As expected the euro continued moving towards the downside. This is likely the beginning of a temporary downtrend that will span several more weeks.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

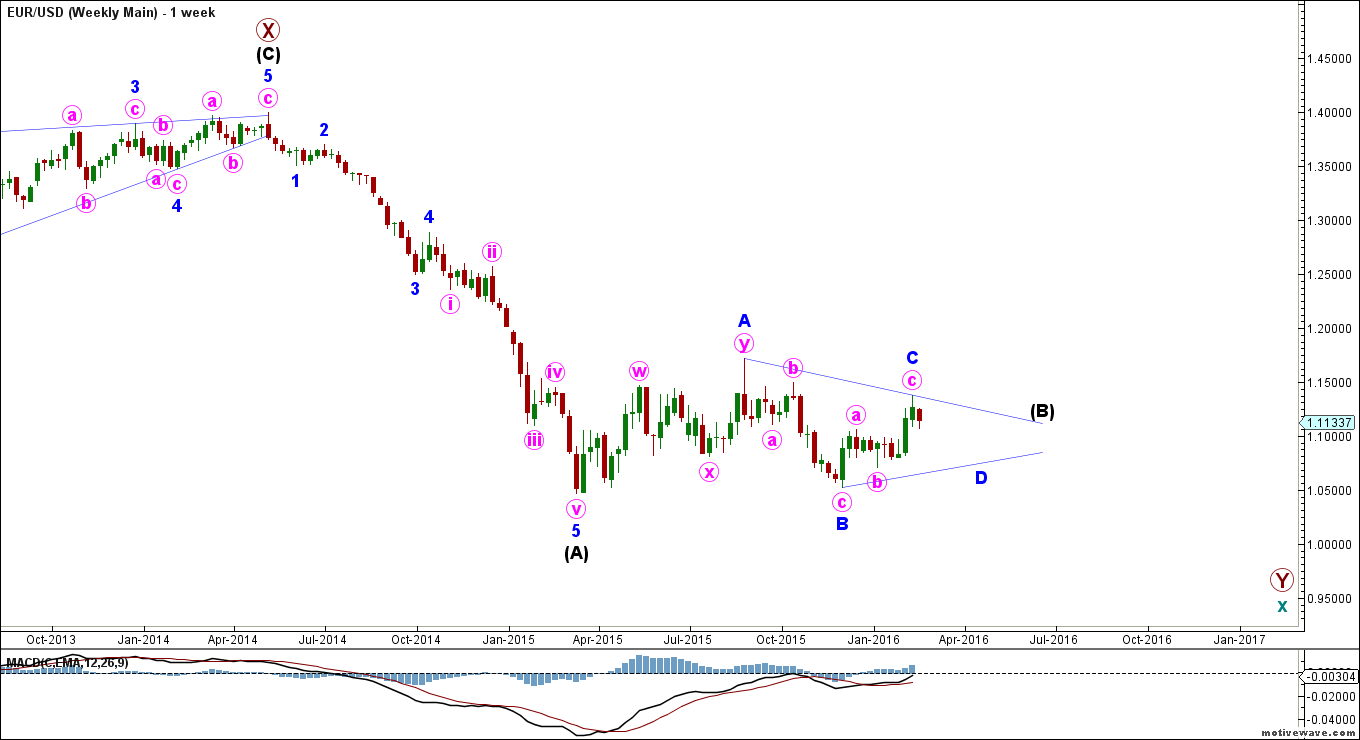

Weekly Main Count

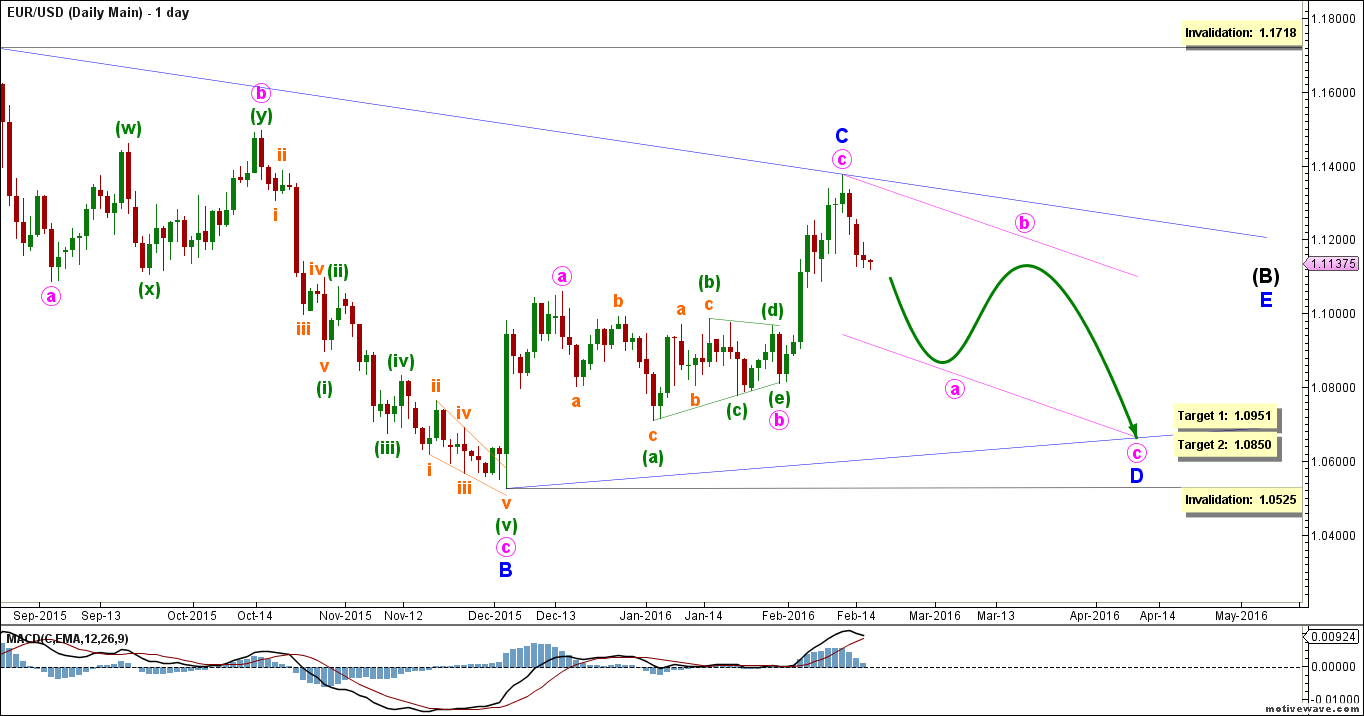

– Invalidation Point: 1.1718 – 1.0525

– Confirmation Point: –

– Downwards Target: 1.0951 – 1.0850

– Wave number: Minor D

– Wave structure: Corrective

– Wave pattern: Zigzag

Weekly Alternate Count

– Invalidation Point: 1.1718

– Confirmation Point: 1.0525

– Downwards Target: 1.0525 – 1.0430

– Wave number: Minor 3

– Wave structure: Actionary Corrective

– Wave pattern: Zigzag

Big Picture

The bigger picture sees that the euro is moving towards the downside in cycle wave x, which is forming a double zigzag labeled primary waves W, X and Y.

Primary wave Y is forming a zigzag labeled intermediate waves (A), (B) and (C).

Intermediate wave (A) formed an impulse labeled minor waves 1 through 5.

Within it, minor wave 3 reached 261.8% the length of minor wave 1.

Minor wave 5 extended as an impulse labeled minute waves i through v, reaching 161.8% the length of both minor waves 1 and 3.

Main Weekly Wave Count

This main count sees that the euro is still moving sideways in intermediate wave (B), which is likely forming a contracting triangle labeled minor waves A through E.

Minor wave A formed a double zigzag labeled minute waves w, x and y.

