EUR/USD Forecast: Financial rescue keeps rising, crisis remains the same

- EU Finance Ministers agreed on a rescue package, the US Fed announced massive support loans.

- Data fully reflecting lock-downs will start emerging in the upcoming days.

- EUR/USD advancing on the dollar’s weakness, no reasons to buy the EUR.

The EUR/USD pair edged higher this week as the market moved away from the greenback. Hopes led the way at the beginning of the week, amid improving numbers related to the coronavirus pandemic, signalling the curves are flattening, particularly in Europe. Still, the numbers of new contagions and daily deaths are outrageous. In the US, almost half a million citizens are confirmed cases. Health systems are at a brink of collapsing globally, the population is quarantined at home, and only essential businesses are allowed.

Economic stalemate and more financial rescue

The end of the economic deadlock, however, is nowhere near. Most countries are extending their lockdown, as the curves flattening is utterly slow. In this scenario, policymakers had had to come back to the rescue.

The Federal Reserve took additional steps to provide up to $2.3 trillion in loans to support households and businesses, as part of the relief bill passed by Congress. Support is also meant for stated cities and municipalities to help local governments manage cash flow stresses. The announcement came alongside weekly claims figures, which showed that over 6 million American filled for unemployment benefits last week.

In the EU, and after two-day stressing discussions, finance ministers finally agreed on a €540 billion stimulus relief package via the European Stability Mechanism, meant to support member stated. Basically, cheap loans through the so-called “coronabonds.”

Worth noting that all these announcements are immediate responses to deal with the ongoing crisis, but nothing is on the table on how to relaunch the economies once the pandemic is over. Uncertainty is high, and trends within the FX board will be tough to define.

Data reflecting the lockdown coming in

The macroeconomic calendar included little updated data beyond the mentioned US unemployment fugues. The preliminary estimate of the Michigan Consumer Sentiment Index for April came in at 71, a 9-year low, from 89.1 final in March. Inflation in the world’s largest economy was confirmed at 1.5%% YoY, with the core annual reading printing at 2.1%.

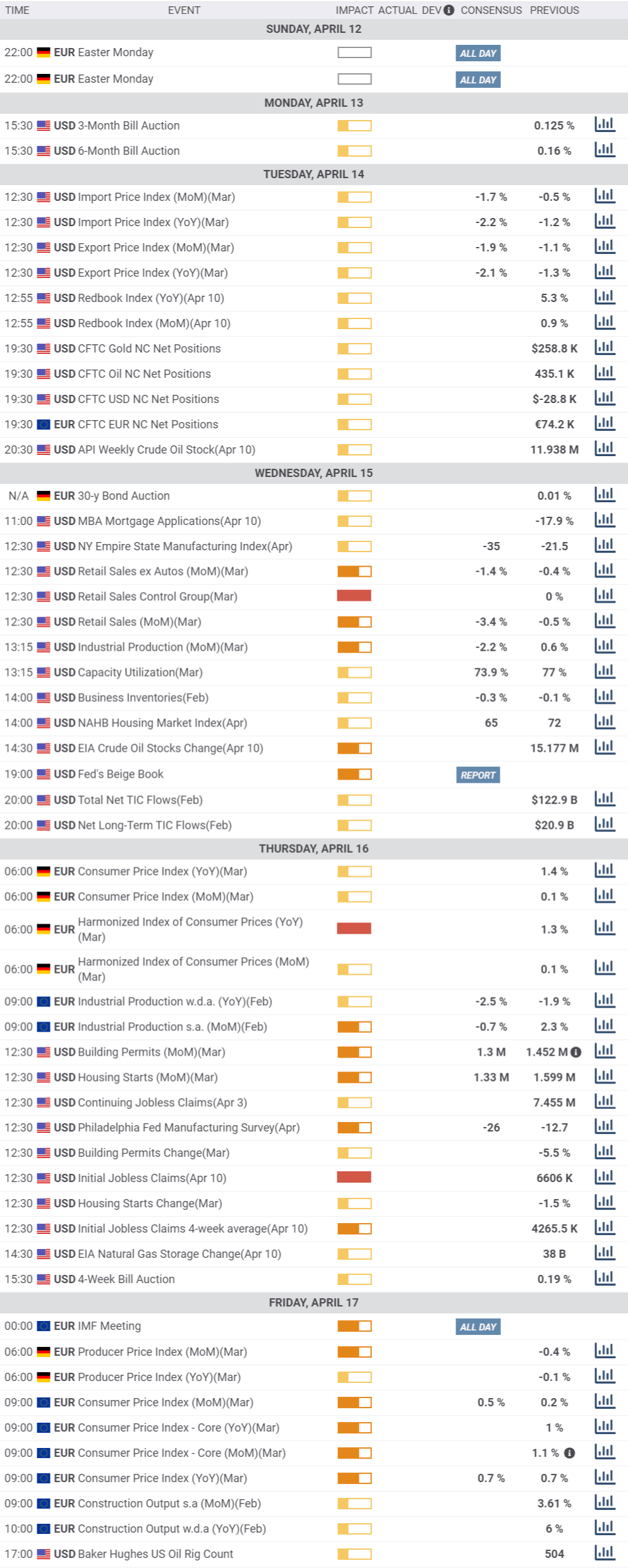

The upcoming macroeconomic week will start on Wednesday, with US March Retail Sales. Data will partially reflect the ongoing data, as it’s collected mid-month. Anyway, sales are seen down by 3.4%, which seems quite optimistic considering how things are going. On Thursday, the focus will be on US employment figures, as the country will release initial claims for the week ended April 3, which will reflect the full impact of quarantines. As for the EU, the Union and Germany will unveil their March final inflation data.

