is set to increase in the report for September. It will be interesting to see if Brexit anxiety has had any impact on shopping.

Here are the upcoming UK macro events, as they appear on the economic calendar:

US events: Further trade developments, retail sales

Further developments on the trade front remain central to USD trading. A deal may weaken it while a breakdown of talks may boost it. Markets await a US announcement of postponing the planned tariff increases scheduled for October 15.

Retail sales stand on the US calendar. Shoppers have been active and kept the economy afloat in recent months. Satisfactory growth rates of 0.3-0.4% are expected in September, similar to the rises seen in August.

Here is the list of US events from the FXStreet calendar:

GBP/USD Technical Analysis

The surge in GBP/USD sent it to the 200-day Siple Moving Average, shattering the 50 and 100 SMAs on its way up. Momentum has turned positive and the Relative Strength Index remains below 70 – below overbought conditions.

The fresh high of 1.2705 is the first level of resistance. It is followed by 1.2780 which was the high point in June. Further above, 1.2960, 1.3050, and 1.3130 await cable. However, it may enter overbought conditions at some point.

Looking down, support awaits at 1.2580, which was September's high. Next, we find 1.2415 that separated ranges in September, followed by 1.2390 that played a similar role. The next level to watch is 1.2310, which capped it in August, followed by the recent low of 1.22.

GBP/USD Sentiment

It is hard to bet on Brexit, but Boris Johnson may have a point by saying that Brits are tired of Brexit. He may convince enough MPs to sign off on a deal. While a hard Brexit is not optimal for markets, growing uncertainty and the risk of a no-deal are far worse.

The FX Poll is showing a bearish sentiment on all-time frames, with falling targets. While average targets have risen, only the short-term outlook has been substantially upgraded. Forecasters may have been caught by surprise by the news, or remain skeptical that an accord can be clinched.

Related Forecasts

- USD/JPY Forecast: Trump's art of the trade deal may trigger extended rally

- EUR/USD Forecast: Insufficient signs but more than enough hopes

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637064018601361249.png&w=1536&q=95)