US Durable Goods Orders in April show strong underlying expansion

- Business investment jumps to highest since August 2020.

- Overall goods orders restrained by automobile and chip shortage.

- March orders revised sharply higher in all categories.

- First quarter GDP unchanged at a 6.4%, initial claims fall.

Business managers and consumers expect a prosperous future judging by their willingness to invest and sign long term contracts. Strength in these two sectors make it likely the vibrant first quarter expansion continues to mid-year.

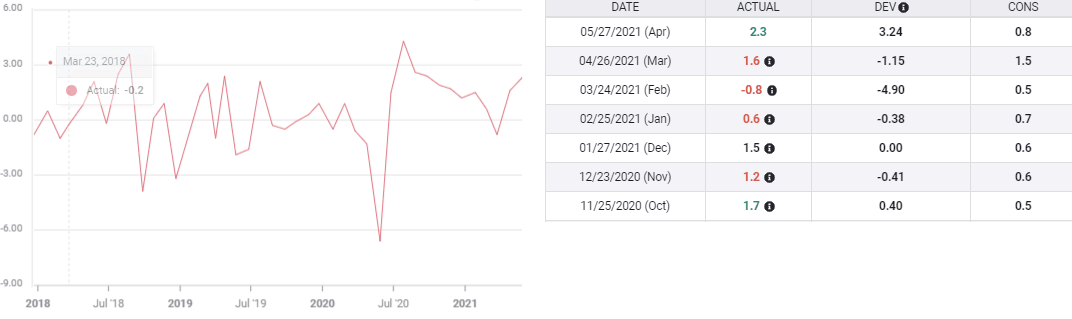

Capital goods spending by American companies rose 2.3% in April, nearly triple the 0.8% forecast. The March gain in these Nondefense Capital Goods Orders ex-aircraft was revised to 1.6% from 0.9%.

Nondefense Capital Goods

Overall orders for Durable Goods slipped 1.3% last month, far less than the 0.7% median forecast. The decline was due almost entirely to a 6.2% drop in orders for new cars and trucks.

Automobile dealers have plenty of customers but manufacturers can't supply enough vehicles because of a global shortage of computer chips. These supply bottlenecks will be around for several months until the production problems created by the pandemic lockdowns are cured and the backed-up demand is filled.

Goods orders excluding transportation rose a healthy 1%, a bit more than the 0.8% prediction. Orders in March doubled to 3.2% from 1.6% after adjustment.

Durable Goods Orders ex-Transport

FXStreet

Commercial aircraft purchases climbed 17.4% in April. Boeing Company of Chicago had its first positive month after a year of cancellations. It also sold its first 737 MAX jets after the worldwide grounding from computer problems that caused two crashes.

Orders outside of US Defense Department procurement were flat in April after March’s revised 2.2% increase, initially listed at 0.5%.

US economy

In a separate release, first quarter US growth was unchanged at 6.4% after the initial GDP revision. The current Atlanta Fed estimate for the second quarter is 9.1%.

Business spending has picked up sharply in the last two months averaging just under 2% each after being slightly negative, -0.1% in January and February.

Consumers also seem willing to purchase items that require a long-term payout, like cars, implying confidence about their employment prospects. This is somewhat at odds with the April Retail Sales numbers which were flat after gaining 5.1% per month in the first quarter.

Initial Jobless Claims dropped to 406,000 in the May 21 week from 444,000, the fourth week in a row of pandemic lows. Continuing Claims fell to 3.642 million from 3.738 million prior.

Initial Jobless Claims

FXStreet

Market response

Treasury yields responded to the better economic news with the 10, 5 and 30-year yields rising while the 2-year was unmoved.