EUR/USD technical outlook

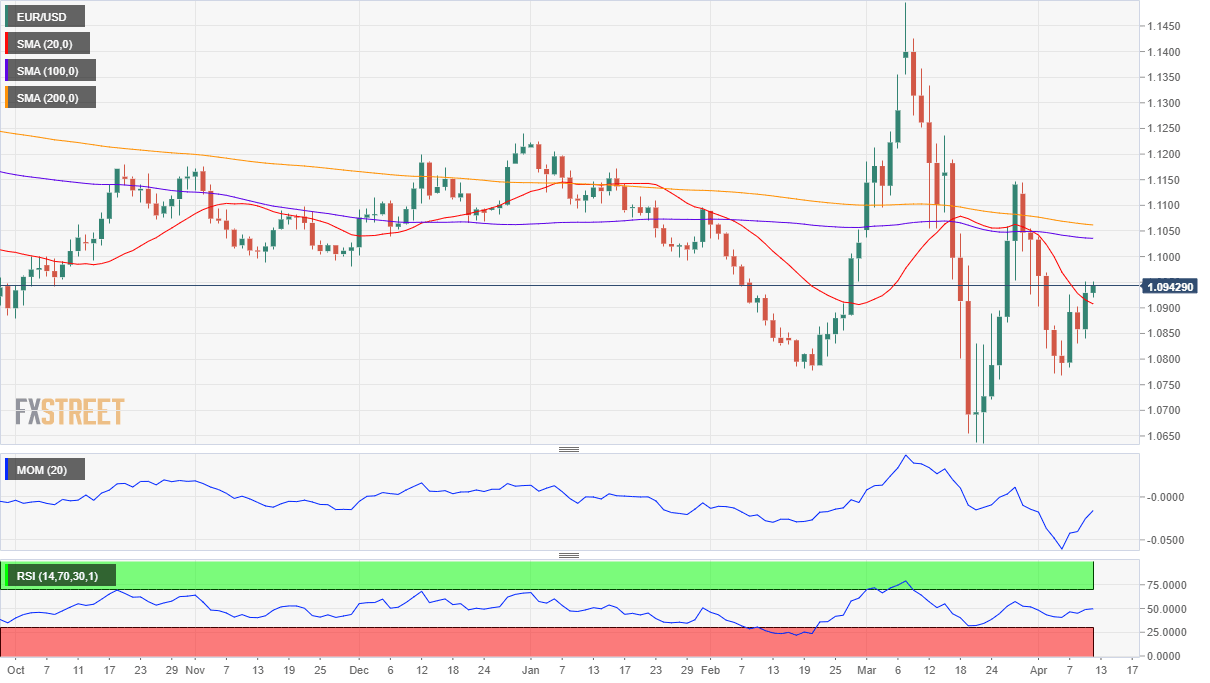

From a technical point of view, the EUR/USD pair, despite advancing, has held at the lower end of its previous weekly range. The market seems to be in its way to stabilise after the wild moves seen at the beginning of March when the pandemic crisis unfolded. The recovery seen these last few days, stalled at around the 38.2% of the latest daily advance measured between 1.0635 and 1.1147.

Nevertheless, the long-term perspective still favours the downside, as, in the weekly chart, the pair continues to develop below all of its moving averages. The 20 SMA lacks directional strength at around 1.1030, while the 100 SMA grinds lower below the 200 SMA, both over 300 pips above the shorter one. Technical indicators remain within negative levels, off their lows but directionless.

In the daily chart, the pair has settled above a bearish 20 DMA but remains below the larger ones. The Momentum indicator entered positive territory, but the RSI remains within neutral levels, both flat at the end of the week.

The advance of the shared currency was linked to the dollar’s weakness, and any other directional move will continue to depend on the market’s sentiment toward the greenback.

Beyond the mentioned Fibonacci resistance at 1.0950, where the pair has also settled its weekly high, the next relevant resistance comes at 1.1030, en route to the 1.1100 price zone. Supports, on the other hand, come at 1.0890, 1.0820 and 1.0770.

EUR/USD sentiment poll

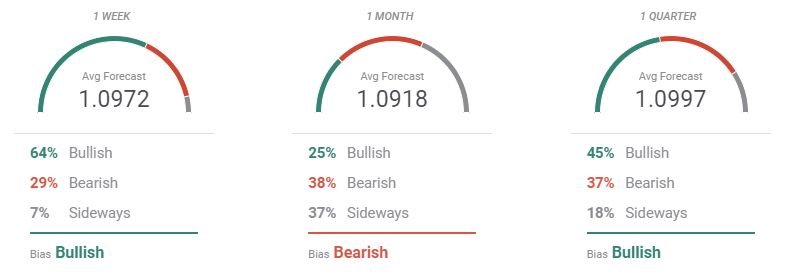

The FXStreet Forecast Poll shows that speculative interest is far from convinced about a directional move. The pair is seen bullish this week, bearish in one-month and back bullish in the quarterly perspective, although in the three time-frames under study, it’s seen between 1.0900 and 1.1000. The potential of a bearish move is being limited by the feeling that massive stimulus will continue to weaken the greenback.

As for the Overview chart, the wide ranges of possible targets in all the time-frame under study have left moving averages pretty much directionless in the monthly and quarterly views. For the upcoming week, the moving average is bullish but barely above the current level, suggesting some more range-trading ahead.

Related Forecasts:

GBP/USD Forecast: Has coronavirus peaked? That is the question in the US, the UK, and for Johnson

AUD/USD Forecast: Can optimism prevail? Australia's jobs report, Chinese GDP, US coronavirus eyed

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.