Happy 2016, everyone! We hope you had a fantastic new year.

As expected the euro moved towards the upside, reached our first target at 1.0896, and exceeded it by 50 pips, completing a contracting triangle of a fourth-wave correction. And as is invariably the case on the completion of a triangle, price should witness a dramatic drop very soon.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

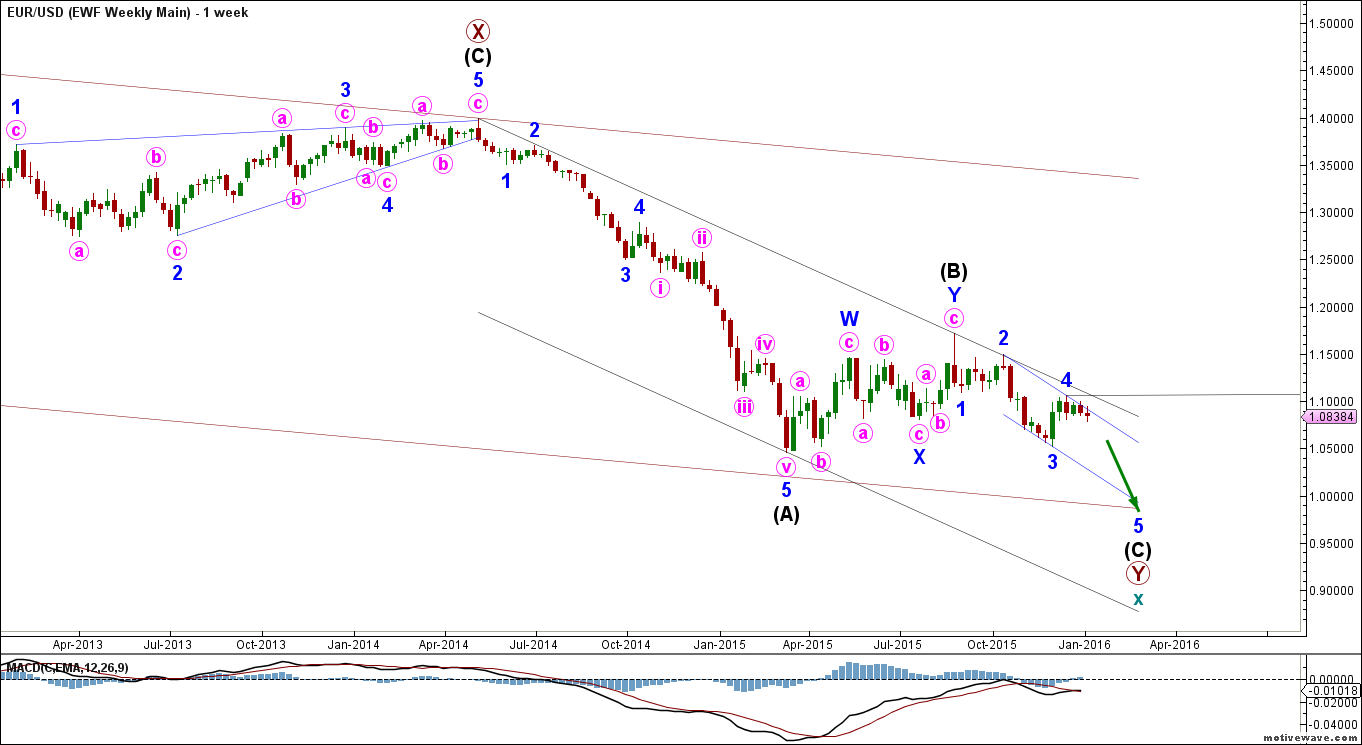

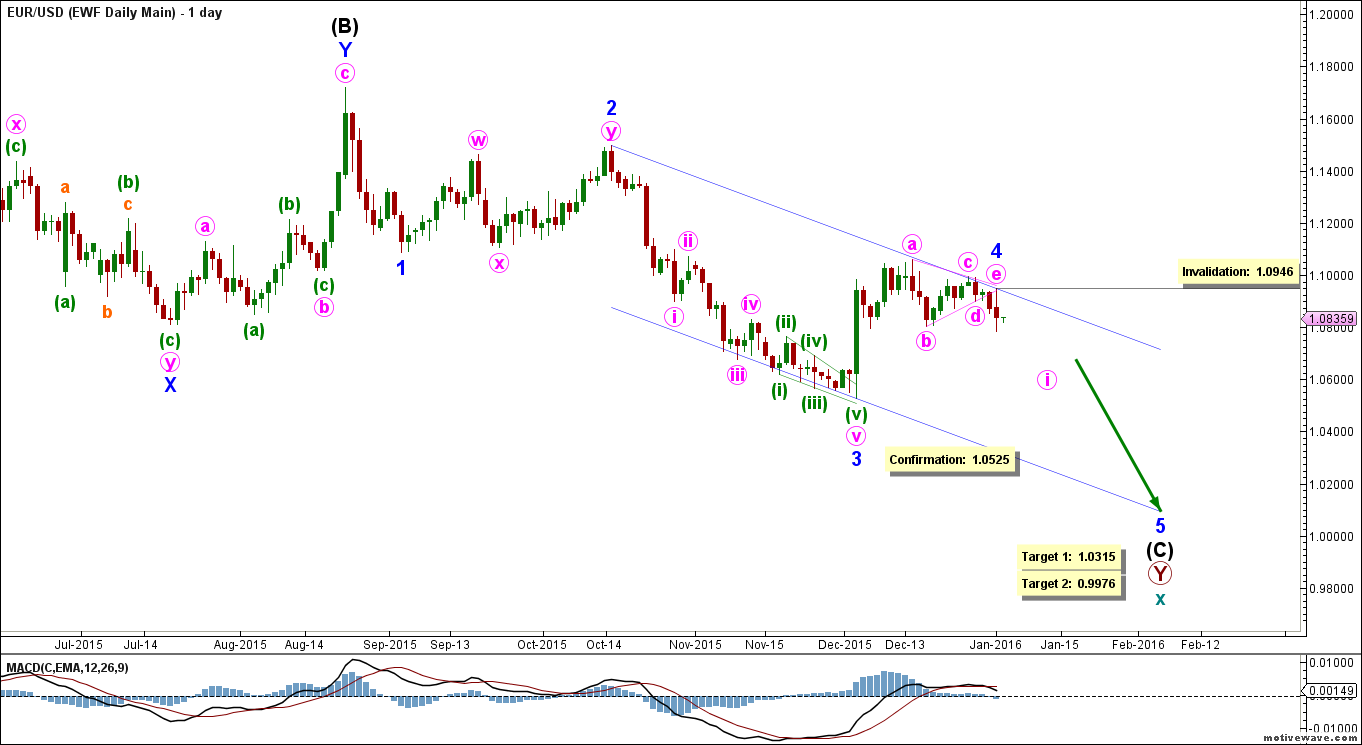

Weekly Main Count

– Invalidation Point: 1.0946

– Confirmation Point: 1.0525

– Downwards Target: 1.0315 – 0.9976

– Wave number: Minor 5

– Wave structure: Motive

– Wave pattern: Impulse

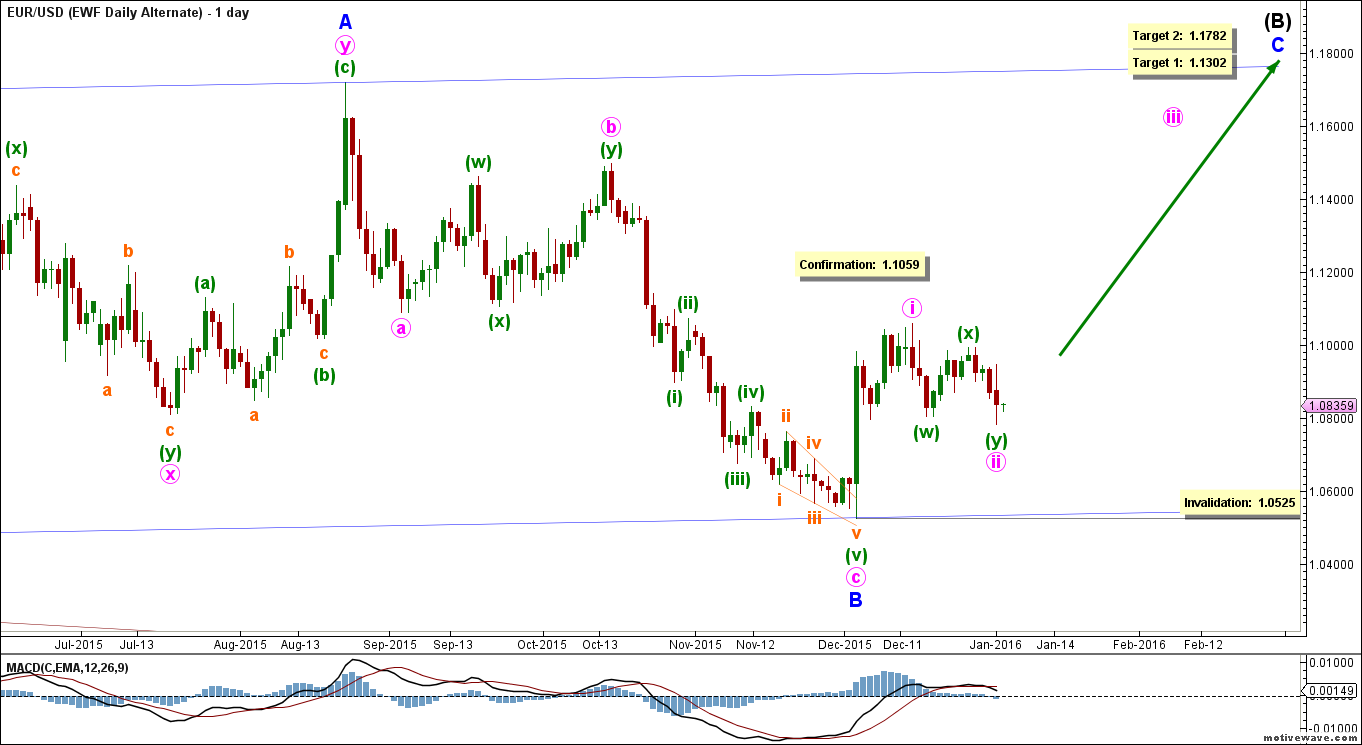

Weekly Alternate Count

– Invalidation Point: 1.0525

– Confirmation Point: 1.1059

– Upwards Target: 1.1302 – 1.1782

– Wave number: Minor C

– Wave structure: Motive

– Wave pattern: Impulse

Big Picture

The bigger picture sees that the euro is moving towards the downside in cycle wave x, which is forming a double zigzag labeled primary waves W, X and Y.

Primary wave Y is forming a zigzag labeled intermediate waves (A), (B) and (C).

Intermediate wave (A) formed an impulse labeled minor waves 1 through 5.

Within it, minor wave 3 reached 261.8% the length of minor wave 1.

