- ECB's monetary policy adjustments smashed the common currency.

- EUR/USD to consolidate next week, bounce sharply afterward as the market is not ready to test 1.1000.

Tough week for the common currency, following a more than dovish surprise for the ECB. The central bank was expected to downgrade inflation and growth forecasts and to maintain rates on hold, which it did. The downward surprise was the announcement of a new round of TLTRO, the third one. Furthermore, Draghi & Co. pushed back rate hikes plans, stating that will now will remain at their current levels at least until the end of 2019 or as long as required. Draghi blamed external factors as the main reason behind the poor data that triggered these decisions. The EUR/USD pair fell to its lowest since June 2017, printing 1.1175 before paring losses. The pair bounced modestly from such a low but was unable to extend gains despite a mixed US employment report. The US added just 20K new jobs in February, well below the expected 180K. The headline, however, was the only dismal figure, as January number was upwardly revised to 311K from 304K, while the unemployment rate was better-than-expected, falling to 3.8%. Additionally, Average Hourly Earnings rose 0.4% MoM and by 3.4% YoY, beating the market's forecasts. The decline in the headline reading was attributed to dismal weather conditions, partially offsetting its negative impact.

Meanwhile, growth in the EU showed modest signs of improving according to the final versions of Markit February PMIs, falling short, however, to suggest a bottom has been reached. Growth progressed at its slowest pace in four years in the Union. Fears are still high. In the US, on the other hand, the ISM Non-Manufacturing PMI impressed to the upside, alongside housing data.

The scale is skewed in favor of the greenback, with multiple US figures scheduled for next week to determine whether dollar's strength is set to continue in the longer run, starting with Retail Sales on Monday and CPI data on Tuesday. The EU macroeconomic calendar has little of relevance to offer until next Friday when the Union will unveil CPI figures.

There's a couple of political factors that have yet to be resolved and could affect these two currencies. China-US trade talks are making 'progress' according to both parts, but there's no agreement yet. Market players are optimistic about it, but such optimism could turn into pessimism if no solution is quickly announced. The other critical factor is Brexit, as the market is focused on how it will affect the UK, but everyone forgets about the other half. A hard landing will affect Europe to a lesser extent, but won't be a bed or roses.

EUR/USD technical outlook

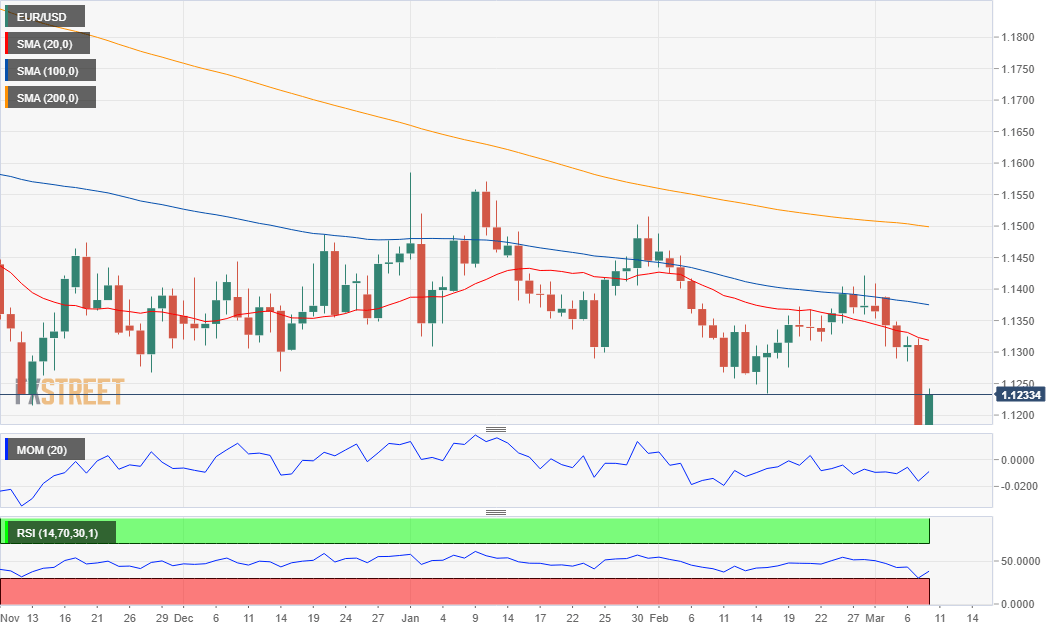

The EUR/USD pair trades around 1.1232, measly 50 pips above its multi-year low. The weekly chart has now a clear bearish stance, with the pair developing below all of its moving averages, with the 20 SMA accelerating its decline and close to cross the 200 SMA. Technical indicators head south, the Momentum with limited strength and near neutral readings but the RSI now at its year low at 39, supporting further declines ahead.

In the daily chart, the pair settled far below all of its moving averages, all of them with marked bearish slopes, while technical indicators barely recovered from their daily lows, the RSI holding near oversold readings, also supportive of a bearish continuation.

The mentioned weekly low is the first resistance ahead of the 1.1100/20 price one, where the pair has several weekly lows from early 2017. Below the level, bears will try to test the 1.1000 figure. The pair would need to regain 1.1300 to be able to correct higher, with room for a high in the 1.1375/1.1400 region.

EUR/USD sentiment poll

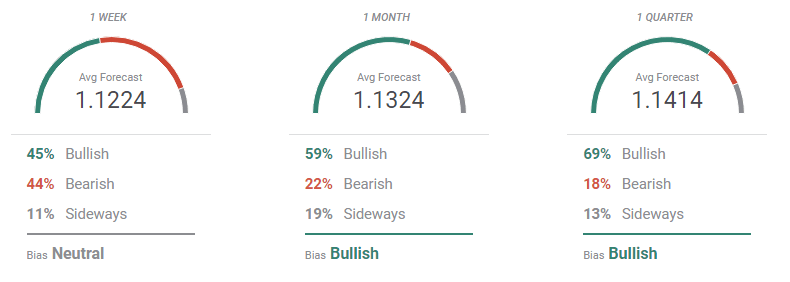

The FXStreet Forecast Poll offers quite a mixed sentiment picture, as the range of possible targets for the upcoming week goes from 1.09 to 1.17, indicating that investors are still struggling to determine whether growth or central banks weigh more. Nevertheless and despite the neutral stance, the larger accumulation of targets is below the current level, which results in the Overview moving average having a nice bearish slope.

In the monthly perspective, however, there's a sharp U-turn in sentiment, with most targets above the current level and bulls up to 59%. The upward pressure is even larger in the 3-month view, with 69% of the polled experts betting for further gains, with the pair seen on average at 1.1414.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.