EUR/USD: We are paring back our bearish view in the short-term. Small basing candles point to a squeeze higher in range. Overall we are bearish and would prefer to fade upticks against resistance in the 1.1350 area. Our downside targets are towards 1.1125 and then 1.0990.

USD/JPY: Consecutive topping candles have prompted us to turn bearish. A low close today would add to our bearish conviction towards targets near 108.20. Below 108.20 would point lower towards our next targets near 106.40 and then 105.20.

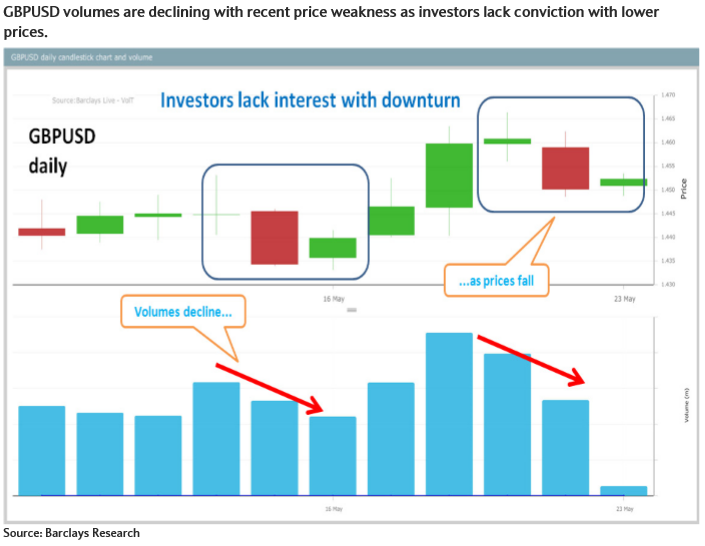

GBP/USD: Thursday’s topping signal ahead of resistance in the 1.4680 area has prompted us to turn bearish in the short term. An increase in trade volumes would encourage our bearish view towards our targets in the 1.4340 area.

AUD/USD: Small basing candles signal a breather from recent weakness. We are sticking with our bearish view following the close below 0.7260, the 200-dma. Our targets are towards 0.7040 and then the 0.6825 year-to-date lows.

NZD/USD: No change. Low volumes along with the recent uptick help to keep us bearish. We are looking for a move below 0.6710 low to signal lower towards targets near 0.6665 and then 0.6545.

USD/CAD: No change. The break above the 1.3015 range highs has prompted us to pare back our bearish view in the short term. Risk is a squeeze higher towards 1.3220 before sellers emerge.

This content has been provided under specific arrangement with eFXnews.

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.