EUR/USD Forecast: Further pullbacks remain on the table

- EUR/USD dropped to fresh lows near 1.0780 on Thursday.

- The Dollar regained extra pace on the back of rising risk aversion.

- Reignited slowdown jitters lent support to the Greenback.

EUR/USD posted notable losses on Thursday, reversing post-FOMC gains amidst a stronger US Dollar (USD) in a context where risk aversion prevailed.

That said, the USD Index (DXY) managed to regain balance and advance to the 104.40 zone on the back of the broad-based sell-off in the risk-linked galaxy, which gathered extra steam on the back of slowdown fears in the US economy.

The rebound in the Dollar picked up pace and left behind part of the post-Fed weakness after the central bank kept interest rates unchanged and noted that inflation remained "somewhat" excessive, reiterating that it would not reduce rates until there is more certainty that inflation is moving steadily towards 2%.

In addition, Chief Powell mentioned that the FOMC is moving closer to a potential rate cut, possibly in September. He added that if inflation continues to decrease, economic growth remains strong, and the labour market remains stable, a rate cut could be considered.

The policy divergence between the Fed and the ECB is likely to persist, with both expected to cut rates soon. However, fresh weakness in US fundamentals flagged risks to the view of a soft landing, in line with some loss of momentum in the Eurozone's recovery, all opening the door to a probable stronger Dollar and further retracements in EUR/USD.

On the US docket, the ISM Manufacturing PMI eased to 46.8 in July, while weekly Initial Jobless Claims increased more than expected by 249K in the week to July 27.

Adding to the view of the loss of momentum in activity in the euro area, the final HCOB Manufacturing PMI in Germany and the euro bloc remained well below the 50 threshold that separates expansion and contraction.

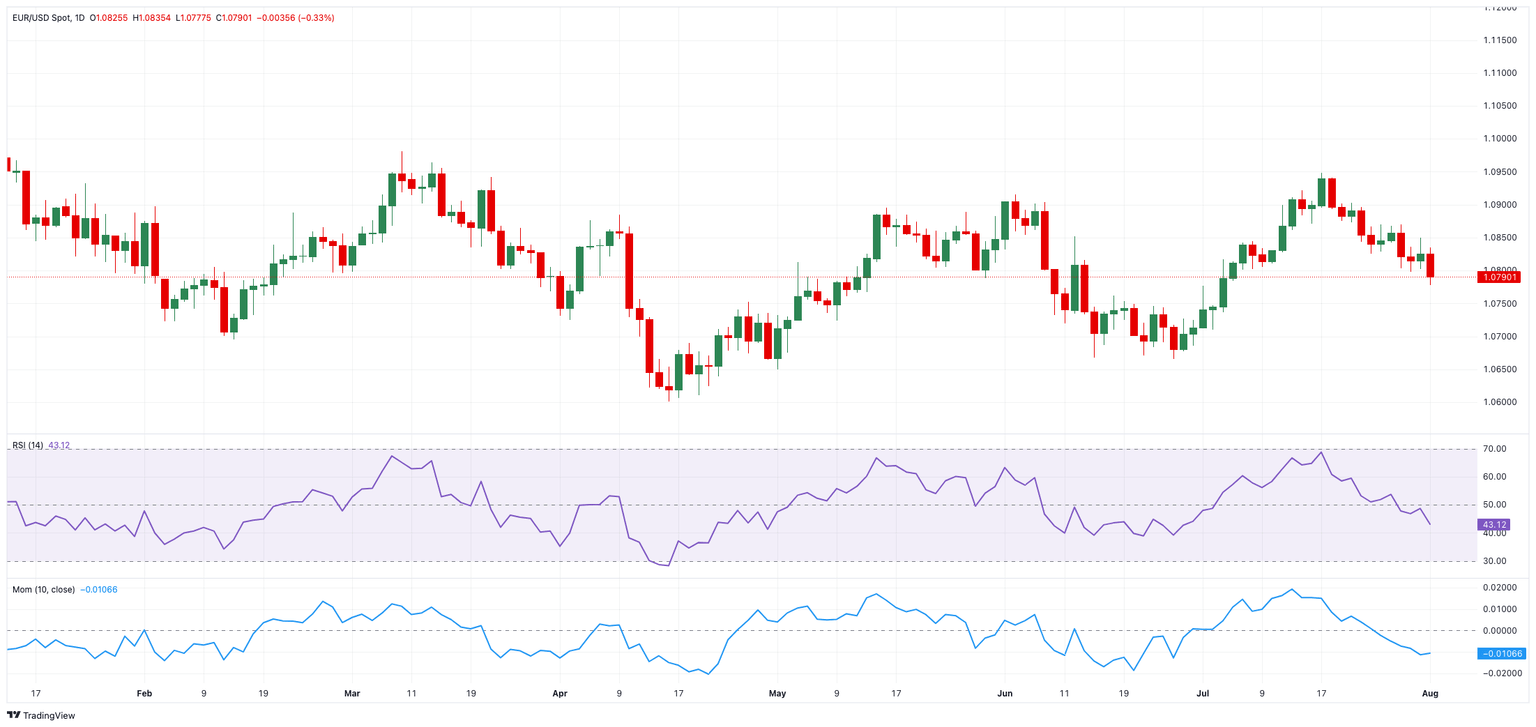

EUR/USD daily chart

EUR/USD short-term technical outlook

On the downside, EUR/USD's next target is the weekly low of 1.0777 (August 1), ahead of the June low of 1.0666 (June 26), and the May bottom of 1.0649 (May 1).

On the upside, the first hurdle is the July top of 1.0948 (July 17), followed by the March peak of 1.0981 (March 8) and the crucial 1.1000 yardstick.

Looking at the big picture, the pair's bearish bias should remain in place if it stays below the crucial 200-day SMA (1.0823).

So far, the four-hour figure indicates fresh weakness. Against that, initial support comes at 1.0777 seconded by 1.0709. On the upside, the 200-SMA is at 1.0806 ahead of the 55-SMA at 1.0842 and 1.0849. The relative strength index (RSI) returned to about 39.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.