AUD/USD Forecast: Can optimism prevail? Australia's jobs report, Chinese GDP, US coronavirus eyed

- AUD/USD has recovered amid hopes for turning a corner on coronavirus.

- Australia's jobs report for March, Chinese Q1 GDP figures, and a potential COVID-19 peak in the US are eyed.

- Mid-April's daily chart is showing that bears are losing some ground.

The Australian dollar has been moving up alongside global stocks, as coronavirus cases seem to near a peak, especially in the US. Apart from updates on America's situation, Australia's jobs report, China's growth numbers, and other developments will likely shape AUD/USD in the post-Easter week.

This week in AUD/USD: Optimism rules

New York is the epicenter of coronavirus in the US, and while the daily death toll surpassed Italy and Spain at least during one day – there are signs that new cases are leveling off. Optimism about nearing the apex in COVID-19 infections in the world's largest economy pushed stocks higher and weighed on the safe-haven dollar.

The risk-on Aussie also benefited from a contained situation in Australia. At the time of writing, mortalities in the land down under are only in double-digits while cases are in the thousands. The global death toll is nearing 100,000, with the instances topping 1.5 million.

The A$ also benefited from the Reserve Bank of Australia's decision. The central bank left the interest rate unchanged as expected and suggested that the situation has stabilized, and no imminent action is needed. Home loans and investment lending for homes dropped in Australia in February – bit the development predates the illness.

S&P slashed Australia's credit rating amid crisis, as the downfall in the government's revenues and extraordinary spending hurt Australia's coffers. AUD/USD initially dropped but recovered afterward.

In China, Australia's No. 1 trading partner, residents of Wuhan – where coronavirus originated – were allowed to travel and return to normal. However, China has yet to revert activity to pre-disease levels.

Close to the end of short week, the Federal Reserve announced several lending programs worth $2.3 trillion. The news overshadowed another disastrous Unemployment Claims report – above 6 million once again. Stocks surged on the promise for additional liquidity and the US dollar dropped.

Australian and Chinese events: Australian jobs, Chinese GDP

As long as Australia's coronavirus situation remains contained, investors may look at economic data rather than health updates. Officials are considering how to gradually remove the lockdowns and send children back to school. Australia's daily number of cases peaked on March 28 with 457 and has since been falling.

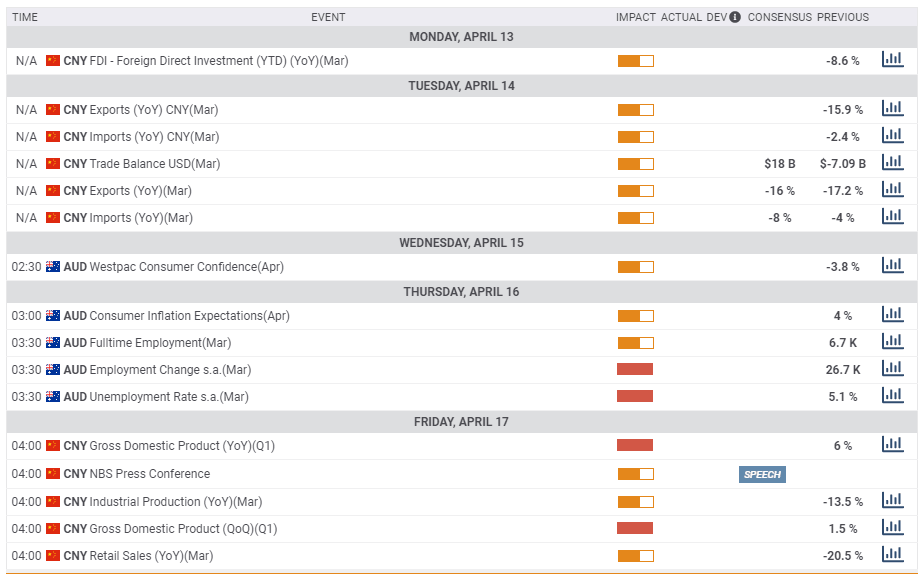

China's trade data for March kicks off the week with exports and imports projected to fall once again, reflecting the global downturn. Any sign of stabilization or recovery may boost the Aussie.

Australia's employment data for March stands out. The nation's Unemployment Rate stood at 5.1% in February and when the economy gained 26,700 jobs. Te land down under likely suffered in March. It is essential to note that a moderate increase in the jobless rate may be the result of a fall in the participation rate as some people gave up on seeking work in these turbulent times.

China's Gross Domestic Product figures for the first quarter of 2020 are a wildcard. GDP statistics usually match Beijing's expectations, and some suspect they are being smoothed to meet the Communist Party's targets. COVID-19 has hit the world's second-largest economy hard early in the year. Still, it is unclear if China suffered an outright contraction or just a severe slowdown. Any figure will likely trigger high volatility and potentially raise more questions than answers. For reference, the economy grew by 6% yearly in the last quarter of 2019.

