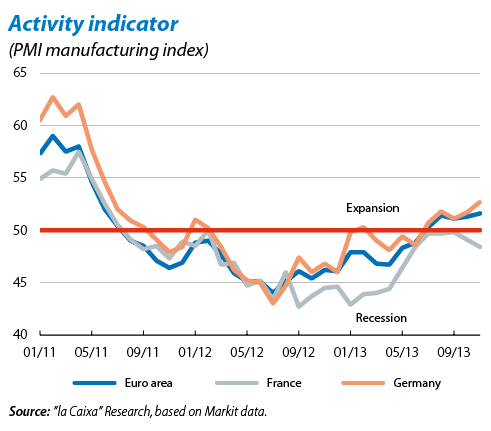

One of the indicators raising questions is the PMI, usually a highly reliable predictor of the short-term trend in GDP. While in Germany this has consolidated at levels clearly above 50 points, as from which positive growth rates are normally recorded, in France it has notably slumped over the last few months. Consequently, the differences in growth rates between both countries look very likely to, at least, continue in 2013 Q4.

Beyond this short-term trend, structural indicators for the two economies, both macroeconomic and those concerning the economic environment, show notable differences which suggest that the paths taken by these two economies might diverge considerably over the coming years. The recent trend in key macroeconomic indicators is highly revealing. While Germany has already passed its pre-crisis level of GDP, France is still slightly below this level. Significant differences can also be seen in the labour market. Germany's unemployment rate is lower than France's and the latest data do not point to this gap narrowing in the near future. The performance by each country's foreign sector also differs greatly. German exports have remained strong over the last few years with an average annual growth rate of 7.7% between 2010 Q1 and 2013 Q3. In France, however, this growth rate has remained at 4.6%. The greater internationalisation of the German economy and the comparative trend in labour costs in both countries (see the enclosed table) lead us to believe that this difference could continue over the coming quarters.

Those indices that attempt to measure the state of the economic environment, on the other hand, tend to reflect an economy's underlying trends and are therefore usually a good indicator of its long-term growth capacity. The competitiveness index calculated by the World Economic Forum is very useful in this respect. Germany is in a better situation in five of the most relevant areas: differences in infrastructures and technological capacity are less marked while the greatest discrepancies can be found in institutions, labour market efficiency and, to a lesser extent, innovation. The good news for France is that such differences can be resolved through structural reforms. However, the lack of political and social will to carry these out does not encourage optimism.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.