Bitcoin Weekly Forecast: Bitcoin bulls brace for jump to $11,000

- Bitcoin (BTC) ends ween in a green zone, lags behind some altcoins.

- The regulatory trends bode ill for the cryptocurrency industry.

- The long-term Bitcoin's trend remains bullish as long as it stays above $9,600.

Bitcoin (BTC) has been growing for three weeks in a row. The first cryptocurrency hit $10,504 on Thursday - the highest level of 2020; however, the upside proved to be unsustainable as BTC/USD retreated to $10.250 by the time of writing, it is still over 5% higher on a week-on-week basis.

Since the beginning of the year, Bitcoin gained over 43%, though it is nor the best result among digital coins. It seems that this crypto rally is fuelled altcoins, while BTC has to catch up. As a result, its market share dropped below 62% and hit 61.4% earlier this week. No wonder that cryptocurrency experts started speaking about altseason.

Thus, Tezos (XTZ) is an uncontested growth leader out of top-20 this week. The coin gained over 55% to trade at $3.40. Chainlink, Huobi Token, Ethereum and Bitcoin SV are also doing well, all of them have grown by over 20% in recent seven days.

Crypto bulls vs. US regulators

The cryptocurrency regulation topic is far from being exhausted. The head of the US Treasury Steven Mnuchin promised to roll out a new cryptocurrency regulation that would make the industry more transparent for the law enforcement authorities and ensure that no money is laundered via digital assets. The American financial regulatory bodies want to know who sends the money, who receives it and what for. In other words, they want to deprive the industry of the very feature that has long been touted by crypto enthusiasts as the key benefit.

While the authorities try to curb manipulations in trading and prevent illegal activities like tax evasion and terrorism financing, the industry may feel the pain. Many US-based cryptocurrency exchanges have already undergone significant changes to avoid issues with the regulators. Some of them, including Poloniex and Bittrex chose to leave the US market. This trend is set to continue.

The similar sentiments are brewing in Europe, where new anti-money laundering Directive (AMLD5) has already forced the exchanges either to close business or to move out of the region.

BTC/USD: Technical picture is good for long-term bulls

From the long-term point of view, BTC/USD is poised for further growth with the next aim at $11,000. This barrier coincides with 61.8% Fibo retracement for the downside move from July 209 high to December 2019 low. Once this resistance is out of the way, the upside momentum will start snowballing as cautious traders will drop their wait-and-see approach and start jumping this bullish train.

BTC/USD daily chart

Weekly RSI has flattened out, which the bulls might need some breathing time before another strong move. The technical setup on a daily chart supports this view. The daily RSI stays flat close to the overbought levels, but there are no clear signs of reversal as of yet.

Moreover, the price is supported by $10,150 (50% Fibo retracement of the above-said move). This barrier was tested on several occasions during recent days, but each time BTC managed to return above this critical line. Once it is broken another strong support of $10,000 will come into view. Considering a thick layer of protective orders will cool down the sellers and help engineer a rebound. Otherwise, the sell-off will continue towards $9,600. This level is regarded as pivotal for the current bullish trend.

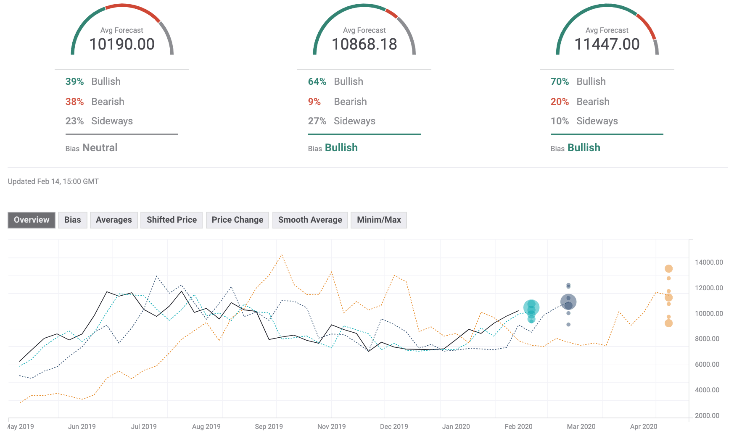

The Forecast Poll of experts has stayed mostly unchanged since the previous week. The expectations on all timeframes except weekly remained bullish. Though the percentage of investors with positive long-term sentiments decreased from 80% to 70%. The average price forecast on all timeframes moved above 10,000. Notably, the quarterly price forecast settled above $11,000.

Author

Tanya Abrosimova

Independent Analyst

-637172882188046336.png&w=1536&q=95)