EUR/USD Forecast: Big budget, end-of-month flows and downside momentum all point lower

- EUR/USD has been edging lower as US yields rise and ahead of US data.

- Biden's big-budget and a correction of some of the dollar falls in May could push the pair lower.

- Friday's four-hour chart is showing momentum has turned negative.

How far does $6 trillion go? In the short term, a mere press report about President Joe Biden's fiscal 2022 budget is pushing the dollar higher. While stock cheer the prospects of more government investment and faster growth, the specter of larger US debt weighs on bonds. Treasury yields are rising and the greenback follows.

Will this trend continue? The dollar has also received a boost from Thursday's mostly upbeat economic releases and Friday's publications could add fuel to the fire. While headline Durable Goods Orders disappointed with a drop, the non-defense ex-air component – aka "core of the core" surprised with a leap of over 2%.

This increase in investment is good news for the economy. Moreover, weekly jobless claims extended their decline, hitting a new pandemic low of 406,000. Gross Domestic Product growth remained unchanged at 6.4% annualized in the second read, a minor miss that was shrugged off by investors.

US Durable Goods Orders in April show strong underlying expansion

Friday features the release of Personal Income, Personal Spending and Core Personal Consumption Expenditure (Core PCE) – the Federal Reserve's favorite gauge of inflation. Economists expect it to surpass the bank's objective of 2% but by how much? If the indicator for May beats estimates – like the Consumer Price Index – the greenback could get another boost.

US PCE inflation preview: Gold remains key asset to watch

While there are three more days until May officially ends, Friday's trading will likely see choppy end-of-month trading. Monday is a bank holiday in both the US and the UK, meaning money managers will be scrambling to adjust their portfolios. As the dollar has been on the back foot during the month, an upside correction cannot be ruled out.

All in all, the greenback has room to rise. What about the euro? European Central Bank member Isabel Schnabel said that the increase in European bond yields is natural, hinting at her reluctance to further ECB intervention. Moreover, France revised its first-quarter GDP down from +0.1% to -0.4% – making it the second consecutive quarter of contraction and thus an official recession.

All in all, Friday could see EUR/USD extending its falls.

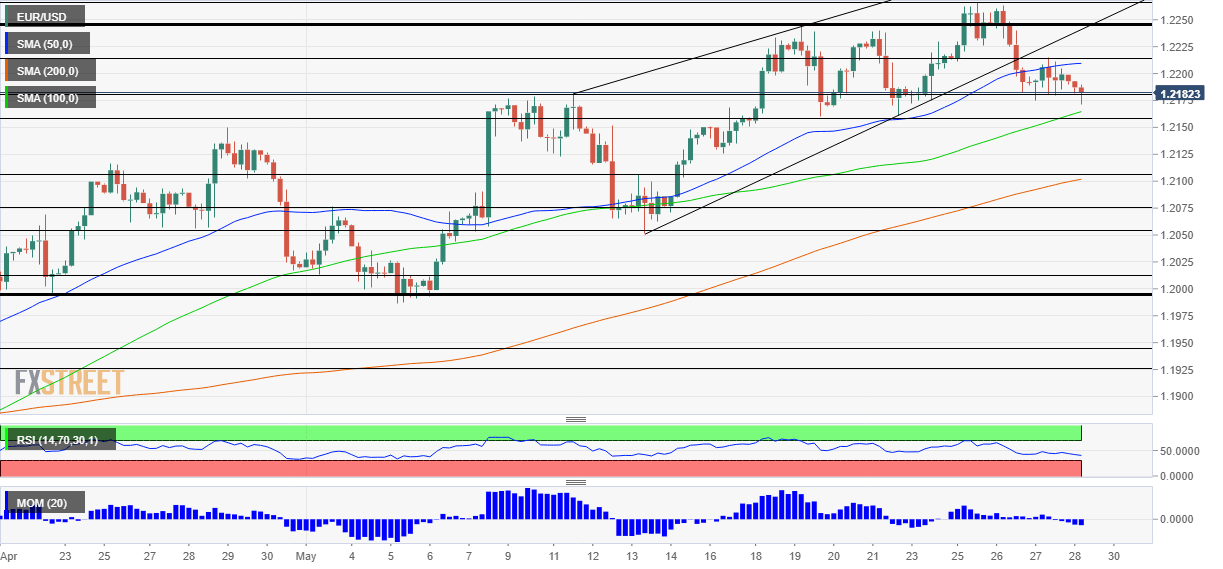

EUR/USD Technical Analysis

Euro/dollar has dropped below the 50 Simple Moving Average on the four-hour chart and momentum has turned negative. Bulls may find some solace in the fact that the currency pair still trades above the 100 and 200 SMAs. Nevertheless, bears are gaining ground.

Some support awaits at 1.2155, which provided support last week. It is followed by 1.2105, a cap from earlier in the month, and then by 1.2075.

Some resistance is at the recent high of 1.2210, followed by the former triple top of 1.2245 and finally by the May peak of 1.2266.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.