Cable unfolded towards the downside as expected under the alternate count. Both targets were reached and exceeded by 29 pips.

Evidence is compiling against the current corrective downtrend but nonetheless, we should always assume that the trend remains the same until proven otherwise as that is what the market keep teaching us day in and day out. We will go through the studies supporting trend reversal in today`s analysis.

As always we will wait for either count`s confirmation points to be reached to determine the highly probable count.

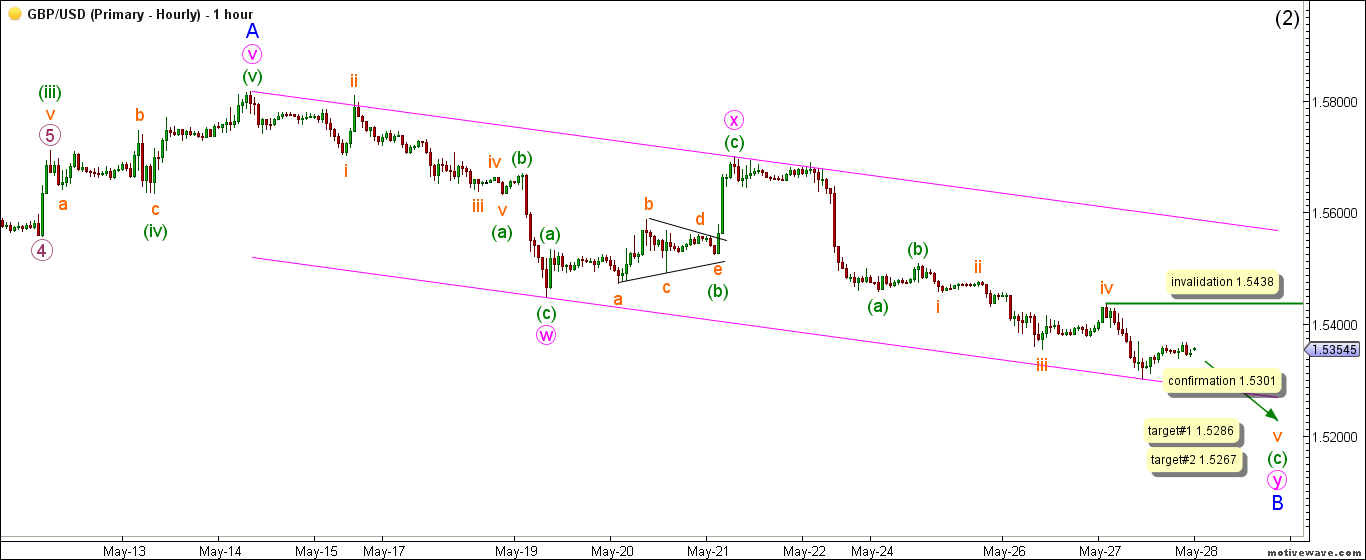

Main Hourly Count

– Invalidation Points: 1.5438

– Confirmation Point: 1.5301

