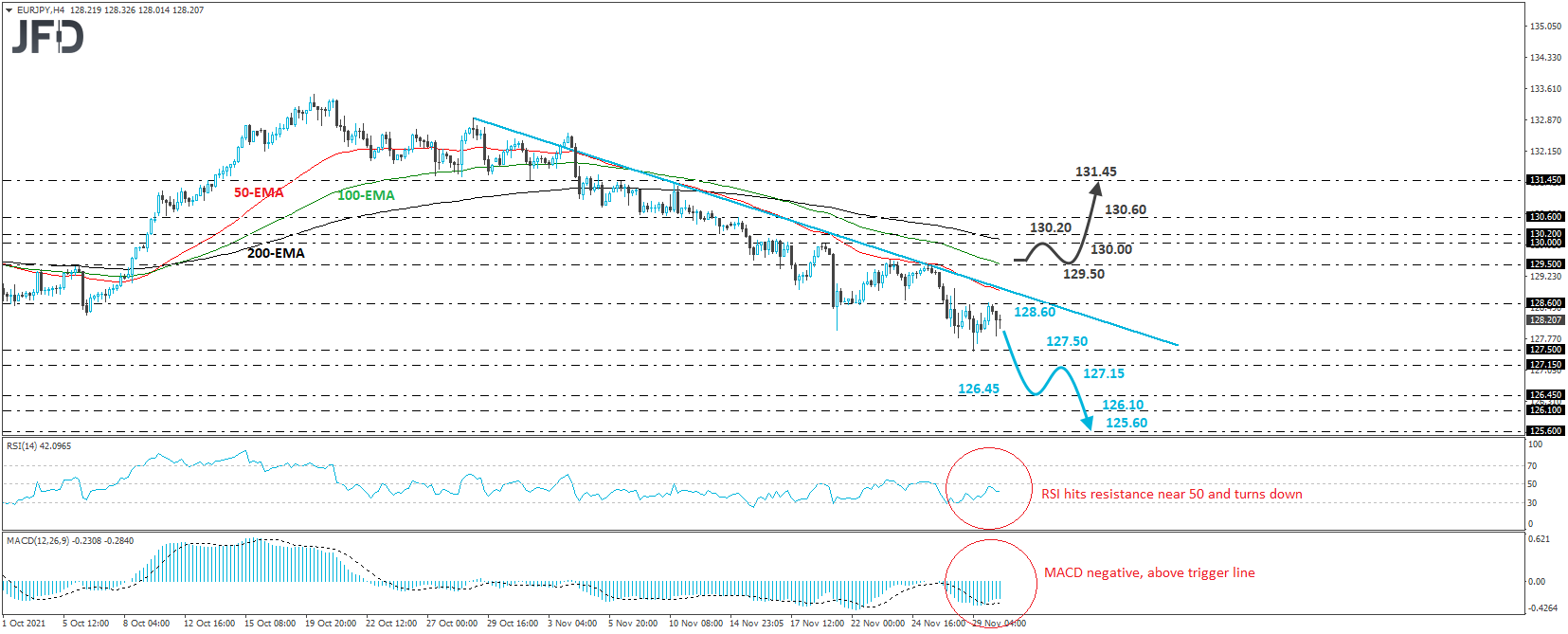

EUR/JPY traded higher yesterday, after hitting support at 127.50. However, the recovery stayed limited near the 128.60 territory, where the rate hit resistance and retreated again. Overall, EUR/JPY continues to trade below the downside resistance line taken from the high of October 29th, and thus, we will consider the short-term picture to be negative.

If the bears are willing to stay in the driver’s seat, then we could see another test near 127.50 soon. A break lower would confirm a forthcoming lower low and could initially challenge the 127.15 barrier, marked by the inside swing high of February 8th, where another dip could extend the fall towards the low of the next day, at 126.45. If that hurdle is not able to stop the downtrend either, then we could see the sellers diving towards the 126.10 or 125.60 territories, marked by the lows of February 4th and January 27th, respectively.

Turning our gaze to the short-term oscillators, we see that the RSI turned down again after hitting resistance near its 50 line, while the MACD, although negative, still lies above its trigger line. Both indicators detect downside speed, which supports the notion for further declines, but fact that the MACD remains above its trigger line makes us careful over another bounce before the next negative leg.

Nonetheless, in order to start examining the bullish case, we would like to see a strong rebound back above 129.50. The rate will already be above the aforementioned downside line, and we could see a test near the round figure of 130.00 or the 130.20 zone, marked by the high of November 19th and 12th, respectively. If the bulls are not willing to stop there, then we could see them targeting the 130.60 obstacle, marked by the high of November 15th, the break of which could extend the advance towards the peak of November 8th, at 131.45.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.