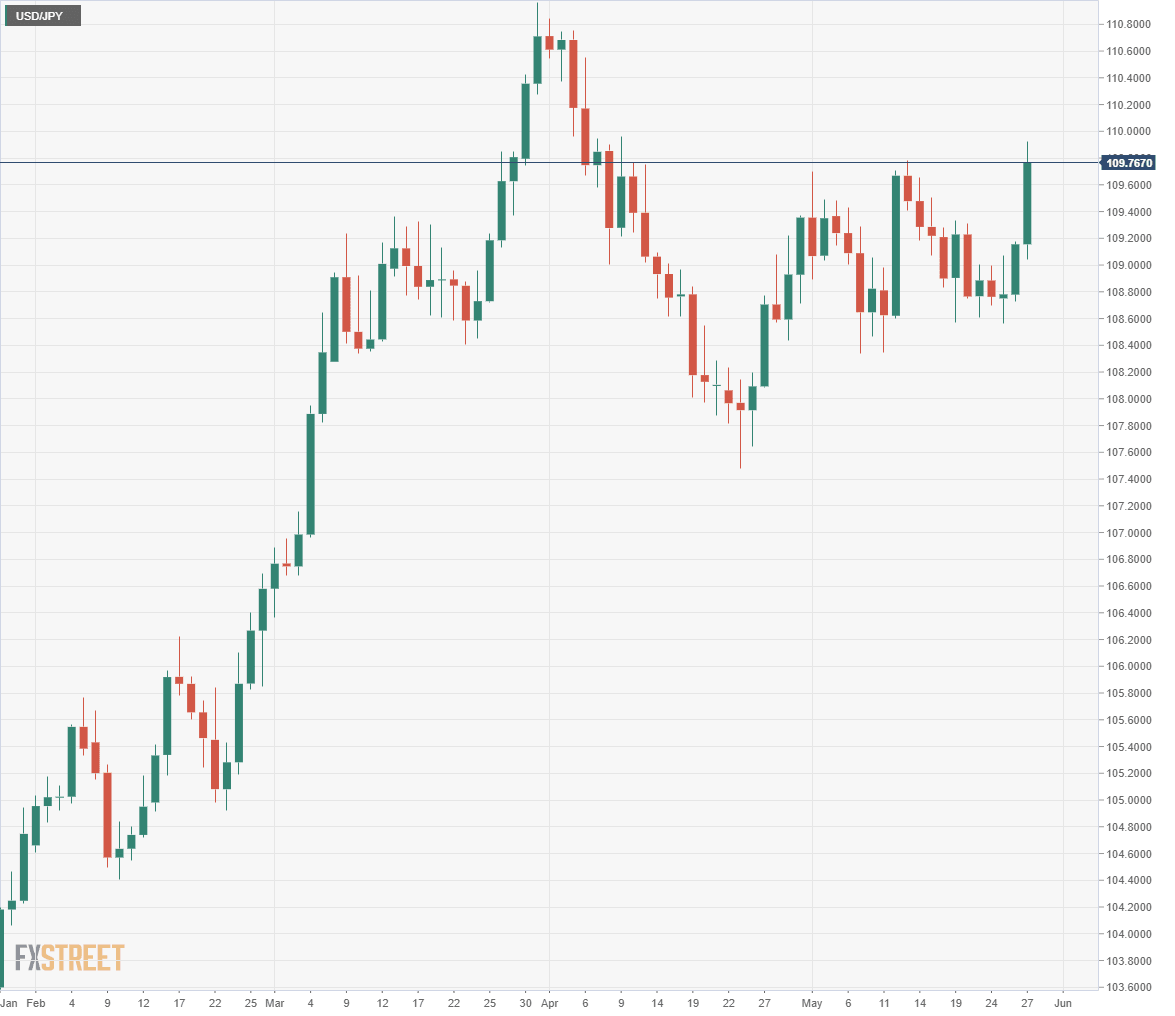

The US dollar was mixed in early afternoon trading, gaining against the yen, losing against the euro, sterling, kiwi and Canada and flat with the Australian dollar.

American equities were mostly higher, with the S&P 500 up 0.07%, the Dow 0.26% and the NASDAQ down 0.03%.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.