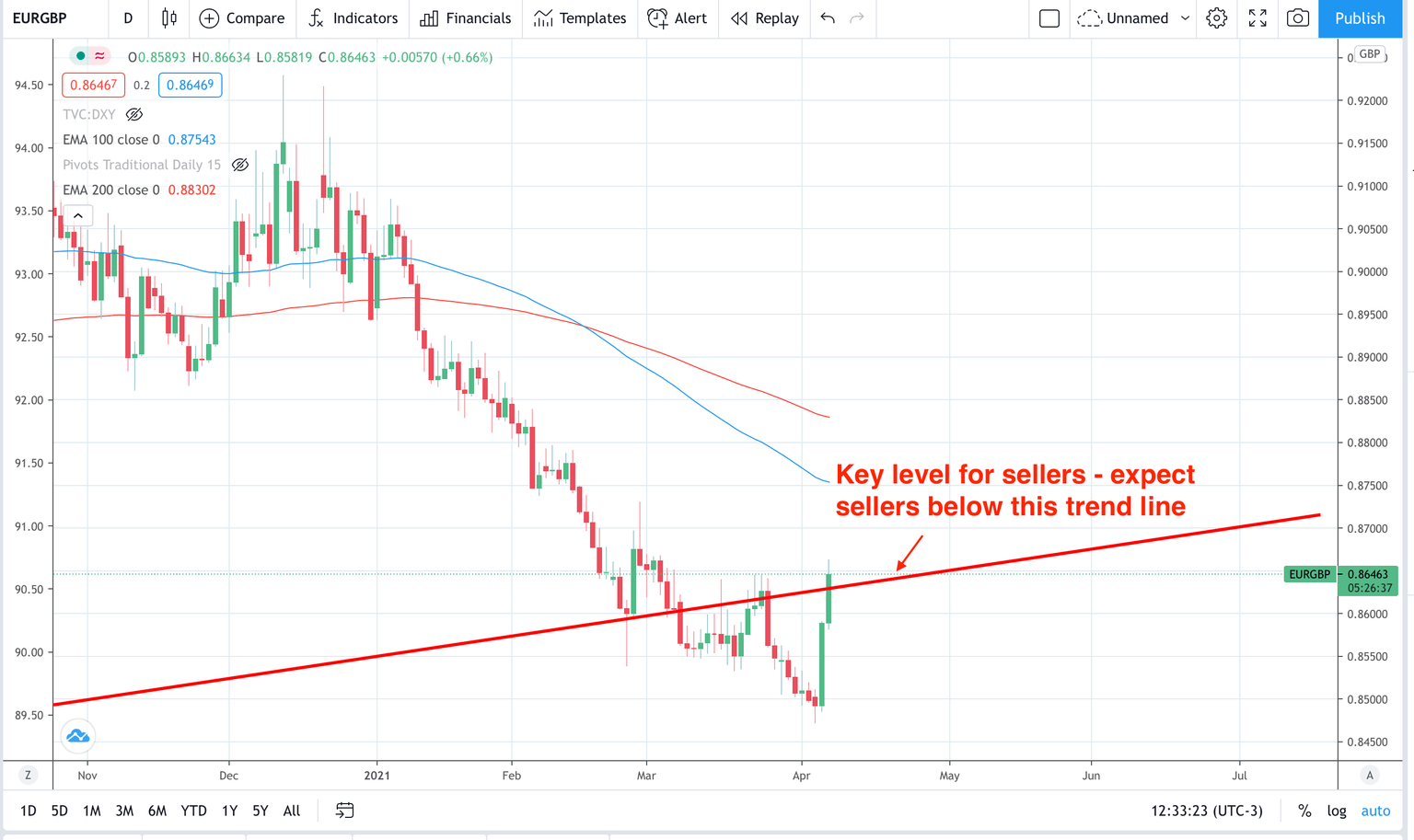

EUR/GBP sellers ahead?

The UK is poised to enter its second stage of reopening on April 12 as restaurants and bars re-open. The IMF on Tuesday this week have announced that they expect the UK economy to grow faster than the US and Eurozone in 2022 with a growth of +5.3% forecast in 2021 and a 5.1% forecast for 2022. As vaccinations pick up in the UK normal activity is expected to resume and this should help boost UK consumption.

In contrast, the IMF saw a slower growth for the eurozone compared to the UK. The eurozone is struggling to roll out vaccines and there is a growing risk of a third wave of COVID-19 cases. This will mean a slower re-opening of European Countries and is likely to weaken the euro. The more serious the latest case count rise becomes, the weaker the euro will likely become.

This means that the EURGBP could see sellers on retracements over the coming few days.

Key trade risks

-

Any significant improvement in the outlook for Europe and the spread of COVID-19 will invalidate this outlook

-

Any slowdown in either the speed of the UK’s vaccination programme or the re-opening plan will invalidate this outlook.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.