- EUR/USD bulls took a breather near 32-month tops amid holiday-thinned liquidity conditions.

- The prevalent bearish sentiment surrounding the USD should help limit any meaningful slide.

- Any dip towards the 1.2235 resistance breakpoint could now be seen as a buying opportunity.

The EUR/USD pair was seen oscillating in a narrow trading band through the first half of the European session and consolidated its recent strong gains to the highest level since April 2018. In the absence of any fresh fundamental catalyst, bulls took a brief pause and refrained from placing fresh bets amid year-end thin trading volumes. That said, sustained selling bias around the US dollar should help limit the downside, rather supports prospects for a further near-term appreciating move.

Investors continued to dump the USD on hopes for a stronger global economic recovery in 2021 and expectations that the Fed will keep interest rates lower for a longer period. Apart from this, the likelihood of additional US financial aid package and regulatory approval of AstraZeneca/Oxford COVID-19 vaccine remained supportive of the underlying bullish tone in the equity markets. This was seen as another factor that further undermined the greenback's relative safe-haven status.

There isn't any major market-moving economic data due for release from the Eurozone. This, in turn, leaves the pair at the mercy of the USD price dynamics. The US economic docket highlights the only release of the usual Initial Weekly Jobless Claims. The data is unlikely to provide any meaningful impetus. However, the broader market risk sentiment might continue to influence the USD price dynamics and assist investors to grab some opportunities on the last trading day of the year.

Short-term technical outlook

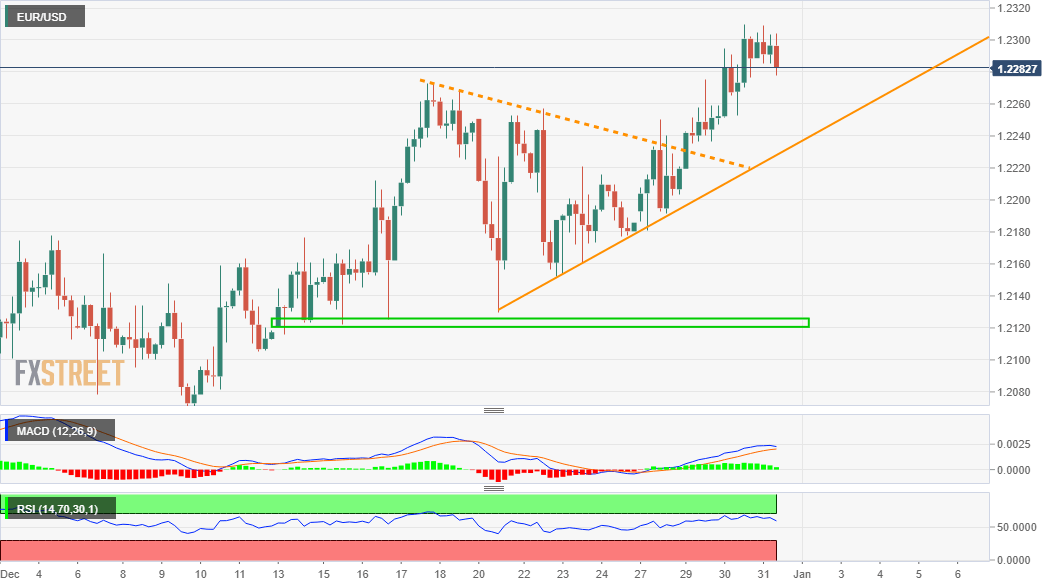

From a technical perspective, the pair this week confirmed a fresh bullish breakout through a symmetrical triangle and seems poised to prolong its recent upward trajectory. However, RSI on the daily chart has moved on the verge of breaking into the overbought territory and warrants some caution for aggressive bullish traders. This makes it prudent to wait for a modest pullback or some near-term consolidation before the next leg up. The next relevant target on the upside is pegged near the 1.2340 level, above which the pair could aim to reclaim the 1.2400 mark in the near-term.

On the flip side, any meaningful pullback might now be seen as a buying opportunity and remain limited near the triangle resistance breakpoint, currently near the 1.2230 region. The mentioned support coincides with another ascending trend-line support, which if broken decisively might prompt some technical selling. The pair might then turn vulnerable to break below the 1.2200 mark and accelerate the corrective slide further towards the 1.2130-25 congestion zone, tested earlier this week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD climbs to fresh monthly high above 1.0800

EUR/USD gathered bullish momentum and advanced to its highest level in a month above 1.0800 in the American session on Tuesday. The renewed selling pressure surrounding the US Dollar ahead of Wednesday's key inflation data provides a boost to the pair.

GBP/USD rises toward 1.2600 on renewed USD weakness

After falling toward 1.2500 in the early American session, GBP/USD regained its traction and turned positive on the day above 1.2550. The US Dollar struggles to find demand following the producer inflation data and allows the pair to stretch higher.

Gold regains its poise on broad US Dollar’s weakness

Following Monday's decline, Gold stages a rebound toward $2,350 on Tuesday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% after April producer inflation data, allowing XAU/USD to hold its ground.

Ethereum knocking at support’s door

Crypto market capitalisation rose 0.8% over the past 24 hours to 2.2 trillion, but growth exceeded 2% for most of the period. However, it dipped at the start of active European trading, temporarily returning to levels of a day ago.

PPI surprises on the upside, but CPI may not follow suit

US producer price data for April surprised on the upside, suggesting that inflation pressure at the start of the inflation pipeline could be building once again. Final demand PPI rose to 2.2% from 1.8%.