EUR/USD Forecast: Corrective advances likely, but intrinsically bearish

- US data mixed on Friday, but still indicating economic growth in the country.

- German economy in trouble, dragging the common currency further lower.

- EUR/USD bouncing modestly from multi-month lows, at risk of falling.

The shared currency was once again the worst performer against the greenback, with EUR/USD falling to levels last seen in April 2017. Down for a second consecutive week, the pair has closed in the red eight of the last ten days, and lower lows are the norm. Despite extremely overbought and the increased risk of a bullish corrective movement, the pair is intrinsically bearish with not much at sight that could change that picture.

The dollar is stronger due to continued economic growth, confirmed by US data, but also gets support from its safe-haven condition. Crossing the Atlantic, however, things are not that good.

Data, Powell, and growth

US core annual inflation came in better than anticipated at 2.3% in January, while the headline reading rose to 2.5%. German CPI, on the contrary, was up by 1.7% as expected when compared to a year earlier. This Friday, the EU’s largest economy reported its Q4 economic growth remained pat, missing the market’s expectations. For the whole Union, growth in the same period came in as expected at 0.1%.

US January Retail Sales met the market’s expectation by printing 0.3%, although the core reading, Retail Sales Control Group came in at 0.0%, below the expected 0.3%. The preliminary estimate of the February Michigan Consumer Sentiment Index printed at 100.9, largely surpassing the market’s expectation of 99.5.

Fed’s Chair testimony before the Congress included different and interesting comments, although probably the words that the market cared most were those about rates. Powell & Co. hinted they are comfortable where rates are, and despite Trump’s pressure, policymakers are in no rush to move them, repeating as usual that adjustments in monetary policy are data-dependent. But also clarified that economic growth continues stable, suggesting no moves at sight. Among the risks to the economy, he mentioned the coronavirus outbreak, although the Fed is not yet able to asses its possible effects.

What’s next in the data front

The calendar next week starts with a holiday in the US. Germany will release the February ZEW Survey on Tuesday, with the economic sentiment in the country seen deteriorating. The US Federal Reserve will publish the Minutes of its latest meeting on Wednesday, not expected to surprise. The Fed’s stance is quite clear. On Thursday, it will be the turn of the European Central Bank to unveil its Monetary Policy Meeting Accounts. These could be a bit more noisy, as President Lagarde is yet to be fully understood by speculative interest.

On Friday Markit will publish the preliminary estimates of February PMI for the Union and the US. German manufacturing output is seen contracting further, to 44.8. If German data continues to disappoint, the EUR will continue to fall.

EUR/USD technical outlook

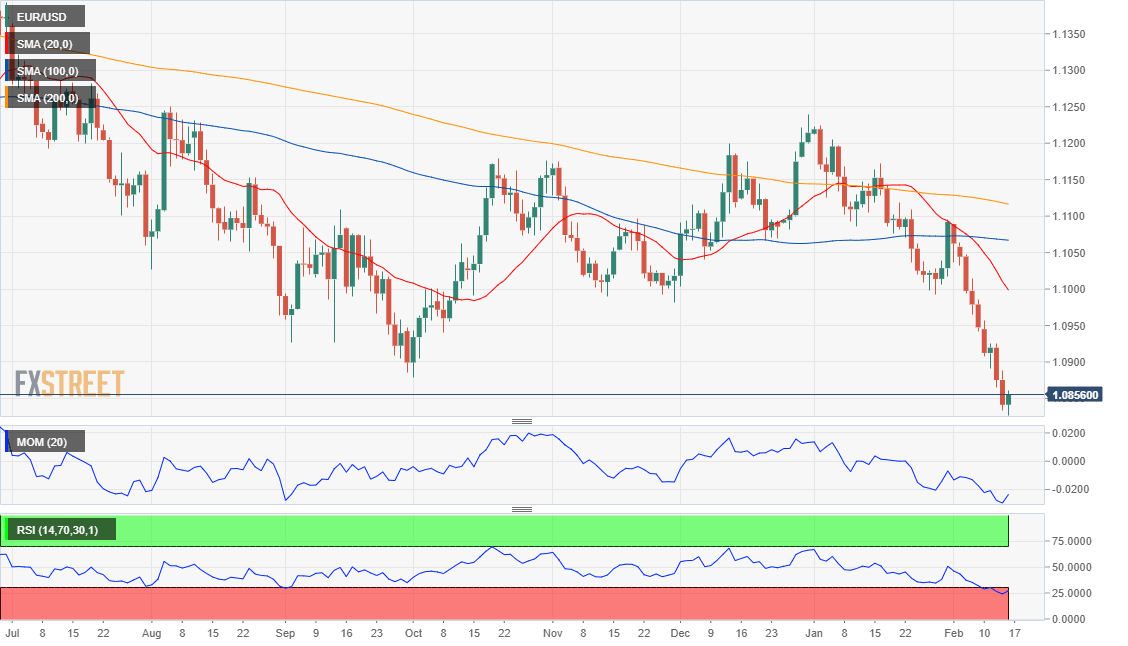

The weekly chart for the EUR/USD pair shows that it further extended its slump below its 20 SMA, while the 100 SMA nears the 200 SMA far above the current level, becoming irrelevant in terms of levels to watch, but reflecting sellers’ strength. The Momentum indicator lacks directional strength but holds within negative levels, while the RSI heads firmly lower at around 37, in line with another leg lower.

In the daily chart and given Friday’s recovery, technical indicators have begun correcting extreme oversold conditions, but the 20 DMA maintains a strong bearish slope below the larger moving averages and at around 1.0995.

The pair would need at least to rally past 1.0925 for bears to consider retreating. In that case, the upward corrective movement could continue up to the 1.1000 region, where sellers will again give a good battle. Above this last, the next resistance area is 1.1040/60. The pair has bottomed at 1.0826, the immediate support ahead of 1.0770. Below this last, the decline next week could continue toward 1.0720.

EUR/USD sentiment poll

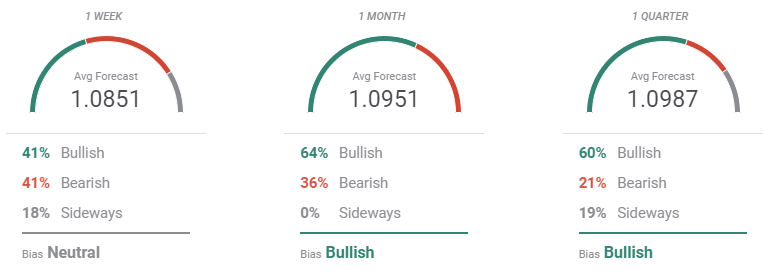

The FXStreet Forecast Poll supports an upcoming correction as the pair is seen holding neutral in the weekly perspective and later advancing, although on average, it is seen holding below the 1.1000 level. Additionally, bulls in the monthly view account for 64% of the polled experts, decreasing to 60% in the quarterly perspective. Bears in the long-term, are just 21%.

The Overview chart shows that, while most targets accumulate above the current level in the monthly chart, most turn to current or lower levels in the three-month view. The weekly moving average is firmly bearish, while the quarterly one also heads sharply lower. Overall, the pair is seen correcting from current levels but retaining the long-term bearish trend.

Related Forecasts:

Bitcoin Weekly Forecast: Bitcoin bulls brace for jump to $11,000

GBP/USD Forecast: Boris-bounce faces top tests, double-top, after the reshuffle rally

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.