EUR/USD Forecast: Another drop to 1.0600 is not ruled out

- EUR/USD’s bullish attempt faltered ahead of 1.0700.

- The Dollar regained momentum on hawkish Fedspeak.

- The ECB is seen reducing its interest rate three times this year.

A marked rebound in the US Dollar (USD) motivated EUR/USD to interrupt its weekly recovery and refocus on the downside soon after hitting tops around 1.0690 earlier on Thursday.

The firmer tone in the Greenback, in the meantime, came amidst further hawkish tone from Fed officials as well as investors’ reassessment of the timing of a potential rate cut by the Federal Reserve (Fed), now expected to happen later than previously anticipated, possibly in December.

The resurgence of the bull trend in the US Dollar coincided with a decent bounce in US yields across the yield curve and a consistent narrative regarding the divergence in monetary policy between the Fed and other G10 central banks, especially the European Central Bank (ECB).

In this regard, Board member Villeroy proposed a rate cut at the bank’s upcoming meeting, while his colleague Simkus advocated for three rate cuts this year, and Kazaks emphasized the high likelihood of a rate reduction in June.

The above starkly contrasted with comments from Fed’s J. Williams (New York), who underscored that the Fed's decisions are grounded in favourable data, emphasizing the robustness of the economy and the reduction of imbalances. While recognizing the necessity for rate cuts, he clarified that there are no predetermined increases, adding that if the data necessitate higher rates, the Fed may adjust accordingly.

Looking ahead, the relatively subdued economic fundamentals in the eurozone, coupled with the resilience of the US economy, reinforce expectations for a stronger Dollar in the medium term, particularly considering the prospect of the ECB cutting rates before the Fed. In such a scenario, EUR/USD is expected to undergo a more pronounced decline in the short term.

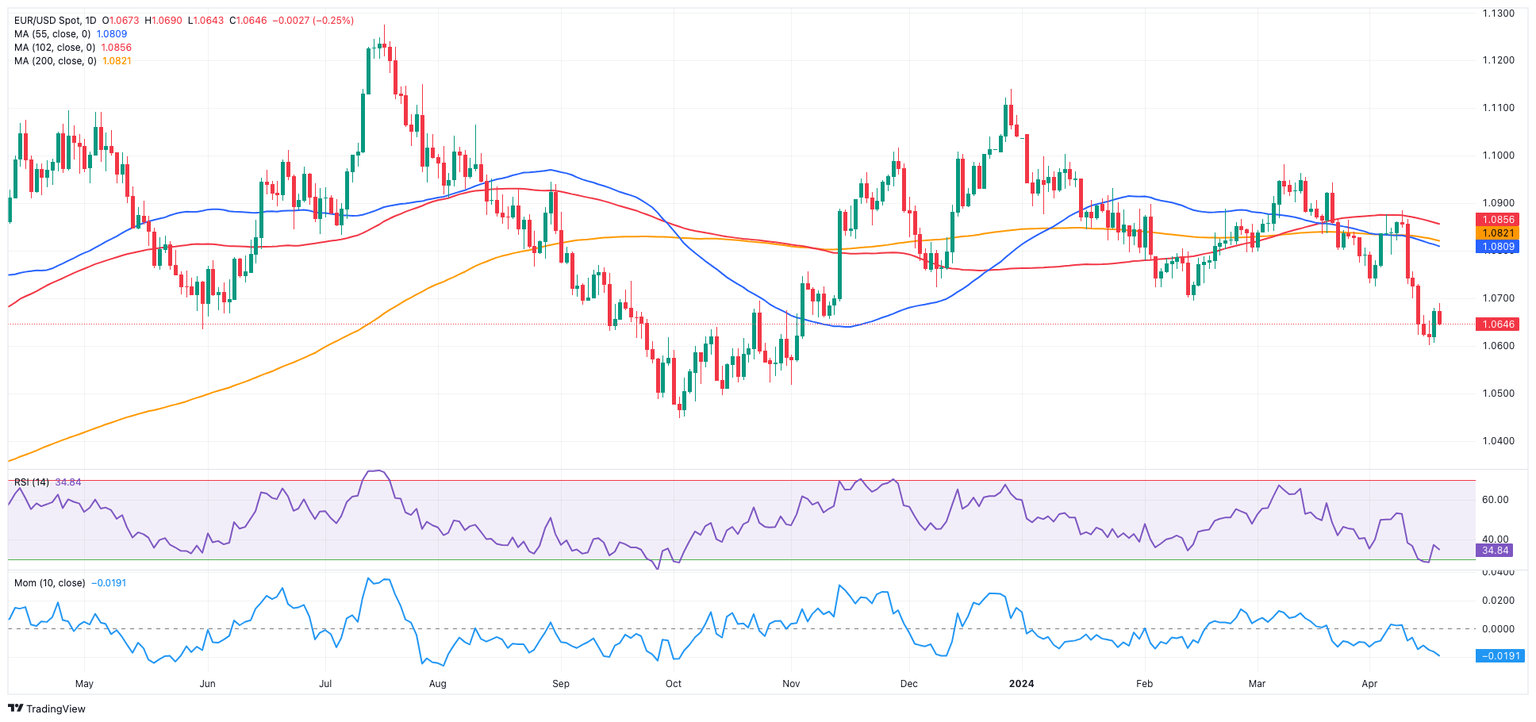

EUR/USD daily chart

EUR/USD short-term technical outlook

The drop from the 2024 low of 1.0601 (April 16) may indicate a return to the November 2023 low of 1.0516 (November 1), before the weekly low of 1.0495 (October 13, 2023), the 2023 bottom of 1.0448 (October 3), and the round milestone of 1.0400.

On the upside, EUR/USD is expected to face early resistance at the important 200-day SMA of 1.0822, followed by the April high of 1.0885 (April 9), the March top of 1.0981 (March 8), and the weekly peak of 1.0998 (January 11), all before reaching the psychological barrier of 1.1000.

The 4-hour chart shows that the bearish trend seems to have regained some impetus. Against it, the initial support is at 1.0601, followed by 1.0516. In the opposite direction, the initial up-barrier is at 1.0690, ahead of 1.0756 and the 100-SMA at 1.0757. The Relative Strength Index (RSI) plummeted to around 43.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.