– Downwards Targets: 1.5286 — 1.5267

– Wave number: B blue

– Wave structure: Corrective

– Wave pattern: Double Zigzag

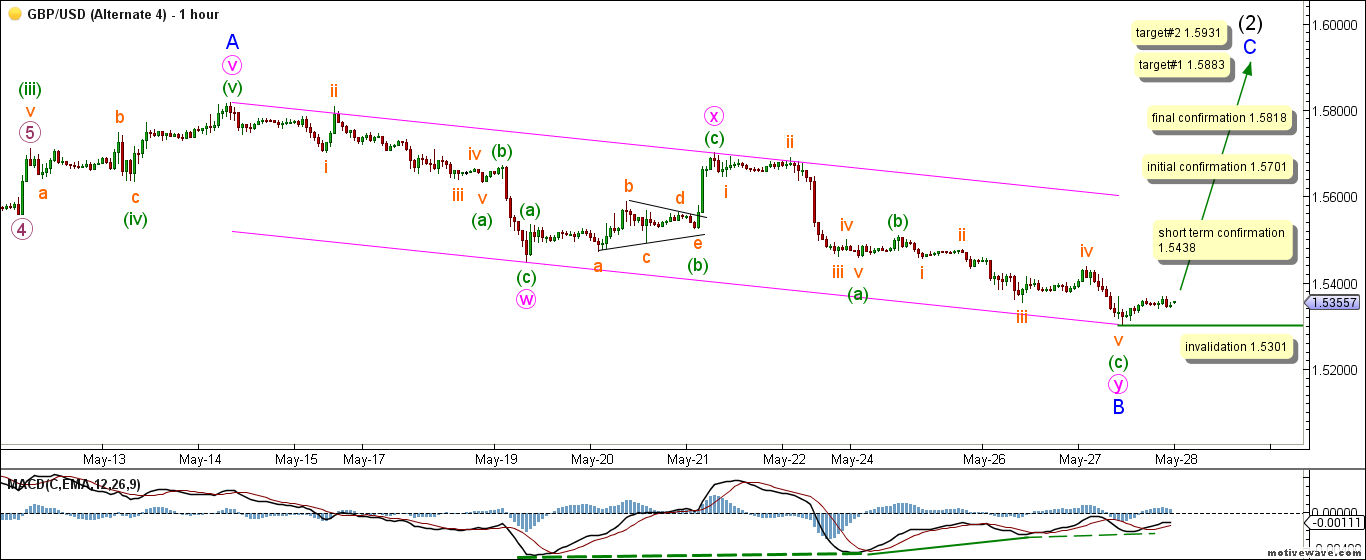

Alternate Hourly Count

– Invalidation Points: 1.5301 — 1.7193

– Confirmation Point: 1.5438 — 1.5701 — 1.5818

– Upwards Targets: 1.5883 — 1.5931

– Wave number: C blue

– Wave structure: Motive

– Wave pattern: Impulse/Ending diagonal

Main Hourly Wave Count

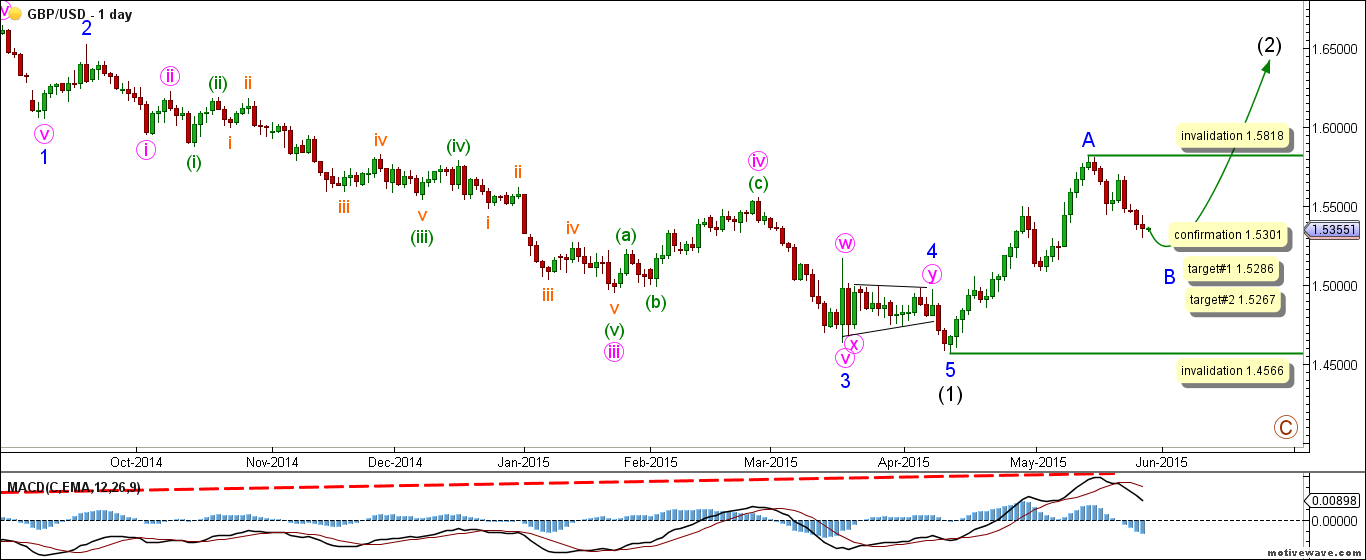

This count expects that primary wave B maroon is complete as a zigzag labeled intermediate waves (A), (B) and (C) black and that primary wave C maroon is unfolding towards the downside.

