EUR/USD Forecast: Bears take over amid dismal German data

EUR/USD Current price: 1.0805

- German growth missed expectations, inflation ticked higher in July.

- Financial markets gear up for first-tier data scheduled throughout the rest of the week.

- EUR/USD bearish case becomes stronger, with 1.0800 about to give up.

The EUR/USD pair recovered some ground after bottoming at 1.0802 on Monday, but price action remains sluggish across the FX board as investors gear up for first-tier events scheduled throughout the rest of the week, while mixed European data undermined demand for the Euro.

The Bank of Japan (BoJ) will announce its decision on monetary policy early on Wednesday, while Australia will publish Q2 inflation-related figures alongside. Later in the day, the Federal Reserve (Fed) will also announce its monetary policy decision. In the meantime, the United States (US) will publish multiple employment-related figures ahead of the Nonfarm Payrolls (NFP) report on Friday. Finally, the Bank of England (BoE) will unveil its decision on Thursday.

During European trading hours, Germany reported the Q2 Gross Domestic Product (GDP), which fell 0.1% QoQ, according to preliminary estimates, worse than the 0.1% advance expected. The Eurozone flash Q2 GDP, however, printed at 0.3%, better than the 0.2% anticipated by market players. At the same time, the EU reported that Consumer Confidence remained steady at -13 in July, as expected. Additionally, Germany published the preliminary estimate of the July Harmonized Index of Consumer Prices (HICP) showing price pressures increased on a yearly basis against an anticipated drop.

The United States (US) session will bring the CB Consumer Confidence report for July and June JOLTS Job Openings.

EUR/USD short-term technical outlook

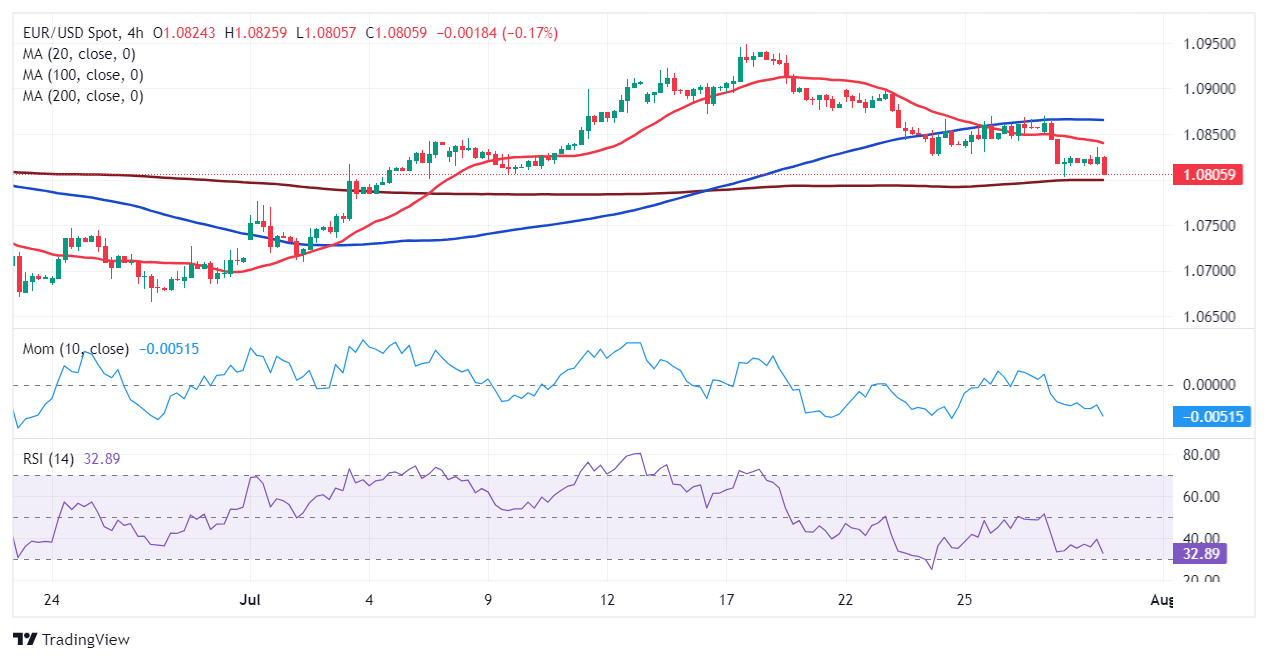

The EUR/USD pair resumed its slide with German data and approaches the 1.0800 region ahead of Wall Street’s opening. The daily chart shows increased bearish momentum as the intraday advance stalled below a bearish 20 Simple Moving Average (SMA). In the meantime, a flat 200 SMA provides support at around 1.0800, while technical indicators accelerated south within negative levels, in line with the prevalent selling interest.

In the near term, and according to the 4-hour chart, the case for a downward extension is even clearer. The current long candle with a bearish acceleration below the 20 SMA reflects increased selling interest. The 100 and 200 SMAs, in the meantime, head lower well above the current level, also supporting an upcoming decline. Finally, technical indicators head south almost vertically within negative levels, anticipating a bearish continuation in the upcoming sessions.

Support levels: 1.0800 1.0760 1.0720

Resistance levels: 1.0835 1.0885 1.0920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.