Minor wave 5 extended as an impulse labeled minute waves i through v, reaching 161.8% the length of both minor waves 1 and 3.

Intermediate wave (B) formed a double zigzag labeled minor waves W, X and Y, retracing a little less than 38.2% of intermediate wave (A).

Intermediate wave (C) is forming an impulse labeled minor waves 1 through 5, which will complete primary wave Y, and therefore cycle wave x. This will be confirmed by movement below 1.0462.

Main Weekly Wave Count

This main count sees that intermediate wave (C) is forming an impulse labeled minor waves 1 through 5.

Within it, minor wave 2 formed a double combination labeled minute waves w, x and y, retracing a bit over 61.8% of minor wave 1.

Minor wave 3 formed an impulse labeled minute waves i through v.

Within it, minute wave v formed an ending diagonal labeled minuette waves (i) through (v).

Minor wave 4 formed a contracting triangle labeled minute waves a through e, retracing a bit over 38.2% of minor wave 3.

Minor wave 5 is unfolding towards the downside most likely as an impulse labeled minute waves i through v.

This count expects the euro to continue moving towards the downside in minor wave 5. This will be confirmed by movement below 1.0525.

The MACD indicator tentatively supports this count by showing a bearish crossover.

At 1.0315 minor wave 5 would reach 100% the length of minor wave 1, then at 0.9976 it would reach 100% the length of minor wave 3.

This wave count is invalidated by movement above 1.0946 as minute wave ii may not move beyond the start of minute wave i.

Alternate Weekly Wave Count

This alternate count sees that intermediate wave (B) is still unfolding as a flat labeled minor waves A, B and C.

Minor wave A formed a double zigzag labeled minute waves w, x and y.

Minor wave B formed a zigzag labeled minute waves a, b and c, retracing 95% of minor wave A.

Minor wave C is unfolding as an impulse labeled minute waves i through v.

Within it, minute wave ii formed a double zigzag labeled minuette waves (w), (x) and (y), retracing 50% of minute wave i.

This count expects the euro to continue moving towards the upside in minor wave C to complete intermediate wave (B). This will be confirmed by movement above 1.1059.

At 1.1302 minor wave C would reach 61.8% the length of minor wave A, then at 1.1782 it would reach 100% of its length.

This wave count is invalidated by movement below 1.0525 as minute wave ii may not move beyond the start of minute wave i.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.