As expected the euro continued moving strongly towards the downside, reach both our first and second targets, and exceeded them by 25 pips.

Since price has been moving largely as expected and well according to the rules and guidelines of Elliott Wave analysis, we would now expect to see a moderate sideways-to-upwards correction that should last for two or more weeks.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

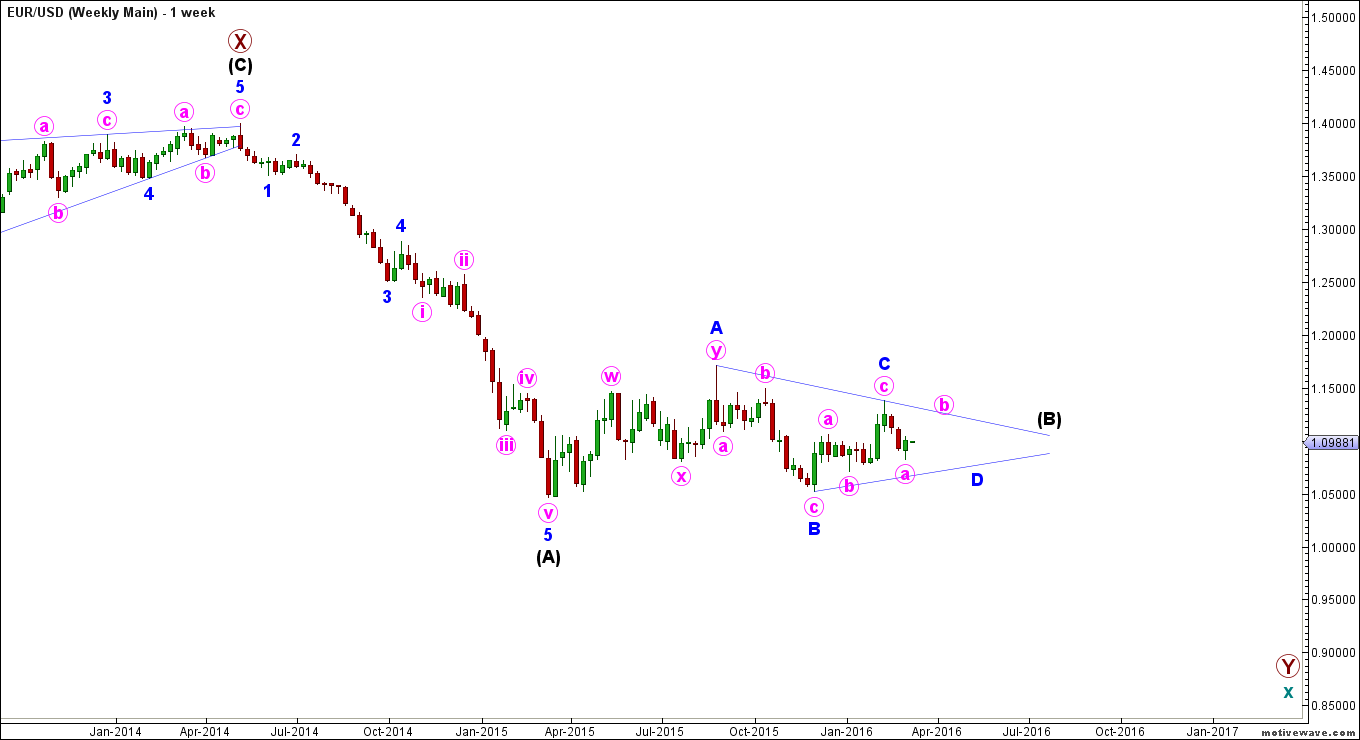

Weekly Main Count

– Invalidation Point: 1.1376 – 1.0516

– Confirmation Point: –

– Upwards Target: 1.1101 – 1.1166

– Wave number: Minute b

– Wave structure: Corrective

– Wave pattern: Zigzag, Flat, Triangle, or Combination

The bigger picture sees that the euro is moving towards the downside in cycle wave x, which is forming a double zigzag labeled primary waves W, X and Y.

Primary wave Y is forming a zigzag labeled intermediate waves (A), (B) and (C).

Intermediate wave (A) formed an impulse labeled minor waves 1 through 5.

Within it, minor wave 3 reached 261.8% the length of minor wave 1.

Minor wave 5 extended as an impulse labeled minute waves i through v, reaching 161.8% the length of both minor waves 1 and 3.

This main count sees that the euro is still moving sideways in intermediate wave (B), which is likely forming a contracting triangle labeled minor waves A through E.

Minor wave B formed a zigzag labeled minute waves a, b and c, retracing 95% of minor wave A.

Minor wave C formed a zigzag labeled minute waves a, b and c, retracing close to 78.6% of minor wave B.

Minor wave D is likely forming another zigzag labeled minute waves a, b and c.

Within it, minute wave a is most likely complete.

This count expects the euro to start moving towards the upside in minute waves b. Minute wave a took 14 days to unfold, so we can expect minute wave b to develop over two or more weeks.

At 1.1101 minute wave b would retrace 50% of minute wave a, then at 1.1166 it would retrace 61.8% of its length.

This wave count is invalidated by movement above 1.1376 as minute wave b of minor wave C may not move beyond the start of minute wave a. It’s also invalidated by movement below 1.0516 as minor wave D may not move beyond the start of minor wave C.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.

_20160309220934.png)