In addition to GDP, China publishes industrial output data for March, which may show an uptick in comparison to previous months but a yearly drop. In February, the YoY fall stood at 13.5%.

Here the most prominent Australian and Chinese releases on the economic calendar:

US events: Peak or no peak?

Have cases in New York and the US as a whole peaked? President Donald Trump would like to open the economy – or at least part of it – as soon as possible. Health figures from the country's largest city will likely continue having a significant impact on market sentiment.

The safe-haven dollar will likely advance in response to disappointing news and fall upon positive developments.

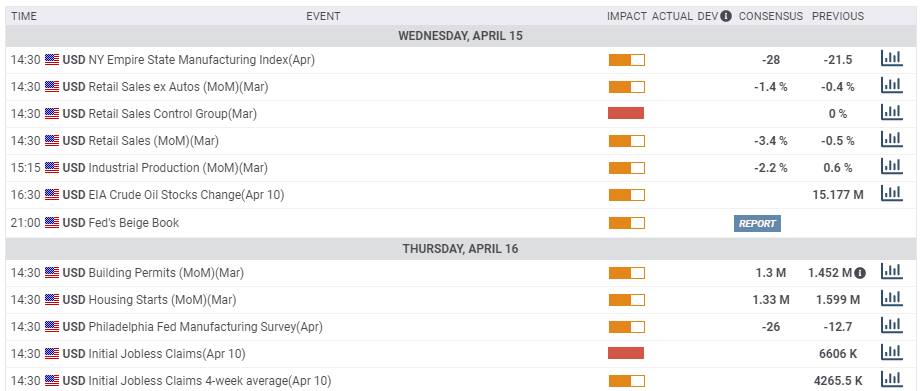

The economic calendar features several events that will likely rock markets. Retail Sales statistics for March are set to show a drop, reflecting the influence of lockdowns and layoffs on workers. There may be a difference between headlines figures – potentially underpinned by stockpiling – and other items. The Control Group remains of high importance.

The Federal Reserve' Beige Book will provide an update on business sentiment in the current situation. Anecdotal reports from the Fed's contacts are set to be gloomy.

Weekly jobless claims are set to remain in the millions, as firms continue adjusting to the new reality. The four-week rolling average and continuing claims are eyed.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

Momentum on the daily chart is on the verge of turning positive as the currency pair set higher high and higher lows. While the correction is gaining steam, AUD/USD remains below the 50, 100, and 200-day Simple Moving Averages, a bearish sign.

All in all, the picture is improving, but the Aussie is still not out of the woods.

Resistance awaits at 0.6310, a swing low from mid-March, and then by 0.64 where the 50-day SMA hits the price. It is closely followed by 0.6430, a swing low from late February. The round level of 0.65 and 0.6660 are next.

Some support is at 0.6250, a high point in mid-April. The next line is 0.6215, a swing high in early April. It is followed by 0.61, a temporary cap on the way up, and by 0.60, the psychologically significant level that provided support in April. The next levels to watch are 0.5870, 0.5660, and 0.5505.

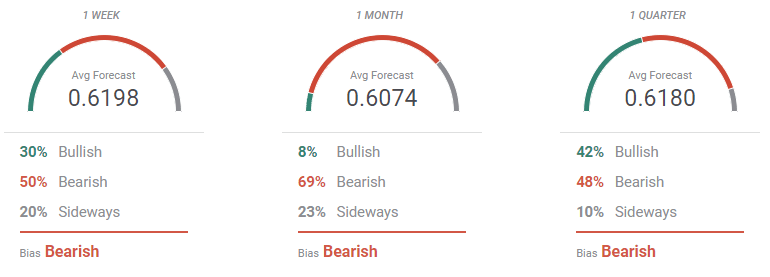

AUD/USD Sentiment Poll

The FXStreet Forecast Poll shows that bears dominate AUD/USD, seen falling back toward 0.6000 in the next few weeks. The average target in the weekly perspective is at around 0.6200, but 50% of the polled experts are seeing the pair declining. Bears jump to 69% in the monthly view and decrease to 48% in the quarterly perspective when the pair is seen trading again around 0.6200.

The Overview chart shows that the moving averages head higher, although the bullish strength fades as time goes by. Also, the spread of possible targets has widened in the quarterly view, with some analyst aiming to 0.52 and others toward 0.70.

Related Forecasts:

Gold Price Forecast: Easy money will be turned into gold

EUR/USD Forecast: Financial rescue keeps rising, crisis remains the same

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637220262201922266.png&w=1536&q=95)