EUR/USD Forecast: Euro could break out of range on ECB policy announcements

- EUR/USD extends its sideways grind above 1.0420 in the European session on Thursday.

- The Fed left monetary policy settings unchanged as expected.

- The ECB is widely anticipated to lower key rates by 25 bps.

EUR/USD continues to move sideways in a narrow channel above 1.0400 in the European session on Thursday after closing marginally lower on Wednesday. Investors await the European Central Bank's (ECB) policy announcements and the Gross Domestic Product (GDP) data from the US.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.71% | 0.23% | -0.73% | 0.34% | 1.36% | 1.04% | 0.13% | |

| EUR | -0.71% | -0.41% | -1.30% | -0.23% | 0.64% | 0.44% | -0.48% | |

| GBP | -0.23% | 0.41% | -1.21% | 0.18% | 1.05% | 0.87% | -0.07% | |

| JPY | 0.73% | 1.30% | 1.21% | 1.13% | 2.29% | 2.02% | 1.02% | |

| CAD | -0.34% | 0.23% | -0.18% | -1.13% | 0.82% | 0.69% | -0.24% | |

| AUD | -1.36% | -0.64% | -1.05% | -2.29% | -0.82% | -0.16% | -1.07% | |

| NZD | -1.04% | -0.44% | -0.87% | -2.02% | -0.69% | 0.16% | -1.14% | |

| CHF | -0.13% | 0.48% | 0.07% | -1.02% | 0.24% | 1.07% | 1.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The Federal Reserve (Fed) announced late Wednesday that it maintained the policy rate unchanged at 4.25%-4.5%. In its policy statement, the Fed removed the language suggesting inflation had "made progress" toward its 2% target and said the pace of price increases "remains elevated" instead. In the post-meeting press conference, Fed Chairman Jerome Powell said that there was elevated uncertainty because of significant policy shifts. "We don't need to be in a hurry to make any adjustments," he noted.

The US Dollar managed to stay resilient against its rivals after the Fed event but failed to gather bullish momentum. Later in the day, the US Bureau of Economic Analysis (BEA) will publish its first estimate of the fourth-quarter Gross Domestic Product (GDP) data. Markets expect the US economy to expand at an annualized rate of 2.6% following the 3.1% growth recorded in the third quarter. A weaker-than-forecast print could hurt the USD with the immediate reaction.

The ECB is widely anticipated to cut key rates by 25 basis points. In case ECB President Christine Lagarde adopts a cautious tone regarding further policy easing, citing doubts over the continuation of the disinflation, the Euro could gather strength. If Lagarde acknowledges the worsening growth outlook and reiterates the confidence in inflation stabilizing at around their target level, the Euro could come under renewed bearish pressure.

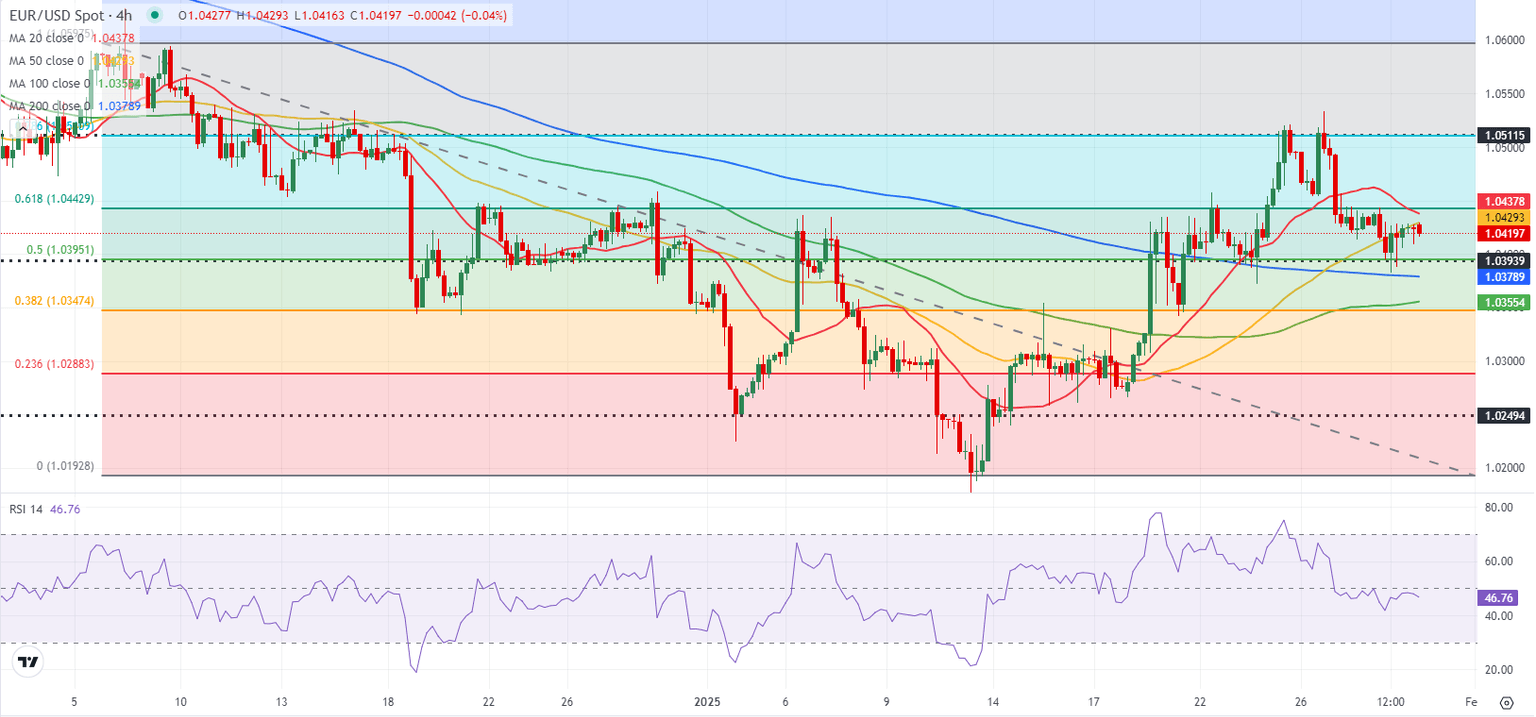

EUR/USD Technical Analysis

The near-term technical outlook fails to provide a directional clue, with the Relative Strength Index (RSI) indicator on the 4-hour chart moving sideways slightly below 50.

On the downside, first support could be seen at 1.0380-1.0390 (200-period Simple Moving Average, Fibonacci 50% retracement of the latest downtrend) before 1.0340-1.0350 (Fibonacci 38.2% retracement, 100-period SMA) and 1.0300 (static level, round level). If EUR/USD stabilizes above 1.0440 (Fibonacci 61.8% retracement), next resistance could be spotted at 1.0500-1.0510 (round level, Fibonacci 78.6% retracement) ahead of 1.0540 (static level) and 1.0600 (beginning point of the downtrend).

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.