Within wave C maroon intermediate wave (1) black is complete as an impulse labeled minor waves 1 through 5 blue and intermediate wave (2) black is unfolding towards the upside.

Wave 1 blue unfolded as a leading diagonal labeled minute waves i through v pink.

wave 2 blue unfolded as a zigzag structure labeled minute waves a, b and c pink.

Wave 3 blue unfolded as an impulse labeled minute waves i through v pink.

Wave 4 blue unfolded as a triangle labeled minute waves a through e pink.

This count expects that within intermediate wave (2) black, wave A blue is complete and wave B blue is at its very late stages.

This count would be confirmed by movement below 1.5301.

At 1.5286 wave v orange within wave (c) green within wave y pink will reach 100 % of the distance traveled from the start of wave i orange to the end of wave iv orange. At 1.5267 wave (c) green within wave y pink will reach 100 % of wave (a) green.

This count would be invalidated by movement above 1.5818 as within wave B blue no X wave may retrace more than 100 % the length of its W wave. As well, this count would be invalidated by movement below 1.4566 as within a zigzag wave B blue may not retrace more than 100 % of wave A blue.

Main Hourly Wave Count

This count expects that minor wave (1) black is complete and that wave (2) black has started unfolding towards the upside.

Within wave (2) black, it is expected that wave A blue is complete as an impulse labeled waves i through v pink and wave B blue is starting to show signs of maturity as well.

Within wave A blue, wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Within wave iii pink, wave (iv) green unfolded as a zigzag labeled waves a, b and c orange.

Wave iv pink unfolded as a double zigzag labeled waves (w), (x) and (y) green.

Wave (w) green unfolded as a zigzag labeled waves a, b and c orange.

Wave (y) green unfolded as a zigzag labeled waves a, b and c orange.

Wave v pink unfolded as an impulse labeled waves (i) through (v) green.

Wave (iii) green extended into waves i through v orange with wave v orange unfolding as an impulse labeled waves 1 through 5 purple.

Wave (iv) green unfolded as an expanded flat correction labeled waves a, b and c orange.

After the completion of wave A blue, it is expected that wave B blue is at its late stages as a double zigzag labeled waves w, x and y pink with waves w and x pink complete and wave y pink is underway.

Wave w pink unfolded as a zigzag labeled waves (a), (b) and (c) green with wave (a) green unfolding as an impulse labeled waves i through v orange.

Wave x pink unfolded as a zigzag labeled waves (a), (b) and (c) green with wave (b) green unfolding as a triangle labeled waves a through e orange.

Within wave y pink waves (a) and (b) green are complete and wave (c) green is unfolding downwards as an impulse labeled waves i through v orange with waves i through iv orange complete and wave v orange is underway.

This count would be confirmed by movement below 1.5301.

At 1.5286 wave v orange will reach 100 % of the distance traveled from the start of wave i orange to the end of wave iv orange. At 1.5267 wave (c) green will reach equality with wave (a) green within wave y pink.

This count would be invalidated by movement above 1.5438 as within wave v orange no second wave may retrace more than 100 % of its first wave.

Alternate Hourly Wave Count

This count expects that wave y pink and therefore wave B blue are complete and that wave C blue has started unfolding towards the upside.

Wave (c) green unfolded as an impulse labeled waves i through v orange.

This count is supported by the presence of the following:

1- MACD bullish divergences: Three MACD divergences which suggest that downtrend is running out of steam.

2- Elliott`s Channel: Drawn from the start of wave w pink to the end of wave x pink with a parallel line drawn at the end of wave w pink. This channel should typically contain corrective structures and that is exactly the case for Cable -so far-.

3- Wave y pink exceeded equality with wave w pink by 29 pips and that is a sign of maturity of a corrective structure like a double zigzag.

Confidence in this count will start to increase by movement above the very short term confirmation point for this count which lies at 1.5438 and the initial confirmation point is at 1.5701. Confidence in this count will increase dramatically by movement above 1.5818.

At this stage we are able to calculate targets for wave C blue which is expected to take few days to be reached. We will be able to calculate short term targets once wave C blue starts to subdivide towards the upside. At 1.5883 wave (2) black will reach 50 % of wave (1) black and at 1.5931 wave C blue will reach 50 % of wave A blue.

This count would be invalidated by movement below 1.5301 as within wave C blue no second wave may retrace more than 100 % of its first wave.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.