Minor wave B formed a zigzag labeled minute waves a, b and c, retracing 95% of minor wave A.

Minor wave C formed a zigzag labeled minute waves a, b and c, retracing close to 78.6% of minor wave B. It’s either complete or near completion.

This count expects the euro to start moving towards the downside in minute waves a, b and c to complete minor wave D.

At 1.0951 minor wave D would retrace 50% of minor wave C, then at 1.0850 it would retrace 61.8% of its length.

This wave count is invalidated by movement above 1.1718 as minor wave C may not move beyond the start of minor wave B. It’s also invalidated by movement below 1.0525 as minor wave D may not move beyond the start of minor wave C.

Alternate Weekly Wave Count

This alternate count sees that intermediate wave (B) is already complete and that intermediate wave (c) is forming an ending diagonal labeled minor waves 1 through 5.

Minor wave 1 formed a zigzag labeled minute waves a, b and c.

Minor wave 2 also formed a zigzag labeled minute waves a, b and c, retracing nearly 78.6% of minor wave 1. It’s either complete or near completion.

This count expects the euro to resume moving towards the downside in minute waves a, b and c to complete minor wave 3. This will be confirmed by movement below 1.0525.

At 1.0525 minor wave 3 would reach the end of minor wave 1, then at 1.0430 it would reach 78.6% of its length.

This wave count is invalidated by movement above 1.1718 as minor wave 2 may not move beyond the start of minor wave 1.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.