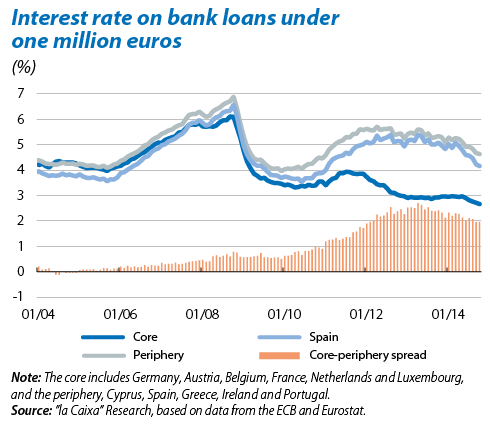

This convergence must therefore continue. Once again the ECB is bound to play an important role. The measures it has announced over the last few months should help to ease monetary conditions in the euro area even further. However, the tepid welcome shown for the first two TLTROs (targeted long-term refinancing operations) and purchases of asset-backed securities (ABS) and covered bonds indicates that they might not be enough to achieve this aim.

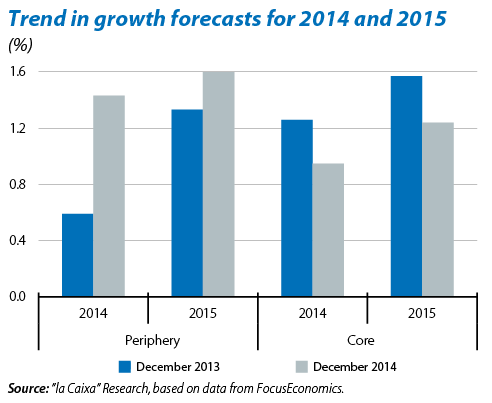

The improvement of growth prospects in the periphery has also helped to reduce financial fragmentation. Over the last year analysts revised upwards their growth forecasts for 2014 and 2015 for the periphery countries, including Spain (see the second graph). The economic recovery of these countries has helped to improve the credit quality of those asking for loans and consequently a relaxation in their conditions of access.

Beyond the boost provided by monetary policy and growth in the short and medium term, it is vital to make further progress at an institutional level in order to achieve long-lasting financial integration. Very positive factors in this respect are the advances made towards banking union, both in supervision and resolution. This new architecture has helped to boost the credibility of the banking sector and break the link between bank and sovereign risk, the initial cause of financial fragmentation. But this is not enough. In a monetary union it is essential to set up mechanisms to improve the coordination of economic policies and to effectively share risk, mechanisms which, for them to be legitimate, must be accompanied by a greater degree of political integration. In short, in order for credit to flow again under equal conditions in all economies of the euro area, it is necessary to continue advancing towards real economic and monetary union, as established in the roadmap agreed at the height of the sovereign debt crisis.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.